Catch the wave!

With the iron ore market experiencing another powerful bull market run, a maiden resource estimate has just been released for a premier iron ore project.

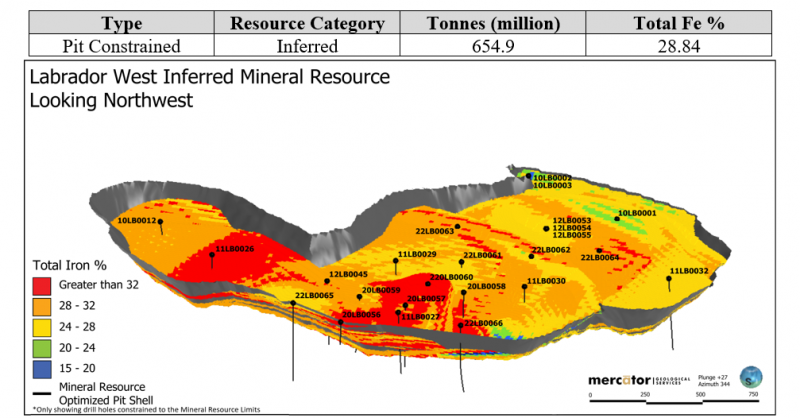

On February 23, 2023, Labrador-based High Tide Resources (CSE:HTRC) released its first resource estimate for its high-grade Labrador West Iron Project.

The first number that obviously leaps out at investors is grade: 28.84% FeT. But this is also a massive deposit: 654.9 million tonnes.

Director and Interim CEO Steve Roebuck framed the news for investors.

“The deposit is robust, starts at surface and has great potential to grow in size. We have a very strong project that should prove appealing to both strategic partners and investors alike. The southern Labrador Trough produces some of the cleanest iron concentrates in the world. With demand increasing and industry pivoting to green iron and green steel, High Tide is very well positioned to be a leader in the next generation of high-quality low-carbon iron projects globally.”

There is a lot for investors to digest there. Let’s break it down.

The deposit is robust starting at surface and has great potential to grow in size.

That’s all music to the ears of mining investors. “Surface deposit” generally translates into good economics, even before considering the stellar grade of the deposit. And the Project has the strong exploration upside potential that investors want to see.

The southern Labrador Trough produces some of the cleanest iron ore concentrates in the world…

Iron is one of the metals where the quality of the ore is a significant factor in both demand and price. The news release offers some further guidance here later on.

The high quality of the deposits in the region allows for a wide range of product diversity, which includes premium fines, concentrate and pellet grades.

This “clean” high-grade iron ore deposit of Labrador West is definitely in strong demand, and the ore will also likely command a premium price when the Project moves to production. A 2021 S&P Global article provides the Big Picture here.

High-grade iron ore supply to struggle to meet demand as China decarbonizes

As the world commits to decarbonization, higher-grade raw materials are essential, such as the “green iron” in Labrador West’s massive, high-grade iron ore deposit.

Labrador West is also well-positioned to service existing markets for high-grade/high-quality iron ore, such as premium iron “fines” (small iron particles), as well as higher-grade concentrates and pellets.

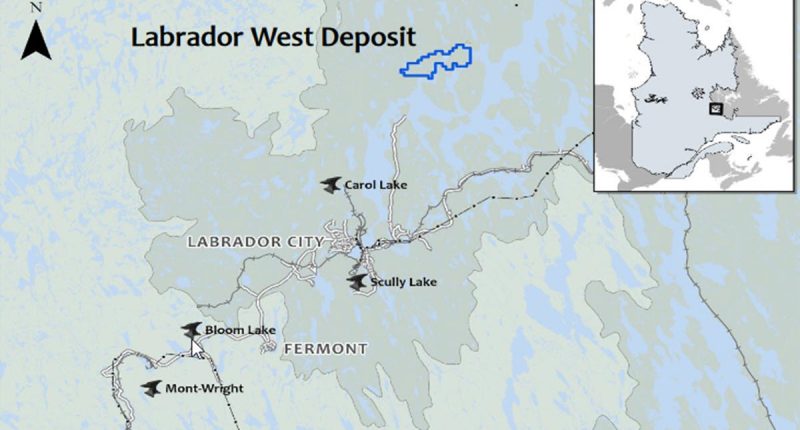

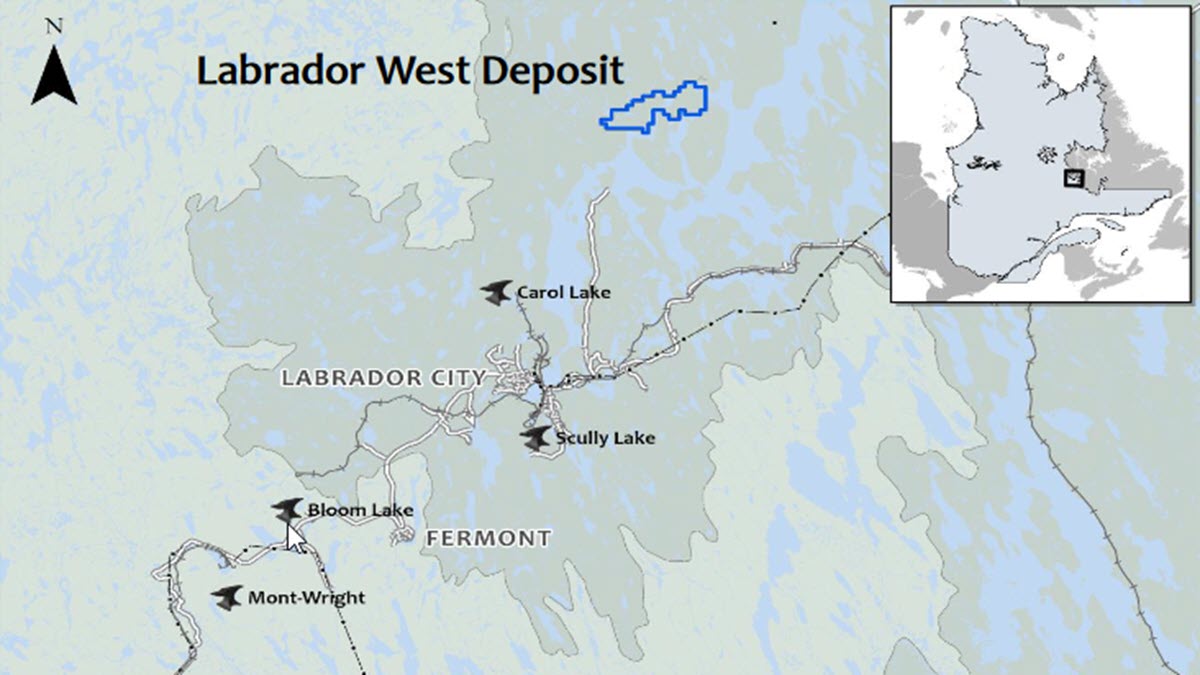

The Labrador West Iron Project is comprised of one mineral license that includes 99 mineral claims covering 2,475 hectares. Located less than 20 km from Labrador City, the Project is “proximal to all the critical infrastructure required to explore and develop a major new iron deposit”.

Initial exploration of the property began in 2010 under the previous operator, Rio Tinto. High Tide Resources began exploring the property in 2020.

A total of 27 drill holes spanning ~7,500 meters of drilling have been completed at Labrador West to date. The Labrador Trough is world-famous as a source of high-grade iron ore, as illustrated by this Canadian Mining Journal article.

Labrador’s iron ore goes global

The world-class Labrador Trough iron mining district has long been a bastion of stability in the often uncertain world of mining.

Having produced more than 2 billion tonnes of iron over 50 years of continuous production, “The Trough” can claim a prominent place in the Canadian mining sector.

Given the pedigree of this iron ore mining district, it’s no surprise that High Tide’s news has received market approval.

Since trading as low as C$0.095 on January 27th, the stock has been on a tear, with HTRC more than doubling. More near-term upside here can come from the iron ore market itself, as indicated in this February 20th article from Financial Review.

Iron ore price heading to US$150 a tonne: Goldman Sachs

Also driving High Tide’s recent run are the Company’s lithium holdings. The Company has released recent news here, as well.

Located in the Thunder Bay Mining District, Big Bang was High Tide’s second lithium property acquisition in the last year (along with the Clearcut Lithium Project, southwest of Val d’Or, Quebec).

Many investors will like this combination: a premier iron ore project backstopped by a growing portfolio of lithium properties.

Even after its recent run, High Tide Resources sits with a market cap of only C$17 million. Astute mining investors will see a lot more upside potential here.

DISCLOSURE: This is a paid article by The Market Herald.