- International Lithium (ILC) has filed a Mineral Resource Estimate (MRE) for its Raleigh Lake Project in Ontario

- The results of the technical report indicate that the project has technical merit

- Future drilling intends to further delineate economic resources downdip and along strike of the current MRE and upgrade inferred resources to indicated

- CEO John Wisbey spoke with Simon Druker about the news

- International Lithium seeks to generate shareholder value from sustainable lithium and rare metals in Canada, Ireland and Zimbabwe

- International Lithium (ILC) last traded at $0.065 per share

International Lithium (ILC) has filed a Mineral Resource Estimate (MRE) for its Raleigh Lake Project in Ontario.

The 48,500-ha Raleigh Project is 100-per-cent owned by ILC and is not subject to any off-take agreements, partnerships or royalties.

The estimate, by Nordmin Engineering, includes lithium and rubidium, both U.S. critical minerals, and conceptualizes both open pit and underground mining scenarios.

The results of the technical report indicate that the project has technical merit. The company’s drill programs will build off previous results to further delineate economic resources downdip and along strike of the current MRE and upgrade inferred resources to indicated.

CEO John Wisbey spoke with Simon Druker about the news.

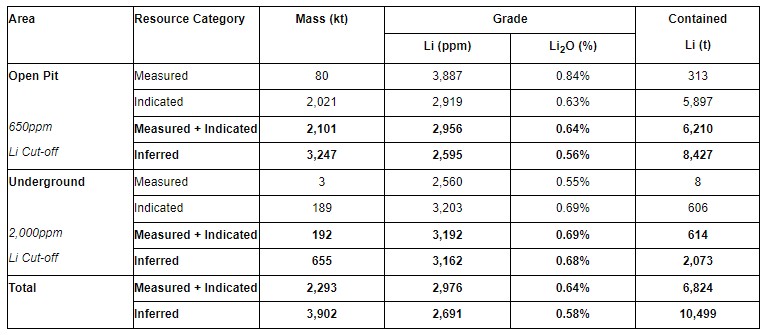

Lithium MRE summary

The MRE for the lithium-caesium-tantalum (LCT) pegmatites of the Raleigh Lake pegmatite field was developed with data from diamond drill holes totaling 13,821 m.

Lithium open pit and underground MRE

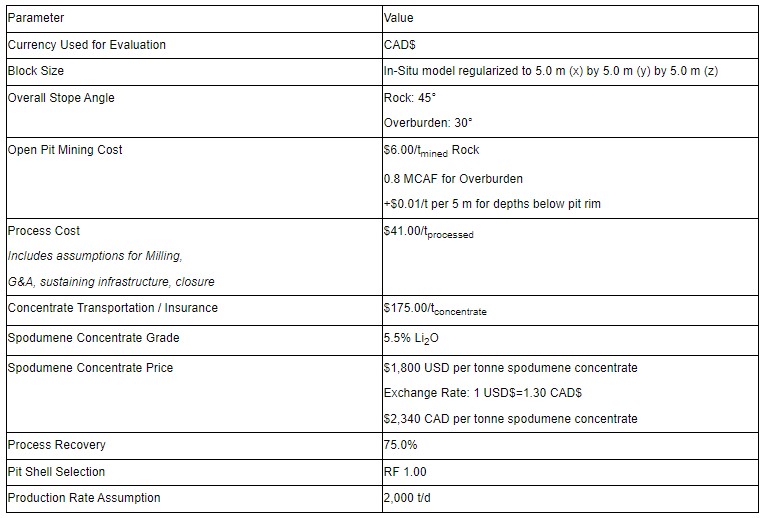

Parameters used to generate the pit shell for the lithium open pit resource

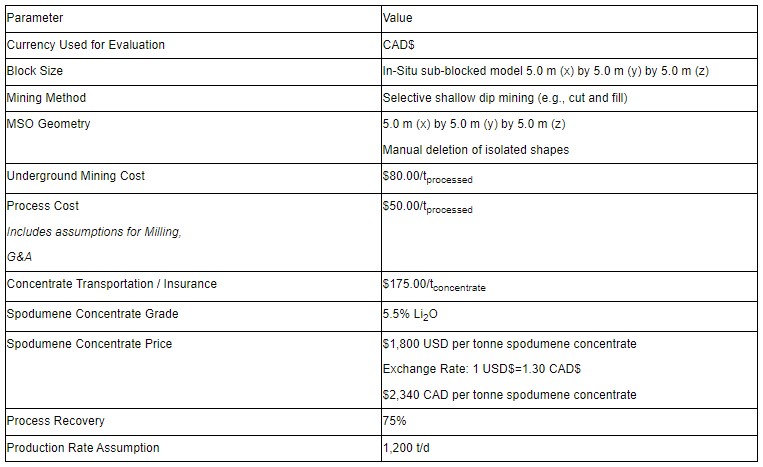

Underground limit analysis parameters (lithium resource)

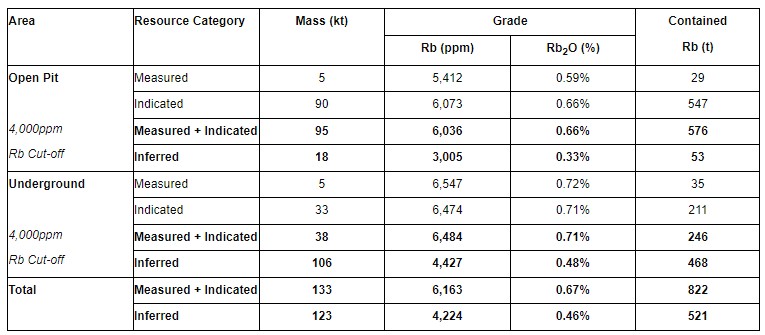

Rubidium MRE summary

The rubidium MRE is based on pockets of high modal abundance of microcline (potassic feldspar) within the LCT pegmatites. Rubidium grades are in excess of 4,000 ppm.

The rubidium open pit and underground resource estimate was constrained above market value due to the current limited world market.

The market price of rubidium carbonate in February 2023 was approximately US$1,160 per kg.

Rubidium open pit and underground MRE

International Lithium seeks to generate shareholder value from sustainable lithium and rare metals in Canada, Ireland and Zimbabwe.

International Lithium (ILC) last traded at $0.065 per share.

This is sponsored content, please see full disclaimer here.