- Rock Tech Lithium (TSXV:RCK) is making a non-brokered C$10 million offering to advance its Canadian operations

- The company will use the funds to develop its Canadian lithium converter facility, as well as for ongoing drilling at its Georgia Lake lithium project in Ontario

- Rock Tech Lithium is a cleantech company focused on producing lithium hydroxide for electric vehicle batteries

- The Canadian lithium stock (TSXV:RCK) has fallen by more than 50 per cent over the past year, but has gained approximately 45 per cent over the past five years

Rock Tech Lithium (TSXV:RCK) is making a non-brokered C$10 million offering to advance its Canadian operations.

The company will allocate approximately C$5 million to continue exploration and development at its Georgia Lake lithium project in Ontario, including drilling and consolidation of adjacent properties. The project houses an indicated mineral resource of 10.6 million tonnes grading 0.88 per cent Li2O, an inferred mineral resource of 4.2 million tonnes grading 1 per cent Li2O, and an estimated post-tax internal rate of return (IRR) of 36 per cent.

The remainder of the funds will go towards general corporate purposes and the development of Rock Tech’s Canadian converter project, which is aiming for initial lithium production in 2027.

The microcap miner will offer up to 7,692,307 units priced at C$1.30 each on a private placement basis. Each unit consists of one common RCK share and one half of one common share purchase warrant. Each warrant entitles the holder to purchase one common share for C$1.69 for 24 months after issuance.

The company expects the offering to close on or about Nov. 7.

All shares issued are subject to a four-month hold period as dictated by Canadian securities law.

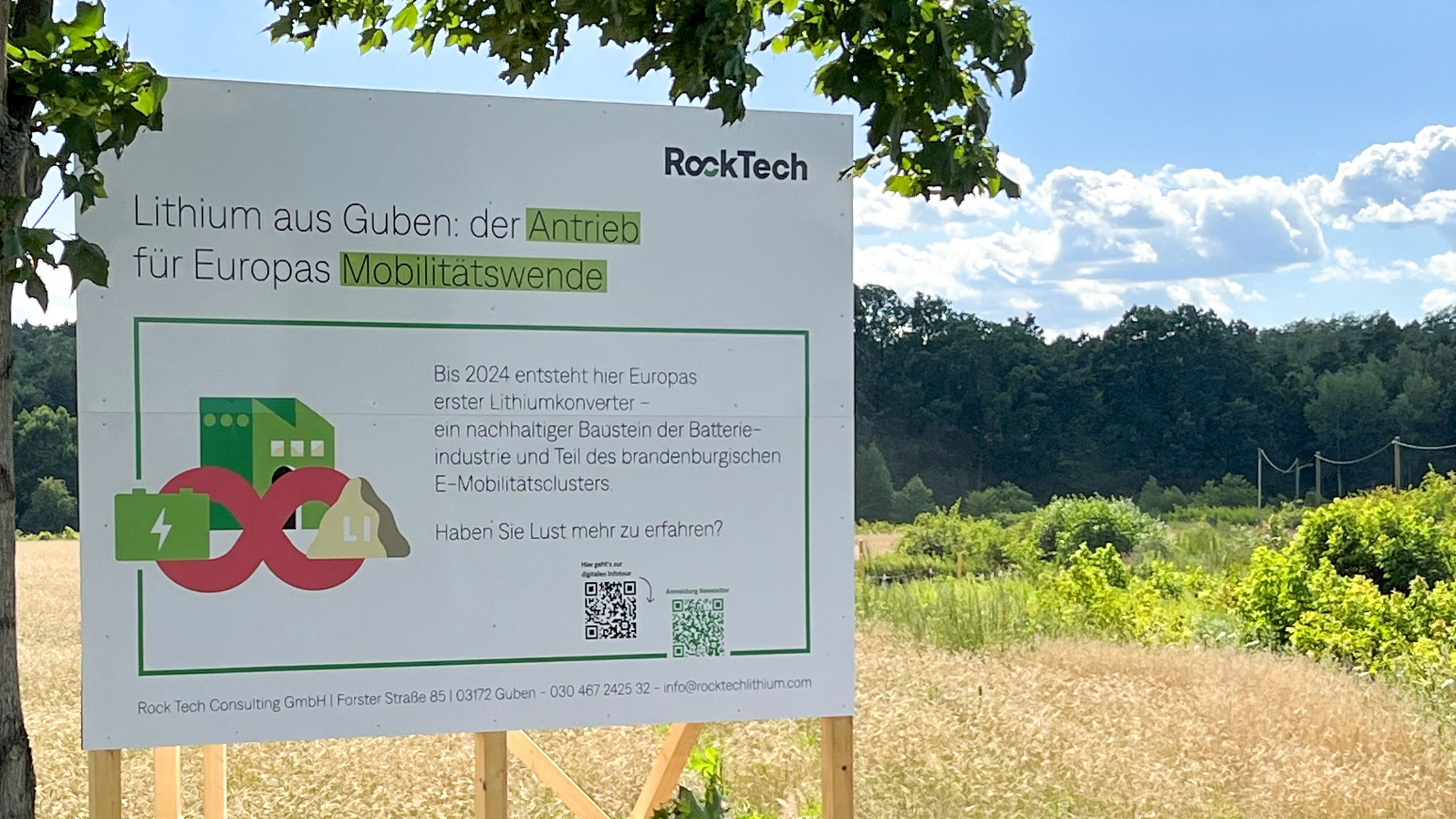

Rock Tech Lithium is a cleantech company focused on producing lithium hydroxide for electric vehicle batteries. It intends to build lithium converters in Canada and Germany, with raw material sourced from discarded batteries, as well as its wholly owned Georgia Lake spodumene project in Ontario.

The company’s first converter in Guben, Germany, features an estimated post-tax NPV (8 per cent) of US$1.2 billion, an IRR of 22.3 per cent, and a capacity to supply lithium hydroxide for more than 500,000 electric vehicles per year. A supply deal with Mercedes Benz was finalized in October 2022.

The Canadian lithium stock (TSXV:RCK) is down by 0.70 per cent trading at C$1.40 per share as of 9:37 am ET. The stock has fallen by more than 50 per cent over the past year, but has gained approximately 45 per cent over the past five years.

Join the discussion: Find out what everybody’s saying about this Canadian microcap mining stock on the Rock Tech Lithium Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.