- Gear Energy (TSX:GXE) will sell its heavy and medium oil assets in Lloydminster to a major publicly traded company for $110 million

- The new company will focus on organic growth from Gear Energy’s high-quality Central Alberta, Southeast Saskatchewan and Tucker Lake assets

- Completion expected in late January or February 2025

Gear Energy (TSX:GXE) will sell its heavy and medium oil assets in Lloydminster to a major publicly traded company for $110 million.

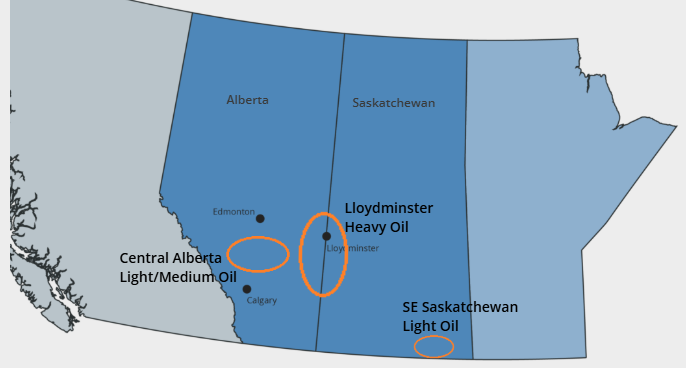

As part of the transaction, Gear will spin off its Central Alberta, Southeast Saskatchewan and Tucker Lake properties into a new entity, Newco, led by Gear’s current management team.

Under the plan of arrangement, Gear shareholders will receive $0.607 per share in cash, Newco shares, or a combination of both, subject to proration limits. The transaction is expected to close by early 2025, pending regulatory and shareholder approvals.

Newco positioned for growth

Newco will retain 31 per cent of Gear’s current production, equivalent to approximately 1,700 barrels of oil equivalent per day (boe/d), and focus on high-potential assets:

- Central Alberta: Low-decline light oil production and stacked growth opportunities.

- Southeast Saskatchewan: Proven Bakken/Torquay light oil development with waterflood potential and reduced emissions via gas conservation.

- Tucker Lake: Undeveloped heavy oil rights in the Cold Lake oil sands region with substantial exploration upside.

Newco’s 2025 capital program will be supported by cash flow and a $35 million credit facility provided by ATB Financial.

Strategic rationale

Gear’s board unanimously supports the transaction, citing its potential to deliver both immediate and long-term value. President and chief executive officer Kevin Johnson emphasized the benefits of this dual approach, stating that, “This transaction offers meaningful cash consideration to shareholders while creating Newco as a growth-focused oil company positioned to unlock significant value.”

The Gear Energy board recommends shareholders vote in favor of the deal, which requires approval from two-thirds of voting shares at a meeting scheduled for early 2025. Directors and officers holding 8 per cent of shares have already committed their support.

Final dividend and transaction timeline

Gear’s last monthly dividend of $0.005 per share will be distributed on December 31, 2024, marking the end of its regular payouts as the company transitions to Newco and completes the sale. The transaction is expected to close by February 2025, following approvals and customary closing conditions.

Advisors and legal counsel

Peters & Co. Limited is acting as lead financial advisor, with ATB Securities Inc. also providing financial advice. Legal counsel for the deal is Burnet, Duckworth & Palmer LLP.

About Gear Energy

Gear Energy is a publicly traded oil exploration and production company headquartered in Calgary, Alberta. Management seeks to grow funds from operations, production, reserves and asset value through a balanced model of exploration, development and strategic acquisitions.

Gear Energy (TSX:GXE) is up by 5.56 per cent trading at C$0.57 per share as of 1:33 pm ET. The stock has given back 14.93 per cent year-over-year but remains up by 23.91 per cent since 2019.

Join the discussion: Find out what everybody’s saying about this oil stock on the Gear Energy Ltd. Bullboard and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo of Gear Energy’s core oil operations: Gear Energy)