- Covalon Technologies (TSXV:COV), a healthcare technology stock, achieves net income profitability for the third straight quarter in fiscal Q4 2024 ending September 30

- Earnings per share in Q4 were $0.02

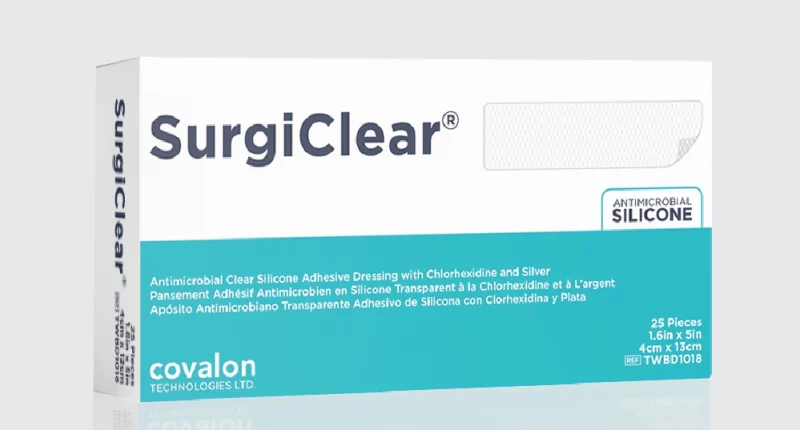

- Covalon is a medical device company focused on advanced wound care, infection control and medical device coatings

- Covalon Technologies stock has added 200 per cent year-over-year and 64.18 per cent since 2020

Covalon Technologies (TSXV:COV), a healthcare technology stock, achieves net income profitability for the third straight quarter in fiscal Q4 2024 ending September 30.

Revenue in Q4 reached $8.9 million, up by 29 per cent year-over-year (YoY), driven by strengthening customer demand for Covalon’s collagen dressing and expanded product offerings within U.S. hospitals. Full-year revenue reached $31.2 million, up by 17 per cent YoY.

Gross profit in Q4 reached $5.3 million, up by 82.8 per cent YoY, with the full-year total reaching $18.9 million, up by 31.3 per cent YoY.

Adjusted EBITDA in Q4 reached $1.1 million, up by $2.9 million YoY, with full-year adjusted EBITDA of $4.8 million, up by $7.5 million YoY.

Net income in Q4 came in at $612,867, up from -$2,880,329 YoY, with full-year net income of $2,669,792, up from -$4,460,998.

The medical technology provider’s Q4 stats follow profitable performances in Q3 and Q2, generating net income of C$1.45 million and C$1.46 million, respectively.

Leadership insights

“We delivered very strong revenue growth coupled with margin improvements, robust earnings and positive free cash flow. Our medical consumables revenue increased 35 per cent for Q4 and 30 per cent for the full 2024 fiscal year,” Brent Ashton, Covalon’s chief executive officer, said in a statement. “As I reflect on my first 12 months at Covalon, I am incredibly proud of our team’s efforts to drive these results in a year of significant change and challenges. We remain focused on delivering strong value to patients and the clinicians who serve them by enhancing our product offerings and supporting exceptional care. The team and I are excited to continue our growth journey and make an even greater impact in 2025 and beyond.”

About Covalon Technologies

Covalon is a medical device company focused on advanced wound care, infection control and medical device coatings.

Covalon Technologies stock (TSXV:COV) is down by 8.08 per cent on the news trading at C$3.30 per share as of 11:21 am ET. The stock has added 200 per cent year-over-year and 64.18 per cent since 2020.

Join the discussion: Find out what everybody’s saying about this healthcare technology stock on the Covalon Technologies Ltd. Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo: Covalon Technologies)