- Blackrock Silver (TSXV:BRC) is reporting the third tranche of assays from the resource conversion program on its Tonopah West project in Nevada

- Highlights include 1.22 metres of 1,469 grams per ton of silver equivalent and 2.01 metres of 1,783 grams per ton of silver equivalent

- Blackrock Silver is a junior exploration company in Nevada developing a property portfolio rich with low-sulphidation, epithermal gold and silver mineralization

- Blackrock Silver stock has added 76.09 per cent year-over-year and 138.24 per cent since 2020

Blackrock Silver (TSXV:BRC) is reporting the third tranche of assays from the resource conversion program on its Tonopah West project in Nevada.

Drilling began in July with a focus on converting up to 1.5 million tons of material from inferred to measured and indicated resources in the shallow southern portion of the DPB resource area.

With 32 of a planned 40 drillholes completed, the company hopes to further substantiate this area’s ability to cover initial years of production, as laid out in Tonopah West’s 2024 preliminary economic assessment. The assessment details an after-tax net present value (5 per cent) of $326 million with $178 million in capex and a payback of only 2.3 years.

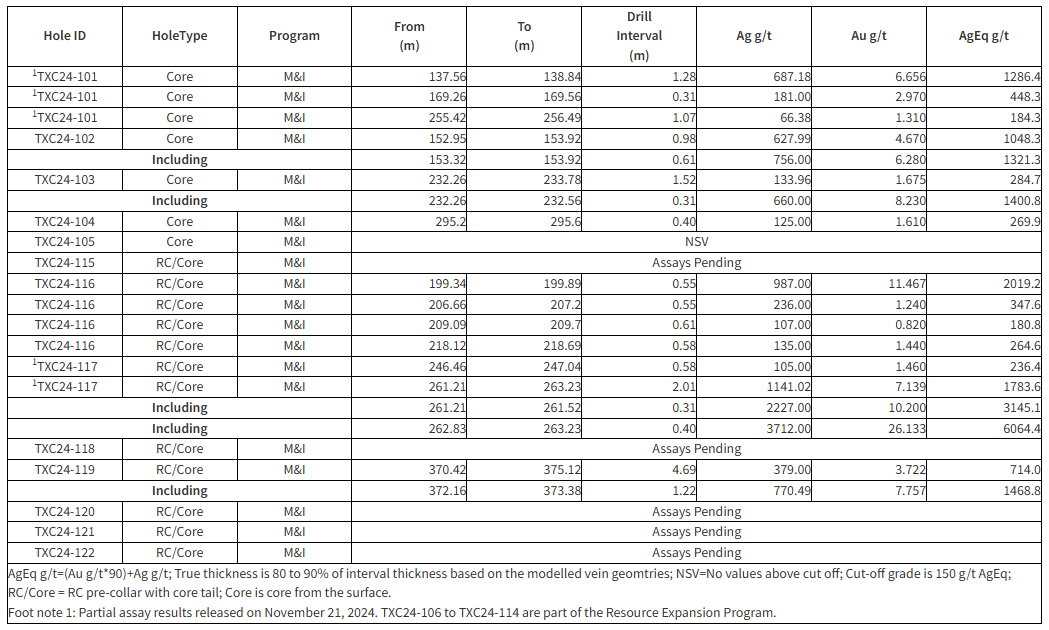

Assays for 28 of the 32 resource conversion drillholes are in hand, with results demonstrating high-grade gold and silver continuity over a 200 m by 250 m area, including numerous kilo-per-ton intercepts.

Third tranche of assays from Tonopah West

Blackrock Silver is also testing expansion potential across a one kilometre trend of vein corridor linking the DBP and the NW step-out resource areas. Assays are pending for all nine drillholes completed to date.

Leadership insights

“Assay results from our ongoing M&I conversion program continue to tie together shallow high-grade gold & silver mineralization both within and up-dip from the existing resource area that is projected to represent the initial years of production at Tonopah West,” Andrew Pollard, Blackrock Silver’s president and chief executive officer, said in a statement. “A new very shallow zone of interest has emerged east of the M&I conversion area, and additional drilling is being deployed to test roughly 200 metres of new strike potential along what is thought to be the Merten vein. In addition, we expect to have our first tranche of assays from our separate resource expansion program over the coming weeks, where 1 kilometre of vein corridor is being drill tested with an aim of adjoining high-grade mineralization between our DPB and Northwest Step Out deposits. Drilling remains ongoing at site, and with a substantial backlog of assays pending at the lab from both our M&I conversion program and resource expansion program, the company is poised for an active start to 2025.”

About Blackrock Silver

Blackrock Silver is a junior exploration company in Nevada developing a property portfolio rich with low-sulphidation, epithermal gold and silver mineralization.

Blackrock Silver stock (TSXV:BRC) last traded at C$0.40 per share. The stock has added 76.09 per cent year-over-year and 138.24 per cent since 2020.

Join the discussion: Find out what everybody’s saying about this silver stock on the Blackrock Silver Corp. Bullboard and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo of Blackrock Silver’s Tonopah West project in Nevada: Blackrock Silver)