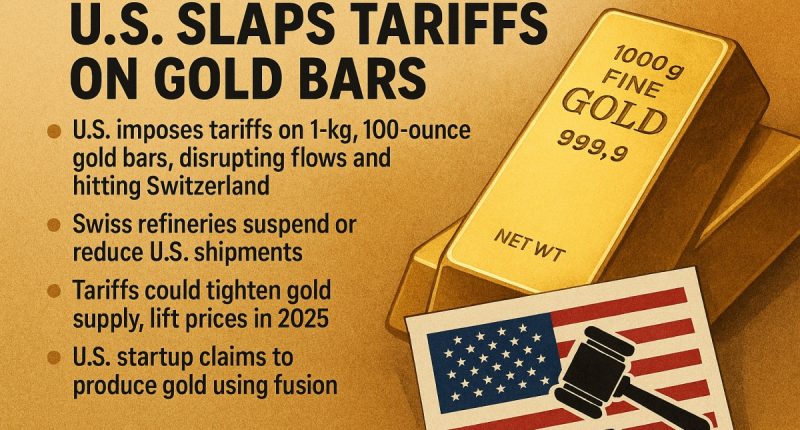

- The U.S. has imposed tariffs on 1-kg and 100-ounce gold bars, disrupting global bullion flows and impacting Switzerland, which exported $61.5 billion in gold to the U.S. last year

- Swiss refineries are suspending or reducing shipments to the U.S. while seeking legal clarity, as nearly $24 billion worth of gold may now be subject to duties

- With gold prices already up 27 per cent in 2025 due to inflation and a weak dollar, the tariffs could further tighten supply and push prices higher

- A U.S. startup, Marathon Fusion, claims it can produce gold using nuclear fusion, but the technology is still theoretical and faces major scientific and commercial hurdles

In a move that could reshape the global gold market, the United States has imposed new tariffs on imports of one-kilogram and 100-ounce gold bars, according to a report by the Financial Times.

The decision, revealed in a July 31st Customs and Border Protection letter, reclassifies these bars under a customs code now subject to duties—reversing previous expectations of exemption.

This article is a journalistic opinion piece which has been written based on independent research. It is intended to inform investors and should not be taken as a recommendation or financial advice.

The sudden policy shift is expected to disrupt international bullion flows and deliver a significant blow to Switzerland, the world’s leading gold refiner. The Alpine nation exported approximately US$61.5 billion worth of gold to the U.S. in the year leading up to June, with nearly US$24 billion of that now potentially subject to tariffs.

Industry insiders say Swiss refineries have already begun suspending or scaling back shipments to the U.S. while seeking legal clarity. Christoph Wild, president of the Swiss Association of Manufacturers and Traders of Precious Metals, called the move “another blow” to Swiss-American trade relations, which have already been strained by a recent 39% import tariff on Swiss goods.

The kilo bar, a key unit traded on New York’s Comex exchange—the world’s largest gold futures market—is central to Switzerland’s exports to the U.S. The timing of the tariff is particularly impactful, as gold prices have surged 27 per cent in 2025 amid inflation fears, rising government debt, and a weakening U.S. dollar.

What this means for gold prices

Analysts suggest the tariffs could further elevate gold prices by constraining supply and increasing costs for U.S. buyers. With Swiss refineries pulling back, alternative sources may struggle to meet demand, especially for the standardized kilo bars used in futures trading.

“Gold has benefited tremendously from the erratic exercise of power by President Trump, making the U.S. dollar and dollar assets less trustworthy and forcing international investors to diversify away,” Chen Zhiwu, chair professor of finance at the University of Hong Kong, explained in an interview.

A glimmer of disruption—or hope?

Amid these tensions, a California-based startup, Marathon Fusion, has made headlines with a bold claim: it can produce gold using nuclear fusion technology. As reported by The Conversation, the company proposes using neutron radiation in fusion reactors to transform mercury-198 into gold-197, the only stable isotope of gold.

While the physics behind element transmutation is well understood, past efforts—such as those at CERN—have yielded only microscopic quantities of gold at astronomical costs. Marathon Fusion’s approach, however, relies on a digital twin of a fusion reactor, suggesting that several tonnes of gold could be produced annually per gigawatt of thermal power.

Yet, experts caution that the technology remains speculative. No commercial fusion reactors currently exist, and any gold produced would initially be radioactive, requiring extensive processing and waste management.

Still, the concept has intrigued investors and scientists alike. If realized, fusion-generated gold could one day disrupt traditional mining and refining industries—potentially even rendering tariffs irrelevant.

Looking ahead

For now, the U.S. tariffs are likely to tighten the gold market and push prices higher, especially if Swiss exports remain constrained. While fusion gold remains a futuristic possibility, the current landscape suggests a volatile period ahead for bullion traders, refiners, and investors.

As geopolitical tensions and technological ambitions collide, the gold market may be entering a new era—one shaped as much by policy as by physics.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.