The world’s path to net-zero emissions hinges on batteries, their underlying technologies, and our ability to secure adequate supplies of the critical metals they need to run—copper for conductivity, nickel for energy density, and cobalt for thermal stability. These metals are the backbone of the clean energy revolution, enabling everything from electric vehicles to renewable energy storage.

First and foremost, let’s start with the facts.

The global energy industry accounts for over 75 per cent of annual global emissions, making it the top contributor to the climate crisis. Within this, electricity and heat production represent about 30 per cent, and transportation about 14 per cent.

The urgent need to decarbonize how we power our homes, travel, and stay warm is being met with accelerating innovation—electric vehicles, wind and solar power, and the batteries that store and deploy clean energy. These technologies are not only reshaping the energy landscape but also driving demand for the metals that make them possible.

Here’s a breakdown of how one company is positioning itself at the forefront of this transformation.

Powering the net-zero future: Why battery metals matter

As the global energy transition accelerates, the demand for critical battery metals—nickel, copper, cobalt, and platinum group metals (PGMs)—is surging. Coniagas Battery Metals (TSXV:COS), a junior mining company based in Québec, is emerging as a compelling investment opportunity thanks to its flagship Graal property, which is drawing enthusiastic attention from geologists and investors alike.

This article is disseminated in partnership with Coniagas Battery Metals. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Why investors should pay attention

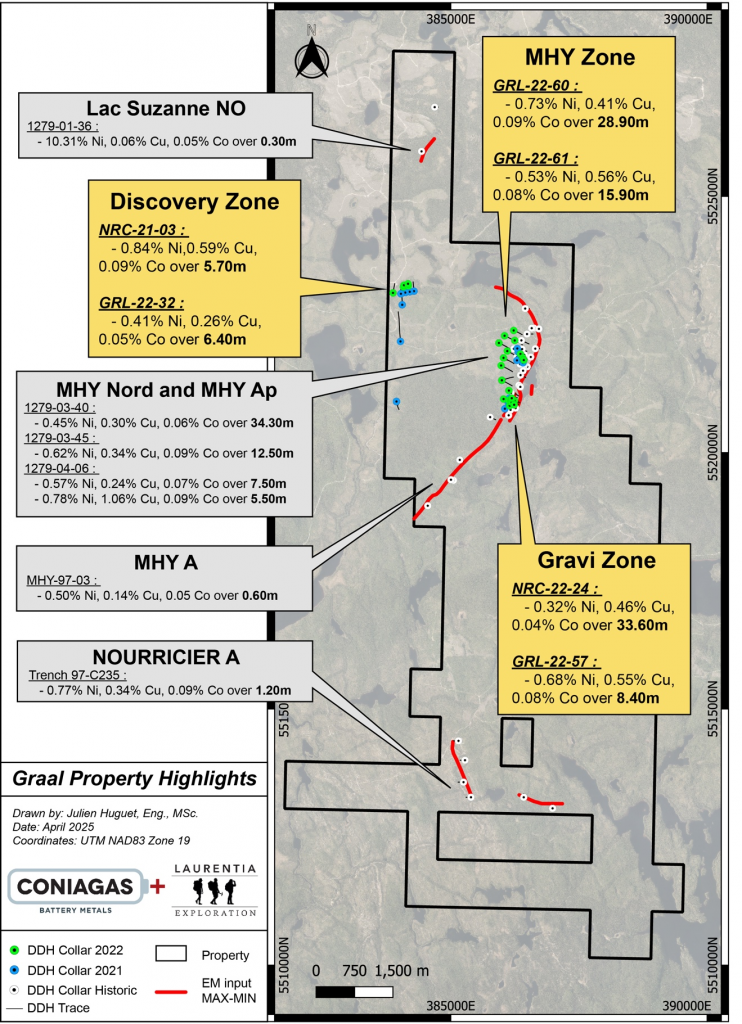

Coniagas is strategically positioned to benefit from the exponential growth in battery metals demand. The company owns 100 per cent of the 61.13 square km Graal property near Saguenay-Lac St. Jean, Quebec—a region known for its rich geological formations and mining-friendly infrastructure. The Graal site is road-accessible year-round, close to the Chute-de-Passe power station, and near the industrial hub of Lac-St. Jean, which offers a skilled workforce and port access to the St. Lawrence River.

Geological excitement: Signs of a major deposit

Geologists are particularly excited by what they see in the geophysics and drilling results at Graal. The property has already revealed promising signs of a large, open-pit mine with profitable grades, and potentially even richer underground zones. Initial drilling has intercepted massive sulfide mineralization at shallow depths (50–100 metres), with standout results including:

- MHY Zone: 28.9 metres of 2.28 per cent copper equivalent, including 0.73 per cent nickel, 0.41 per cent copper, and 0.09 per cent cobalt.

- Discovery Zone: 5.7 metres of 2.23 per cent copper equivalent, including 0.84 per cent nickel and 0.59 per cent copper.

- Gravi Zone: 8.4 metres of 1.91 per cent copper equivalent, including 0.68 per cent nickel and 0.55 per cent copper.

These grades are comparable to those seen in early drilling at Power Metal’s (TSXV:PWM) NISK project, which later revealed even higher grades and abundant PGMs. Similarly, Coniagas has reported significant PGM numbers in its assays, including platinum and palladium, which were initially underreported but are now being recognized as significant contributors to the deposit’s value.

Exploration and expansion

Coniagas has engaged Laurentia Exploration to manage and optimize its exploration activities. The current program includes:

- Prospecting in the southern portion of the property using beep mats and outcrop sampling to confirm historical electromagnetic conductors.

- Airborne mag-EM survey designed to detect superconductive mineralization, especially between the Discovery and MHY zones.

- 9,500 metres of drilling across 58 holes, focusing on near-surface mineralization and extending known intercepts.

The company is also targeting a large conductive layer in the MHY zone, interpreted to be 1.7 km long and at least 850 metres deep, which could indicate substantial underground potential.

Economic and environmental advantages

The Graal property’s mineralization is primarily in sulfides, which are easier and more cost-effective to process into battery-grade metals than laterite deposits. Coniagas plans to use its proprietary Re-2Ox hydrometallurgical process, a closed-loop system with zero discharge, to extract and purify metals. This positions the company as a future supplier of high-purity cathode materials for the EV market.

Investment potential

Despite its promising assets, Coniagas’ stock has seen a 50 per cent decline since this time last year, but a 66 per cent gain since June, creating a potential value opportunity for investors … but that window is closing fast. With only 34.4 million shares outstanding, the company is well-positioned for strategic fundraising without significant shareholder dilution.

Coniagas is preparing for a C$4 million raise to support its 2025 drilling program and a C$12 million pilot plant in partnership with SGS. The company is also securing feedstock deals, including 29 million tons from the Congo and concentrates from Europe, to support long-term production.

Investor’s corner

Coniagas Battery Metals Inc. offers investors a rare combination of geological promise, strategic location, innovative processing technology, and alignment with the global push for clean energy. With geologists excited by the scale and grade of the Graal property, and exploration ramping up, Coniagas is in a stable position for a potential re-rating and long-term growth.

Join the discussion: Find out what everybody’s saying about this junior miner on the Coniagas Battery Metals Inc. Bullboard and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.