With small-cap stocks, as measured by the iShares MSCI World Small-Cap ETF, trading at a price-to-earnings (P/E) ratio of 17.63, and large-cap stocks, measured by iShares’ Global 100 ETF, coming in at a P/E ratio of 27.71, investors are being presented with a 36.6 per cent discrepancy, well beyond the historical average, making it a prospective environment to go bargain hunting.

This article is a journalistic opinion piece which has been written based on independent research. It is intended to inform investors and should not be taken as a recommendation or financial advice.

This brings us to the question of method, and how best to go about isolating sections of the investable universe optimized for the small-cap value opportunity. While there are numerous potential strategies to consider, given that investing is as much an art as it is a science, one rational way to go is accessible to investors across the experience spectrum and involved only three steps. They are:

- Build a no-brainer stock screener.

- Identify prospective income statements.

- Diversify with risk-adjusted positions.

1. Build a no-brainer stock screener

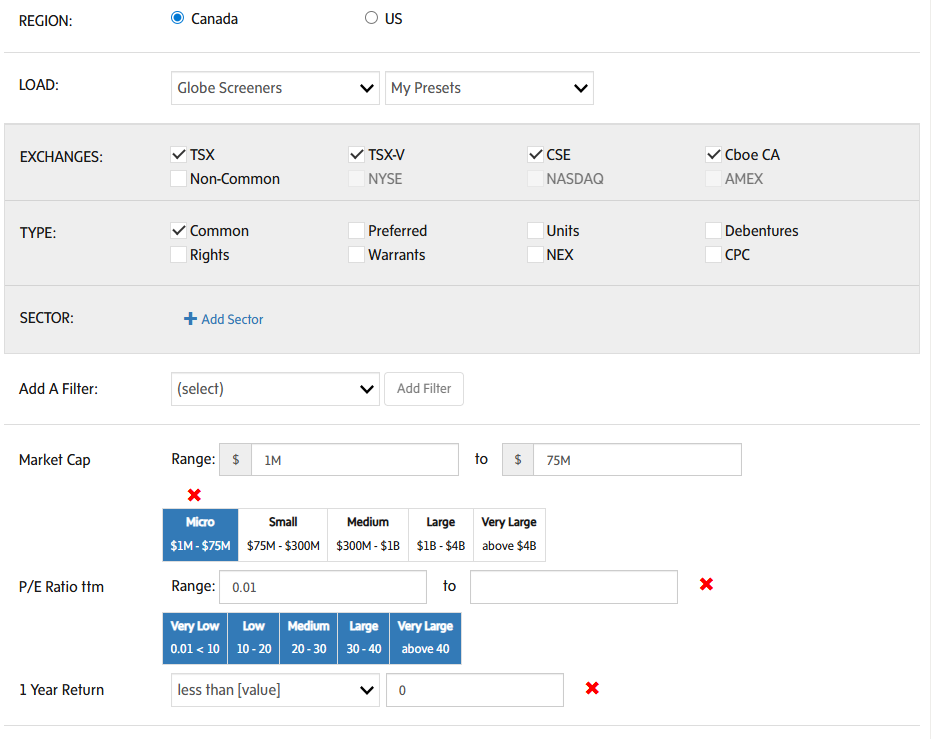

Step number one calls for a stock screener that takes the guess work out of your pool of potential investments. In our case, we’ll narrow our focus to the total Canadian market, selecting for companies trading below C$300 million in market capitalization, with a positive P/E ratio, which have posted negative stock returns year-over-year (YoY) indicating the potential for undervaluation. Here are my parametres, laid out using The Globe and Mail’s free screener tool:

The companies captured by this screener are losing shareholder value, despite their underlying money-making businesses, suggesting that the broader market may be misperceiving the companies’ in terms of their viability as long-term investments.

While you’ve taken a significant stride towards high-quality small-cap value stocks in just one step, there remains work to be done, as many of the names in the screener will have posted negative returns for valid reasons, barring them from potential inclusion in your portfolio.

It’s up to you and me to comb through financial statements, beginning with the worst-performing stocks, in the hopes of encountering operations attractive enough to justify a re-valuation, should value-accretive progress continue into the future.

2. Identify prospective income statements

Once you start to pour through financials by typing company names into Stockhouse, you’ll quickly notice that the list includes lots of mining and energy stocks that don’t generate any revenue. Quickly move past them, as earnings are either one-off asset sales or software malfunctions demonstrating that all stock screeners will pick up duds amid the diamonds they gather for you.

Once you clear away all the smoke and mirrors, what you’re looking for is evidence of growth, profitability, ideally both, with figures in the midst of a positive multi-year trend against which a stock chart can be compared.

Thinkific Labs

One interesting small-cap stock my search alighted on was Thinkific Labs (TSX:THNC), market capitalization C$210.25 million, which tracks a learning platform that allows academies, experts and businesses to create and sell online courses. The business has served more than 35,000 customers to date, including GoDaddy, Nasdaq and Datadog, helping them generate billions in revenue.

If we look back over Thinkific’s past five years, we see that the company has more than tripled revenue from US$21.07 million in 2020 to US$66.94 million in 2024, while steering operations into positive adjusted EBITDA, most recently US$1 million in Q2 2025, as well as positive net income in four out of the past five quarters, with management identifying numerous growth drivers to continue building value into the future (see slide 22 of the Q2 2025 investor presentation).

These numbers suggest a value-conscious management team working in the interests of business health and shareholder value, making the company a good candidate for running through your personal due diligence process, which may include company press releases, market research reports, comparative valuation work, and anything else to ensure a high-conviction decision that allows you to sleep well at night.

A reasonable investor would expect Thinkific’s promise to be reflected in its stock price, but market inefficiency can sometimes throw you a curve ball, in this case a more than 87 per cent loss since 2021, beckoning dry powder off the sidelines for a contrarian play.

PharmaCorp RX

I found similarly enticing upside in PharmaCorp RX (TSXV:PCRX), market capitalization C$56.30 million, a Canadian pharmacy acquirer and operator providing a succession platform for retiring owners.

The company is in the early stage of building a national network of community pharmacies, operating four locations under the PharmaChoice Canada brand to date backed by a strategic alliance signed in 2023.

On its income statements, PharmaCorp’s growth is a testament to management’s disciplined acquisition strategy (see slide 11 of the Q2 2025 investor presentation on SEDAR), delivering positive net income of C$760,000 in Q4 2024 and C$240,000 in Q1 2025, positive adjusted EBITDA of C$687,957 in Q2 2025, complemented by same-store sales growth from 3.9 per cent YoY in Q1 2025 to 11.9 per cent in Q2 2025.

Operations are in active growth mode, with deals in place for two pharmacies in Western Canada, one in Ontario and two in Eastern Canada announced in September alone, and C$9.56 million in cash, C$31.5 million in credit and a pipeline of more than 40 pharmacies positioning management to pursue more value-accretive adds-ons.

Despite PharmaCorp RX’s tangible momentum, the stock has added only 6.67 per cent since listing in July 2024, falling by 38.46 per cent YoY, making it a noteworthy candidate to harvest small-cap value.

Other stocks from my screener that made my value radar sound off were Arrow Exploration, Atlas Engineered Products, Data Communications Management and Covalon Technologies, each offering a credible case for underperforming their track records of growth and profitability.

3. Diversify with risk-adjusted positions

As small-cap value stocks pass muster and earn their spots in your portfolio, it’s important to invest in them only insofar as your financial plan allows.

This means making sure your portfolio remains diversified across asset classes, geography, industry and company size, as well as risk-adjusted according to your tolerance for volatility and the returns required to meet your financial goals, for the more than 10 years it may take your small-cap companies to grow and create value.

As a rule of thumb, an allocation to small-cap value stocks should be large enough to contribute to overall returns, while still having to compete with remaining positions. MoneySense and Motley Fool recommend that investors keep their overall small-cap exposure to between 10-20 per cent of their portfolios.

This exposure should be spread across as many high-conviction companies you succeed in identifying, optimizing your probability of a worthwhile outcome, each attached to a thesis specifying how long you intend to remain invested, what you expect the company to achieve over that time and parametres for liquidating the investment.

Now that you have a working model to add small-cap value stocks to your watchlist, the only tasks left are to run our screener and dive into due diligence. May your research be fruitful and your returns differentiated.

Join the discussion: Find out what investors are saying about these small-cap value stocks on the Thinkific Labs Inc., PharmaCorp RX Inc., Arrow Exploration Corp., Atlas Engineered Products Ltd., Data Communications Management Corp. and Covalon Technologies Ltd. Bullboards and make sure to explore the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.