If Nevada were a country, it would rank fourth among the world’s largest gold producers, trailing only China, Australia and Russia, making it a perennial favorite for prospectors and investors keen to leverage its well-established mining industry and add to the more than 200 million ounces produced in the state to date, a figure that is rapidly rising thanks to fervid demand recently lifting gold to an all-time-high of more than US$4,200 per ounce.

Historically, this meant trying your luck along Nevada’s Carlin or Battle Mountain/Eureka trends, which yielded massive discoveries dating back to the 1800s representing more than 250 million ounces of gold combined.

While these trends have enjoyed most of the spotlight, other prospects have had to contend with more subdued market awareness; that is, until modern exploration methods helped to unlock resources previously economically unfeasible to pursue.

This has been the case with Nevada’s Walker Lane trend, whose respectable 50 million ounces generated since the mid 1800s, spanning an area of about 140,000 kilometres, mostly stem from primitive production methods.

Walker Lane’s vast resources have gone largely untapped because its mostly low-sulfidation epithermal mineralization wasn’t well-understood until modern times, when innovations such as heap leaching and open-pit mining, coupled with the fact that Walker Lane’s mineralization is much closer to surface than Carlin’s, made its land more cost-effective to explore.

According to a recent article from Convergent Mining, a Carlin-type deposit contains refractory ore and organic carbon, whose removal can result in up to 40 per cent higher milling costs compared to Walker Lane, which could represent hundreds of millions or even billions in extra production costs depending on mine size.

Walker Lane sweetens its value proposition by achieving average gold recoveries that are 5 per cent higher than modern Carlin-based operations, resulting in about a US$180 reduction in all-in sustaining costs per ounce, supplemented by associated silver and copper mineralization in significant quantities.

Convergent Mining estimates that, all-in-all, these cost advantages make Walker Lane mineralization 43 per cent more economical than Carlin, making it no surprise that explorers have been finding success in the region over the past few decades. This includes Kinross and Barrick at the Round Mountain mine, one of the most productive in the US, yielding almost 30 million ounces to date, as well as AngloGold Ashanti’s more than 20-million-ounce Beatty gold district, the largest US gold discovery of the 21st century.

A trio of gold and silver projects on the verge of discovery

Walker Lane’s prospectivity extends to junior miners as well, given its comparatively underexplored land package, and as we’ve laid out in this three-part series, Walker Lane Resources (TSXV:WLR) and its high-potential, “on trend” projects are optimally positioned to transform the promise of discoveries into shareholder value.

This article is disseminated in partnership with Walker Lane Resources Ltd. It is intended to inform investors and should not be taken as a recommendation or financial advice.

In part 1, centred on the company’s flagship Tule Canyon project, we delineated how the project’s ~4 kilometre structural corridor hosting high-grade gold and silver benefits from an abundance of mapping, rock samples and soil samples suggesting near-term expansion. A drilling program will get underway by year-end 2025, backed by numerous targets to increasing the project’s likeness to its multi-million-ounce neighbors along the Walker Lane trend.

In part 2, we extended the company’s gold exploration story a little farther out into the future, illustrating the Cambridge project’s data-driven case for discovery, supported by historical high-grade production of 10,000 tons at 0.3 ounces per ton, more than 40 historical workings, plus grab samples up to 93.8 grams per ton (g/t) of gold, trench samples up to 14.65 g/t gold and multiple quartz vein targets to guide the first major exploration program on the project in more than 50 years.

Now, in our third and final article, we will scrutinize the Silver Mountain project, the company’s second runner-up in terms of exploration merit along the Walker Lane trend, painting a picture of why it retains the potential for revealing a company-making discovery – this time of the silver variety – that would likely send the stock soaring, supported by strong demand for everything from jewelry to investment to solar panels that has lifted prices to a record high, with predictions of up to 100 per cent upside over the coming years.

The Silver Mountain project

Silver Mountain, located about 57 km southwest of Goldfield in Esmeralda County, features exploration workings from as far back as 1917, though there’s little in the way of documentation about past exploration or the nature of its mineralization.

The underexplored claims, on BLM land with no surface impairments, are part of a historically productive belt where silver and gold discoveries date back to the 1860s, leading to the construction of numerous mining camps and stamp mills. The Tule Canyon property, Silver Mountain’s neighbor, serves as a prime example, enabling Walker Lane Resources to keep costs low through concurrent exploration.

Other nearby mines in the area speak to Silver Mountain’s outsized upside, including the Nivloc silver mine, Nevada’s largest silver producer from 1938–1943, yielding more than 400,000 tons of ore, and Comstock Lode to the north, the silver-gold deposit that helped Nevada earn its nickname of the Silver State.

Silver Mountain, secured through a 100-per-cent option by 2035 for only $200,000, backs up this upside with geology rich in indications of a potentially large-scale mineralized system.

Modern exploration revealed high-grade, quartz-vein-hosted silver across six showings – as recorded in Nevada’s Mineral Resources Data System – adding heft to the thesis that the project is in the early days of value creation. Supporting prospecting results include:

- The Nevada Bureau of Mines & Geology’s record of two samples in the area grading 1,500 and 3,000 parts per million (ppm) silver, respectively, with one returning 3.5 ppm gold.

- Geological mapping from Silver Range Resources, Silver Mountain’s optionor, identifying a 370-m-long structural corridor with faults hosting high-grade silver veins, where 7 of 16 samples assayed greater than 100 g/t silver.

The most impressive among these samples are concentrated in Old Cabin and Gulch, the most attractive among the six showings, which represent most of the mineralization uncovered to date.

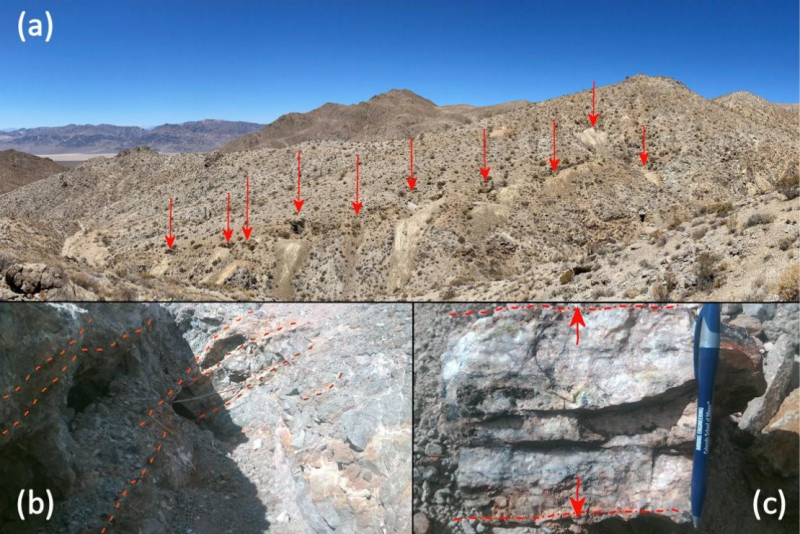

Old Cabin features veins – exposed in workings along a small ridge – that cut intrusive rocks over a vertical distance of more than 30 m, arranging themselves in a stacked vein array with bulk mining potential. Grab samples reach up to 394 g/t silver.

Gulch, for its part, houses veins forming a unified system extending for about 400 m across known workings, where grab samples have returned bonanza grades up to 3,270 g/t silver. This is in addition to underground chip samples at the Silver Bowl mine reaching up to 1,415 g/t silver and 0.48 per cent copper over 0.6 m, with surface samples topping out at 1,245 g/t silver over 0.4 m.

The company is planning more prospecting, geological mapping and sampling of underground workings to better understand Gulch’s high-grade veins and Old Cabin’s prospects for bulk-tonnage mining.

Backed by year-round exploration and a robust inventory of targets, the Silver Mountain project is an essential driver behind Walker Lane Resources’ value proposition, setting the company up to deliver consistent news flow, foster market momentum and diversify its target commodities as Tule Canyon and Cambridge are developed to their fullest extent.

A blatant example of market inefficiency

Despite Walker Lane Resources’ attractive early-stage gold and silver projects, each of which deserves high conviction for transforming exploration upside into shareholder value for years to come, the stock stands at a 24 per cent loss since inception in March 2025, gifting investors with a blatant example of market inefficiency.

On one side of this example, we have a potentially major player in one of Nevada’s most prolific trends, as evidenced by multiple kilometres of mineralization verified by dozens of high-grade samples and historical mine workings.

On the opposite side, we have pessimistic sentiment, which is likely stemming from the complexity of evaluating mineral properties, geopolitical uncertainty nudging investors’ risk tolerance away from junior miners’ high-risk, high-reward nature, as well as lingering inflation nudging investors away from junior mining stocks’ understandably high volatility, caused by the heightened sensitivity of pre-revenue businesses to debt and shareholder dilution.

The upshot here is that these factors are all external, leaving Walker Lane Resources’ fundamentals untouched – including only 19.56 million shares outstanding – making the company a no-brainer addition to your watchlist, should you have room for concentrated, data-driven leverage to a pair of booming commodities in your chosen asset allocation.

Look for positive news flow from Tule Canyon, once drilling gets underway, to create upward momentum in the stock price, tipping the broader market off about the highly prospective gold and silver exploration story only beginning to unfold.

Join the discussion: Find out what investors are saying about this polymetallic gold explorer on the Walker Lane Resources Ltd. Bullboard and make sure to explore the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.