- The global semiconductor supply chain remains under strain, new pressures—driven by surging AI demand and cautious production strategies—are reshaping the market

- For investors, understanding these dynamics is critical as companies like Nvidia (NASDAQ:NVDA), AMD (NASDAQ:AMD), and major consumer electronics brands navigate a challenging environment

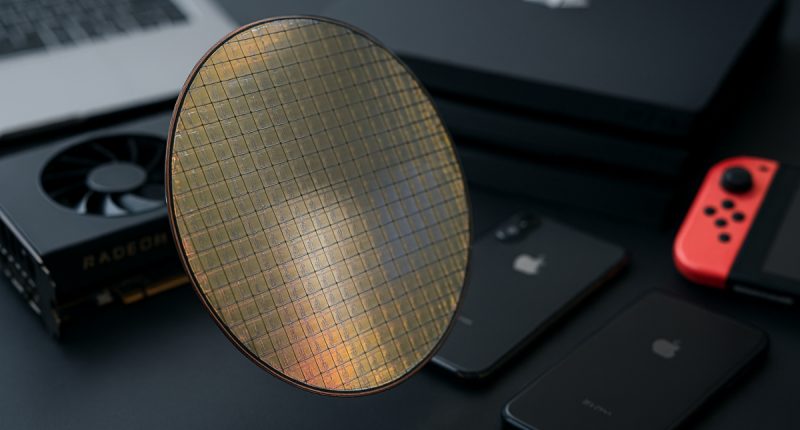

- Semiconductors are the backbone of modern technology and chips power smartphones to game consoles to data centers, chips power nearly every digital experience.

- While supply chains have stabilized compared to 2021, the industry faces a new bottleneck: memory chips—specifically DRAM and NAND, while AI-driven demand is skyrocketing, with hyperscale data centers consuming vast quantities of memory

Semiconductor supply chain resilience

The global semiconductor supply chain remains under strain, and the ripple effects are far from over.

Despite progress since the pandemic-era shortages, new pressures—driven by surging AI demand and cautious production strategies—are reshaping the market. For investors, understanding these dynamics is critical as companies like Nvidia (NASDAQ:NVDA), AMD (NASDAQ:AMD), and major consumer electronics brands navigate a challenging environment.

This article is a journalistic opinion piece that has been written based on independent research. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Why chip shortages still matter

Semiconductors are the backbone of modern technology. From smartphones to game consoles to data centres, chips power nearly every digital experience. While supply chains have stabilized compared to 2021, the industry faces a new bottleneck: memory chips—specifically DRAM and NAND. These components are essential for graphics cards, AI servers, and consumer devices.

AI-driven demand is skyrocketing, with hyperscale data centres consuming vast quantities of memory. Manufacturers, wary of past price collapses, have deliberately kept capacity tight to maintain profitability. The result? Elevated costs, longer lead times, and price hikes across the tech ecosystem.

Nvidia and AMD: Leading positioning despite constraints

Nvidia continues to dominate the AI accelerator market, benefiting from demand for GPUs in data centres. However, its consumer-facing products—like GeForce cards—are not immune to memory cost inflation. AMD, meanwhile, is taking a more direct approach: reports indicate a 10 per cent price increase across its graphics card lineup, following an earlier adjustment for industry customers in October 2025. This move signals a tougher environment for holiday deals and suggests a new pricing baseline heading into 2026.

For gamers and PC enthusiasts, the message is clear: deep discounts may be a thing of the past. Investors should watch how these pricing strategies affect market share and margins, especially as competitors face similar pressures.

Long-term implications for tech and automotive

PCs: Microsoft and Intel

Personal computers remain a cornerstone of semiconductor demand. Microsoft (NASDAQ:MSFT) (Windows ecosystem and Xbox) and Intel (NASDAQ:INTC) (CPU dominance) rely heavily on memory chips for performance. Rising DRAM and NAND costs could push PC prices higher, particularly for premium laptops and desktops. Analysts expect 2026 production forecasts for notebooks to decline, signalling potential headwinds for PC makers.

Smartphones: Apple

The iPhone is one of the most memory-intensive consumer devices. With AI features increasingly integrated into mobile platforms, Apple (NASDAQ:AAPL) faces dual challenges: securing supply and managing costs without alienating consumers. Expect higher retail prices or slimmer margins as memory inflation persists.

Game consoles: Sony and Nintendo

Gaming consoles are not immune. Sony’s (NYSE:SONY) PlayStation and Nintendo’s (OTC Pink:NTDOF) Switch 2 depend on advanced memory for graphics and storage. If shortages worsen, launch timelines and pricing strategies could be impacted (again) —critical factors for investors tracking console cycles and gaming revenue streams.

Automotive: A smaller but growing impact

While cars use fewer memory chips than PCs or phones, the rise of EVs and autonomous systems is increasing semiconductor dependency. Analysts warn that automotive supply chains could feel secondary effects, particularly in infotainment and driver-assist systems.

Investor takeaways

- Pricing power returns: Memory makers like Samsung, SK hynix, and Micron are entering a robust upward pricing cycle, boosting margins but squeezing downstream brands.

- AI as a demand catalyst: Generative AI is the primary driver of this supply crunch, and its growth trajectory suggests pressure will intensify through 2026.

- Consumer electronics at risk: PCs, smartphones, and consoles will see higher retail prices, potentially dampening demand.

- Holiday season alert: For consumers—and investors tracking retail trends—the window for “great deals” on GPUs and gadgets may close sooner than expected.

Straight from the motherboard

Semiconductors remain the lifeblood of modern technology, and their scarcity has far-reaching consequences. For investors, the key is to monitor how companies balance supply constraints with pricing strategies. Those that adapt effectively—whether through vertical integration, strategic partnerships, or premium positioning—will emerge stronger in a market where resilience is the ultimate competitive advantage.

Join the discussion: Find out what the Bullboards are saying about chip stocks like AMD and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.