Gold prices keep breaking records and investor interest is showing signs of renewal along West Africa’s mining corridor, a major exploration initiative is now underway at one of the region’s most promising gold projects.

A new multi‑phase drill program, paired with an updated mineral resource estimate, is poised to redefine the project’s growth trajectory while sharpening its strategic focus for the year ahead.

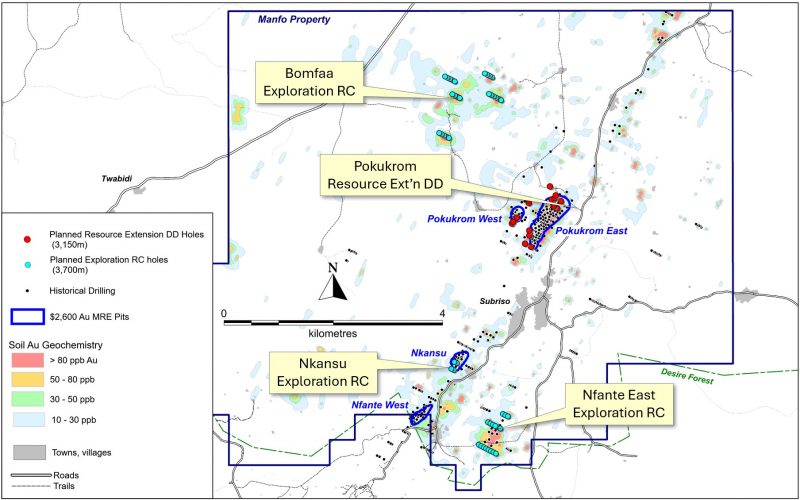

Pelangio Exploration Inc. (TSXV: PX) (OTC Pink: PGXPF) has entered a pivotal new phase in the advancement of its Manfo Project in Ghana, announcing that the first phase of its 2026 drill program is now underway. The program marks an important step in the company’s strategy to expand and upgrade the project’s known gold resources while bringing new, highly prospective targets into play.

This article is disseminated in partnership with Pelangio Exploration Inc. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Phase One drill program: Extending known resources and testing new targets

The launch of a 6,850‑metre drill program signals renewed operational momentum at Manfo. The program includes:

- 3,150 metres of resource extensional diamond drilling – currently underway

- 3,700 metres of exploration reverse‑circulation (RC) drilling – to follow

As outlined in Pelangio’s September 2025 NI 43‑101 Technical Report, this represents the first phase of a larger, multi‑stage plan aimed at resource growth and definition.

Resource extensional drilling: Building on Pokukrom East and West

Diamond drilling is targeting extensions at both Pokukrom East and Pokukrom West—two core deposits within the Manfo Project. Drilling will test along‑strike, down‑dip, and down‑plunge positions to determine whether mineralization continues beyond currently defined boundaries. Any confirmed extensions will guide future infill drilling programs aimed at adding new ounces to the project’s mineral inventory.

Exploration RC drilling: Bomfaa takes centre stage

Following the diamond program, the RC campaign will evaluate several promising targets:

- Bomfaa Au geochemical anomaly – An untested, highly prospective anomaly located 2.5 km northwest of the Pokukrom deposits.

- Nfante East – A target with notable historic intercepts, including

- 6m @ 2.99 g/t Au (2011)

- 17m @ 1.22 g/t Au (2010)

- Southern extension of the Nkansu deposit

Assays will be released periodically over the next several months as drilling progresses.

Manfo resource estimate: Strong foundation for growth

The 2025 MRE update, which used a gold price of $2,600/oz for pit optimizations versus the 2013 Maiden MRE which employed a gold price of $1,450/oz, resulted in an increase to the pit constrained Indicated resource of 246,000 oz (+126%) plus an increase to the pit constrained Inferred resource of 316,000 oz (+395%).

| Year | Indicated | Inferred | ||||

| Tonnes | Au grade (g/t) | Au ounces | Tonnes | Au grade (g/t) | Au ounces | |

| 2013 | 3,973,000 | 1.52 | 195,000 | 2,253,000 | 1.10 | 80,000 |

| 2025 | 11,787,000 | 1.16 | 441,000 | 16,048,000 | 0.77 | 396,000 |

| Increase (oz) | 246,000 | 316,000 | ||||

| Increase (%) | 126% | 395% |

Financing update: Private placement completed at C$4.5 Million and $1,395,933 raised through warrant exercise

Pelangio has also closed the second and final tranche of the non‑brokered private placement first announced in September and increased to C$4.5 million two days later.

- First tranche:

- C$3,462,600 raised

- 19,236,668 units issued at $0.18 per unit

- Final tranche:

- C$1,037,399.76 raised

- 5,763,332 units issued at $0.18 per unit

Gross proceeds will support:

- Exploration activities

- Land maintenance

- Working capital and general corporate purposes

The completion of this placement ensures the company is fully funded for the current drill campaign and related resource‑expansion efforts.

The company also received gross proceeds of $1,395,933 through the exercise of warrants.

A stronger position and momentum ahead

With drilling underway and fresh capital in hand Pelangio Exploration enters 2026 with focus and momentum. The Manfo Project—already hosting more than 800,000 ounces of gold across Indicated and Inferred categories—now stands positioned for meaningful growth pending the results of the extensional and exploration drilling.

“Resource growth. Exploration scale. Capital in the bank.” To find out more about the company, click the video below.

Investor’s corner

Pelangio’s story has already proven compelling: the stock has risen more than 450 per cent on the TSX since January 2025. But with significant exploration catalysts now ahead, this is a moment that warrants deeper due diligence for those evaluating opportunities in the emerging West African gold sector.

To keep up with the latest developments from the company, visit Pelangio.com.

Join the discussion: Find out what the Bullboards are saying about Pelangio Exploration and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.