The global economic climate is becoming increasingly unstable because of a confluence of factors, clouding near-term growth forecasts and creating uncertainty about how to best put capital to work. Key factors include:

- Aggressive US trade policy, weakening labour markets and consumer demand as economies readjust their supply chains to accommodate new tariffs.

- Political instability in Europe and the Middle East ramping up downside risk in the energy market, hindering an essential input across the industry spectrum.

- The rise of deglobalization in the form of nationalism and protectionism, leading to a fall in exports across most of the world’s top 10 economies.

These catalysts are stoking market pessimism, prompting central banks to adopt more dovish interest rate policy to support growth and avoid recession, at the risk of reigniting inflationary pressures, making the path forward anything but clear cut.

The opportunity at the heart of gold’s ongoing ascent

Investors have responded to souring economic conditions by increasing their allocations to gold, calling upon the metal’s multi-generational track record as a value preserver and return driver during periods of falling or decelerating growth, more than doubling the price per ounce over the past five years to a record high of more than US$4,000 as of October 7th. Upward price pressure is expected to continue over the coming years, as per analysis from Goldman Sachs and VanEck, the latter seeing the potential for a US$5,000 ounce by the end of the decade.

With their target commodity going for a hefty price, gold explorers, developers and producers have become some of the most attractive prospects in the stock market today, incentivizing investors to seek out differentiated companies in terms of assets and operations to maximize leverage to gold’s ongoing ascent.

The Walker Lane trend

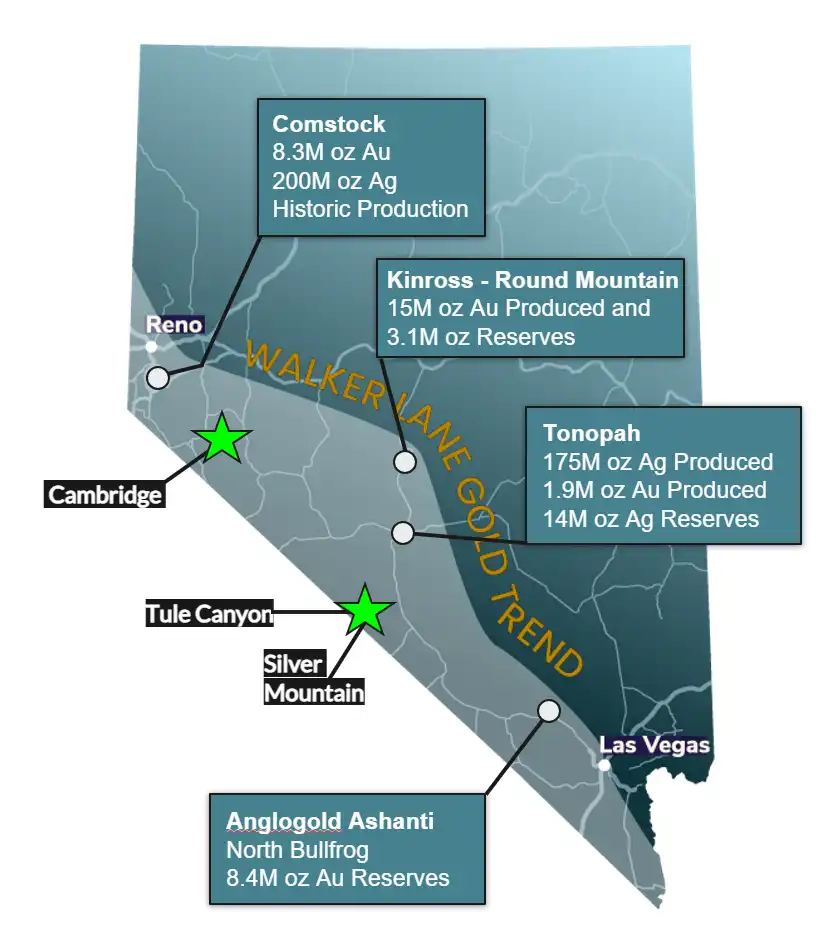

A prospective thesis every gold investor should consider centers on the prolific Walker Lane trend along the California-Nevada border, which has yielded more than 50 million ounces of gold, 700 million ounces of silver and 4 million tons of copper over a more than 150-year history. Standout projects creating value in the area include:

- Kinross Gold’s producing, more than 20-million-ounce Round Mountain mine.

- AngloGold Ashanti’s Silicon-Merlin discovery, one of the largest gold discoveries in North America at more than 15 million ounces.

- Centerra’s development-stage 4.2-million-ounce Goldfield project.

- Hudbay Minerals’ Mason property, housing resources in excess of 51.8 billion pounds of copper, 461 million pounds of molybdenum, 400,000 ounces of gold and 8.8 million ounces of silver.

- Additional notable operators in the area include Hecla Mining, Scorpio Gold, West Point Gold, Silver One Resources, Blackrock Silver, Summa Silver and many more.

Unlike its primarily sediment-hosted gold-mineralized neighbors to the north – the 150-million-ounce Carlin trend and 100-million-ounce Battle Mountain Eureka trend – Walker Lane hosts a diversity of occurrences, including porphyry copper and epithermal gold-silver systems, which are over 40 per cent more economical to extract and offer significant exposure to silver and copper, metals that have also been surging in price as of late, propelled by investor demand for safe havens, as well as exposure to the critical metals underpinning the green energy transition.

When we note that Walker Lane has seen little in the way of modern exploration, it becomes clear that the trend’s prospectivity is only beginning to unfold, with millions of gold equivalent ounces likely still up for grabs, presenting miners with a low-risk, high-reward scenario to contribute to the US metals supply chain.

Walker Lane Resources

Enter Walker Lane Resources (TSXV:WLR), market capitalization C$3.72 million, an explorer with a trio of properties – Tule Canyon, Cambridge and Silver Mountain – strategically located along the Walker Lane trend, each offering investors numerous high-conviction catalysts towards harvesting value and sending the company’s stock, down by 2 per cent since inception in March 2025, into a potentially exponential re-rating.

This article is disseminated in partnership with Walker Lane Resources Ltd. It is intended to inform investors and should not be taken as a recommendation or financial advice.

The junior miner is planning exploration programs on all three properties over the near-term, keen to follow up on high-grade historical results and improve the market’s appreciation of their potential, guided by a leadership team with multiple decades in the mining sector spanning exploration, geology, resource development and capital markets, confident in delivering compliant resources within a 1-2-year timeframe and economic studies over the medium-term.

The Tule Canyon project

Let’s begin our assessment of Walker Lane Resources’ Nevada-based portfolio with its flagship past-producing Tule Canyon project, optioned in March 2025, located 95 kilometres south of Tonopah in Esmeralda County, Nevada.

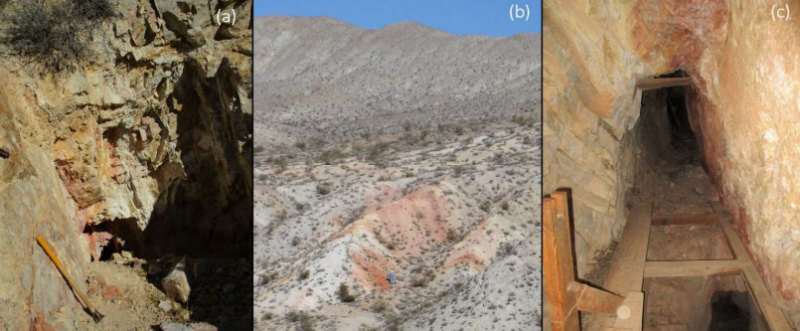

The road-accessible project, consisting of 58 federal lode claims on BLM land with no surface restrictions, shows evidence of placer and hard-rock mining dating back to the mid-1800s, though no modern exploration has been conducted since the 1980s and much of the property, underlain by shallow cover, remains unexplored, presenting Walker Lane Resources with four major targets to drill and demonstrate exploration upside.

These include two gold mines, Eastside and Dark Secret, as well as Ingall’s Vein and the China Doll veins, which substantiate their prospectivity through geological mapping, rock and soil sampling defining a ~4 km structural corridor hosting high-grade gold and silver mineralization. Exploration highlights along this corridor include:

- Numerous gold-in-rock samples grading more than 10 grams per ton (g/t) of gold across all four targets, including surface grab samples up to 27.2 g/t gold from Dark Secret and Eastside.

- Numerous silver-in-rock samples grading more than 100 g/t silver from China Doll and Ingall’s Vein.

- A large magnetic low at Dark Secret and a prominent resistivity high associated with Eastside suggesting the presence of a bulk-tonnage gold target.

- A chip sample across weathered bedrock in the small pit above the underground workings at Dark Secret yielding 40 metres at 0.469 g/t gold, including 20 m at 0.695 g/t gold.

- Steeply dipping structures to the north and northwest at Dark Secret hosting mineralized veins and breccia within shears exhibiting silver and gold mineralization sampling up to 37.3 g/t gold and 4,320 g/t silver.

- Underground grab samples from 5.38 g/t gold to 27.6 g/t gold and a chip sample of 0.30 m at 5.25 g/t gold from Eastside.

Management is planning a drilling program at Tule Canyon expected to break ground in late 2025, following up on mineralization associated with favourable geophysics at Dark Secret and Eastside, in addition to the former’s high-grade north-northwest-trending structures, positioning the junior miner to begin to prove that its multi-million-ounce neighbors are indeed indicative of its portfolio’s prospectivity and worthiness of turning investor sentiment around.

Look out for part 2 of this 3-part series over the coming weeks, in which we’ll define the value proposition behind Walker Lane Resources’ Cambridge property, where grab samples up to 93.8 g/t gold – with 29 per cent yielding above 5 g/t gold – and numerous structural trends verified by airborne magnetic and radiometric surveys suggest significant untapped potential.

Join the discussion: Find out what investors are saying about this polymetallic gold explorer on the Walker Lane Resources Ltd. Bullboard and make sure to explore the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.