Introduction – From junior explorer to valuable asset

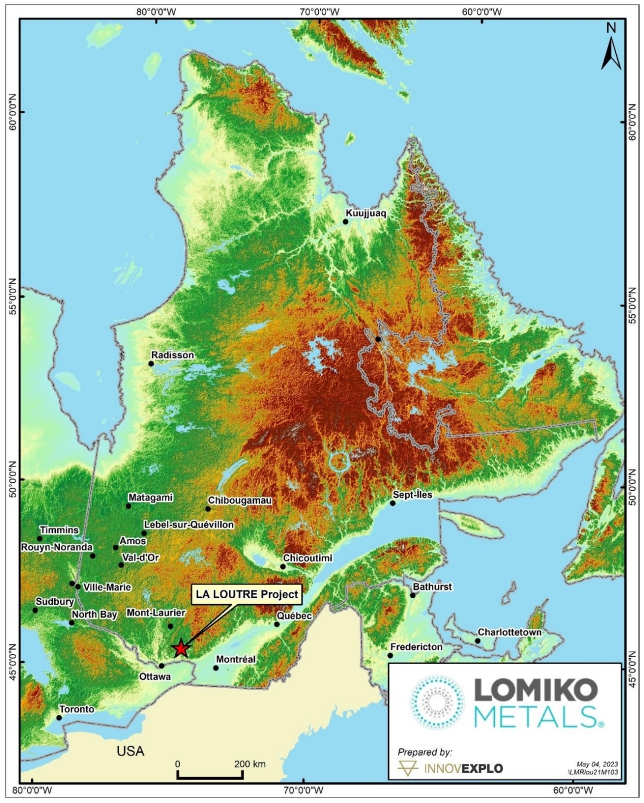

In our previous article, we took a deep dive into Lomiko Metals Inc. (TSX.V:LMR) and its flagship asset, the La Loutre Graphite Project in Québec. We explored the project’s geology, resource scale, and metallurgical promise, highlighting its potential to become a cornerstone of North America’s graphite supply chain.

This article is disseminated in partnership with Lomiko Metals Inc. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Now, we shift focus to Lomiko’s risk-reward profile, key catalysts, and market outlook—critical elements for investors evaluating this junior developer in a rapidly evolving global context. Graphite developers are a rare breed in North America. With China dominating global graphite production and processing, Lomiko’s emergence aligns with a broader geopolitical and industrial shift: the localization of critical mineral supply chains. Positioned in Québec, Lomiko is not just a mining story—it’s a success story.

The bull case

1. High-grade Québec project with scale

La Loutre boasts 64.7 million tonnes of Indicated Resources at 4.59 per cent Cg, with an additional 17.5 million tonnes of Inferred Resources at 3.51 per cent Cg. This scale and grade place it among the top graphite deposits globally, with potential for long-term supply into battery and industrial markets.

2. Validation from battery testing

Lomiko has completed half-cell battery testing with Polaris Battery Labs, confirming strong electrochemical performance of its coated spherical purified graphite (cSPG). Phase 2 testing, including pouch cell trials, is underway—an important step toward commercial validation.

3. Major value to defense, energy transition, and allied governments

Lomiko has received US$8.35 million from the U.S. Department of Defense and C$4.9 million from Natural Resources Canada to support feasibility studies and anode material piloting. This points to its serious relevance to national security and energy independence.

4. Low market cap = asymmetric upside

With a market cap hovering around C$6.5 million, Lomiko offers a classic junior mining asymmetry: high potential upside if key milestones are met, especially in a tightening graphite market.

The bear case / risks

1. Challenges in “cottage country”

La Loutre is located near recreational and residential areas in the Laurentides.

Community concerns over environmental impact and seasonal tourism have prompted Lomiko to adjust its project footprint and timelines. Many early developers strike a balance between challenges and community engagement when the project’s footprint is not well-defined and not all answers are readily available. Finishing the pre-feasibility study will be a considerable advancement, as the project footprint would be better defined, as well as the production profile and project economics. Many answers that are not available at this point will be answered in the study, including water quality, dust mitigation, project footprint, and production profiles that will provide factual information to the local residents.

2. Capital intensity and financing risk

Graphite projects are capital-intensive, and Lomiko’s ability to raise funds consistently— despite recent successful tranches — remains a risk. Dilution and market volatility could impact shareholder value.

3. Technological risk: Synthetic graphite and silicon anodes

While synthetic graphite is dominant today, and emerging anode technologies (e.g., silicon) could shift demand dynamics, natural graphite is the most sought-after material in anodes, as this technology is very well known. Regardless, Lomiko must stay ahead of these trends through R&D and partnerships which are currently underway.

Key catalysts to watch

- Bulk sample and pilot results: A 250–tonne bulk sample, with results expected to validate scalability of anode material production.

- Pre-feasibility / feasibility milestones: Completion of engineering and environmental studies will de-risk the project and attract institutional interest.

- Offtake agreements and government grants: Further commitments from OEMs or governments could significantly re-rate the stock.

- Investor or partner entry: A JV or equity stake from a battery manufacturer or defense entity would be transformative.

Conclusion – For investors with patience and risk tolerance

Lomiko Metals offers a speculative, but strategic play on graphite—a critical mineral at the intersection of clean energy, defense, and industrial sovereignty. For investors willing to navigate permitting and financing risks, Lomiko presents a unique opportunity to gain exposure to a potential future supplier of North American anode material.

Critical minerals aren’t just a green story—they’re a defence and sovereignty story. Lomiko’s alignment with government priorities and its progress at La Loutre make it a junior worth watching.

Join the discussion: Find out what the Bullboards are saying about Lomiko Metals and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.