In March 2025, the price of gold rose from US$2,500 to US$3,000 in only 210 days, representing the metal’s fastest increase on record, which it went on to break in the intervening period to date, reaching an all-time-high of more than US$3,400 per ounce in June. Altogether, gold has posted a more than 100 per cent return since 2022. Let’s go over the confluence of factors at play here:

- Firstly, U.S. foreign policy has been destabilizing as of late, with President Trump’s tariffs sending the global economy into mass reorganization to either hammer out trade deals with the U.S. or find new partners to minimize reliance. Understandably, questions of near-term earnings are shrouded in uncertainty, increasing the appeal of safe-haven assets such as gold, whose value preservation track record spans generations.

- Secondly, while global inflation has come down from its post-pandemic high in 2022, this is largely only on paper for most consumers, whose are still dealing with elevated prices driven by strong labour markets, falling interest rates and a rising trend in deglobalization marked by onshoring critical minerals production and decreasing exposure to unreliable partners. The result, compounded by tariffs, is a tepid investment environment, where hedging and diversification are taking precedence over risk-on sentiment in institutional as well as retail portfolios.

- Thirdly, hovering above the first two bullet points, we have a global environment characterized by elevated tensions, with major wars ongoing in Europe and the Middle East, economic superpowers China and the U.S. at odds with one another, and accelerating de-dollarization driven by President Trump’s volatile governance, all of it further nudging investors into a bias towards portfolio safety.

It’s thanks to this macroeconomic maelstrom that analysts are being forthright about gold’s near-term strength and untapped upside, with J.P. Morgan Research and Goldman Sachs predicting a US$4,000 ounce by mid-2026, representing 14.5 per cent upside from the price of US$3,491 on August 8.

Consequently, picks-and-shovels players supplying the surge – namely explorers, developers and producers – are being gifted with a value-accretive pathway to further their business plans, while investors stand to benefit from quality names best positioned to deliver operational leverage propelled by gold hovering near its all-time-high.

A junior miner on a path to near-term cash flow

A scalable, data-driven thesis to capitalize on gold price strength begins with LaFleur Minerals (CSE:LFLR), market capitalization C$24.98 million, a junior gold explorer in mining-friendly Quebec whose stock has risen by 90 per cent year-over-year, reflecting management‘s rapidly developing path towards production and resource expansion backed by deep expertise in capital markets and geology across a diversity of metals and minerals.

This article is disseminated in partnership with LaFleur Minerals Inc. It is intended to inform investors and should not be taken as a recommendation or financial advice.

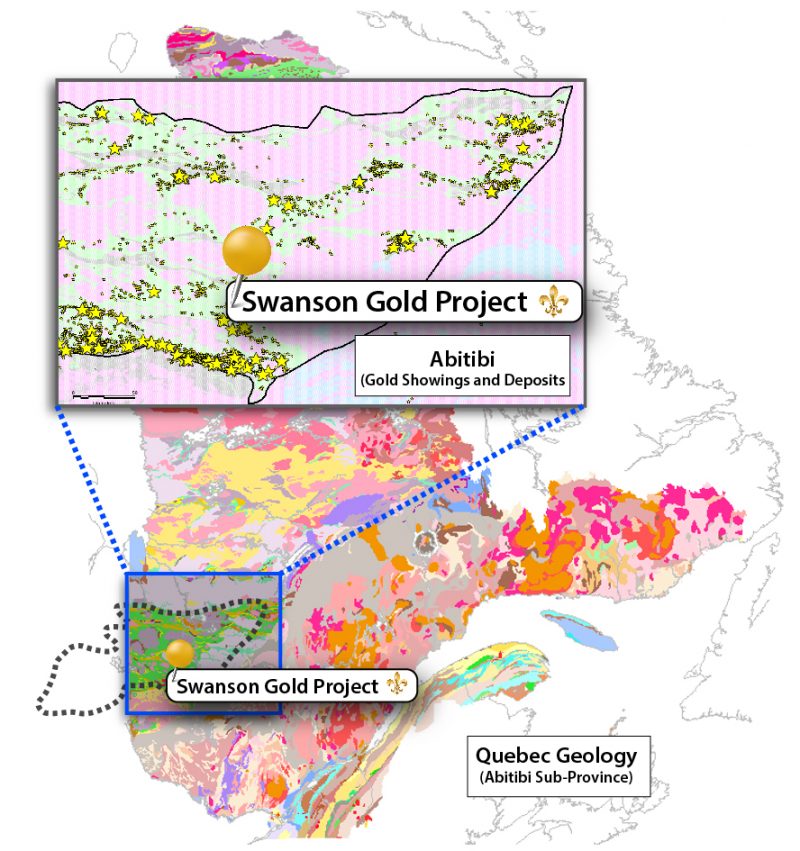

LaFleur is based near Val d’Or in Quebec’s prolific Abitibi Greenstone Belt, Canada’s most productive gold region at more than 200 million ounces to date, granting the company dozens of well-mineralized neighbours, including established producers such as Agnico Eagle Mines and ElDorado Gold and prospective explorers such as Probe Gold and O3 Mining.

LaFleur differentiates itself from these high-profile operators and substantiates its prospectivity by means of vertical integration through its fully refurbished 750-ton-per-day Beacon Gold Mill (permitted to process up to 1.8 million tons of tailings) and vastly untapped, underexplored, district-scale Swanson Gold Project, both of which are wholly owned. Here’s a breakdown:

- The Beacon Gold Mill‘s cost-effective Merrill Crowe processing model and low restart costs of C$4.1 million make it an attractive asset for potential custom milling services in a region host to more than 100 historical and operating mines keen to monetize their ore. According to a valuation report by Bumigeme discussed later in this article, a comparable brand-new mill and tailings storage facility would require more than C$71.5 million and about 5 years of permitting and environmental studies – positioning LaFleur years ahead of other junior miners and on a low-cost, high reward restart path.

- The 18,300-hectare Swanson Gold Project boasts a track record of resource expansion, with management seeing the potential to almost 10x the existing resource to more than 1 million ounces, consolidate its position as one of the largest land packages in the southern Abitibi Gold Belt, while offering investors robust exploration upside to fuel shareholder value creation.

Should gold carry on soaring, LaFleur is positioned to sustainably contribute to meeting investor and industrial demand, evading the whims of capital markets through internally generated cash flow once in production, while providing pure-play leverage beyond owning the metal alone, allowing investors to maximize exposure to gold’s ongoing rally.

Let’s analyze the portfolio, asset by asset, to clarify how LaFleur’s growth runway stands up to due diligence.

LaFleur’s Beacon Gold Mill

LaFleur intends to step into the role of producer in late 2025 following an expected financing close, reaching full capacity at Beacon in early 2026 following a rapid ramp-up. Here’s a refresher of the asset’s development timeline:

- The company became sole owner in October 2024, paying only C$1.1 million for the mill and adjoining past-producing mine following over C$20 million in upgrades and C$5 million in exploration by previous owner Monarch Mining.

- Planning and preparatory work quickly followed in January and March.

- News of initial permitting to process a 100,000-ton bulk sample from the Swanson Project, only 50 kilometres away, hit the wires in May. The sample represents only 3 per cent of property’s existing resource, carries an estimated average grade of 1.89 grams per ton (g/t) of gold, and will help the company hone Beacon’s processing through metallurgical testing.

- A finalized mill restart plan at estimated costs of C$5-6 million arrived in June, following site inspections, parts inventory, as well as geotechnical and tailings storage facility assessments, demonstrating management’s disciplined progress and unwavering focus on reaching initial revenue.

- An independent evaluation report conducted by Bumigeme Inc. in July outlined the massive cost efficiencies between restart cost vs rebuild (C$4M vs ~C$50–70M) which underscores the Beacon Gold Mill’s strong asset value and LaFleur’s foundational strength.

Beacon is estimated to yield between 30,000-40,000 ounces of gold per year at full capacity, representing nearly US$140 million in revenue at prices as of August 8, with the Swanson bulk sample expected to deliver at least 6,350 ounces of gold or more than US$22 million in nearer-term revenue – subject to ongoing permitting – to fund Beacon’s ramp-up to greater efficiencies of scale.

The facility’s proximity to more than 100 deposits, many of which are years away from establishing their own mill, enables low-cost transport and logistics to process ore from nearby projects seeking a quick path to monetization without the need to raise substantive capita. LaFleur is currently engaged in numerous ongoing discussions with institutions and private equity groups about potential partnerships, as well as discussions with commodity trading and debt financing firms to fund the mill’s restart, and recently engaged FMI to lead the charge on a C$5M financing for that purpose.

With gold sitting comfortably above US$3,000 per ounce since President Trump’s tariff regime came to light in Q1 2025, a large number of potential partners that recognize the path to value creation, and Beacon positioned to compete as a low-cost producer in the storied Abitibi region, LaFleur embodies a low-risk thesis to harvest immense upside over the coming months.

This thesis is confirmed in a valuation report by Bumigeme – an engineering firm in Montreal specializing in mining and mineral treatment – estimating full replacement costs for the mill, tailings storage facility and associated permitting of more than C$71.5 million, with rehabilitation and commissioning costs estimated at only C$4.1 million, representing a more than 17x margin of safety.

The report, based on present prices, takes Monarch’s refurbishments, the ongoing gold rally and LaFleur’s prime position to profit from it into full account, and will serve to facilitate funding and partnerships for Beacon’s restart.

Bumigeme’s estimate means LaFleur is currently trading at a market capitalization below the value of less than half of only one of its assets, granting investors exposure to most of Beacon and the entirety of the Swanson Gold Project for free.

LaFleur’s prime location for production deal flow

Given the more than 100 mines in its vicinity, the Beacon Mill has a value-added role to play when it comes to enhancing margins for neighboring operators. As negotiations with a diversity of interested parties run through due diligence and initial revenue shows up on the income statement, investors should look for this role to receive additional market recognition, likely catalyzing LaFleur stock into increasing its ongoing re-rating year-over-year — already more than 3 times the TSX’s 24.90 per cent effort over the period ending August 8.

In the meantime, LaFleur will continue advancing the processing of the aforementioned Swanson bulk sample, putting it on a path to eight-figure revenue, even if third-party deals take a lumpy closing trajectory.

Swanson currently houses a 2024 resource estimate of 123,400 ounces indicated and 64,500 ounces inferred, representing more than US$650 million in the ground. This ounce count reflects an 8 per cent increase in indicated resources and a 626 per cent increase in the inferred category compared to the 2021 estimate, and is spread across 27 gold showings (3x growth since acquisition, also from Monarch) backed by more than 36,000 metres of historical drilling.

Swanson’s large and richly mineralized land package, including the Swanson, Bartec and Jolin deposits along a major structural break, as well as several other showings, are complemented by easy access to a road and a rail line, creating a firm foundation for further development.

Upcoming development initiatives include ongoing preliminary economic assessment work to evaluate an open-pit mining scenario and bulk sample processing, as well as an ongoing fully-funded 5,000-metre diamond drilling program eyeing extensions along strike of more than 50 high-conviction targets identified by airborne geophysics, induced polarization surveys and geochemical sampling. Initial drilling assays are expected in the coming weeks. All-in-all, management sees long-term potential for Swanson to surpass 1 million ounces in gold resources.

In this way, LaFleur is announcing itself to the market as a vertically integrated engine for value creation, with near-term cash flow in its sights and increasingly self-funded resource expansion carrying it into a propitious future, ever purifying investors’ exposure to its soaring commodity.

LaFleur’s re-rating has ample room to run

Falling squarely into the category of net-net – a term coined by famed value investor Ben Graham to refer to companies trading below the value of their assets – LaFleur is a rare bargain, even after the stock’s 90 per cent gain year-over-year, rising above the macroeconomic noise discussed in the introduction through good old-fashioned disciplined development.

In less than two years, the company is on track to evolve from a prospective explorer into a gold producer with a potentially million-ounce resource and an abundance of potential partners actively seeking to invest in its success. With the price of gold testing record levels, this scenario could hardly be more ideal, equipping the low-cost, soon-to-be producer – contingent on financing – to rapidly grow into efficiencies of scale and lay the foundation for a path to profitability that would differentiate it from pre-revenue peers.

With gold expected to not only post a strong 2026, but also build momentum towards US$4,400 by 2027, according to InvestingHaven, and US$4,800 by 2030, according to Incrementum AG, LaFleur benefits from a long runway to pursue these efficiencies opportunistically, re-investing cash to increase flexibility to market dynamics and continue delivering on its potential for significant shareholder value.

The stock’s recent re-rating, occurring entirely pre-revenue, appears to be merely the starting point of a multi-year thesis, one where proven management harnesses high-quality assets and a gold tailwind into an outsized outcome.

Join the discussion: Find out what everybody’s saying about this Canadian gold miner and near-term producer on the LaFleur Minerals Inc. Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.