Exploration is ramping up just outside Princeton, BC, where the latest field team and a diamond drill have arrived to prepare pads for a major program targeting both near‑surface gold and deeper porphyry copper‑gold mineralization. Because the project sits minutes from town—with road access, grid power, and services—no remote camp is required, allowing for faster, lower‑cost mobilization and year-round work.

Company snapshot and location advantage

Sego Resources Inc. (TSXV:SGZ) is advancing its 100 per cent-owned Miner Mountain alkalic porphyry copper‑gold and gold project on the edge of Princeton in British Columbia’s mining-friendly Quesnel Terrane. The property lies roughly 15 km north of Hudbay’s operating Copper Mountain Mine, on the same prolific alkalic porphyry trend—an established belt with power, roads, skilled labour, and supportive local stakeholders.

The project’s proximity to town confers practical benefits: Sego reports power on the property and two‑wheel‑drive access 11 months of the year—reducing logistics costs and avoiding the need for an exploration camp.

Why alkalic porphyry geology matters

Miner Mountain is part of a well-documented alkalic porphyry system, the same deposit class that hosts Copper Mountain to the south. Alkalic porphyries in the Quesnel Terrane (Nicola Group) are known for copper‑gold mineralization associated with potassic alteration (K‑feldspar–magnetite and bornite/chalcopyrite), often forming large, open‑pit mines with gold credits.

In an exclusive interview with the Market Online’s “Capital Compass”, the company’s CEO, J. Paul Stevenson explained that alkalic deposits arenoted for their excellent copper and gold ratios. “They are hard to find, because they don’t have the vast alteration zones,” he said. “The alkalic deposits tend to cluster, so that one normally finds more than one deposit within the system.”

You can watch the interview in full by clicking the video below.

Context for investors: While BC is a global centre of alkalic porphyry systems, similar alkalic suites also occur in other regions (e.g., Australia). Miner Mountain’s setting within BC’s Quesnel belt is particularly significant because it directly aligns with the Copper Mountain camp’s mineralizing system and structural architecture.

November 2025 program: pads now, drills next (~1,000 m planned)

On November 12, 2025, Sego confirmed its diamond drill and field team had arrived at Miner Mountain and were preparing drill pads ahead of drilling. The phase totals about 1,000 metres, split between the shallow South Gold Zone and deeper tests in the Cuba Zone.

South Gold Zone (near surface, bulk‑tonnage gold)

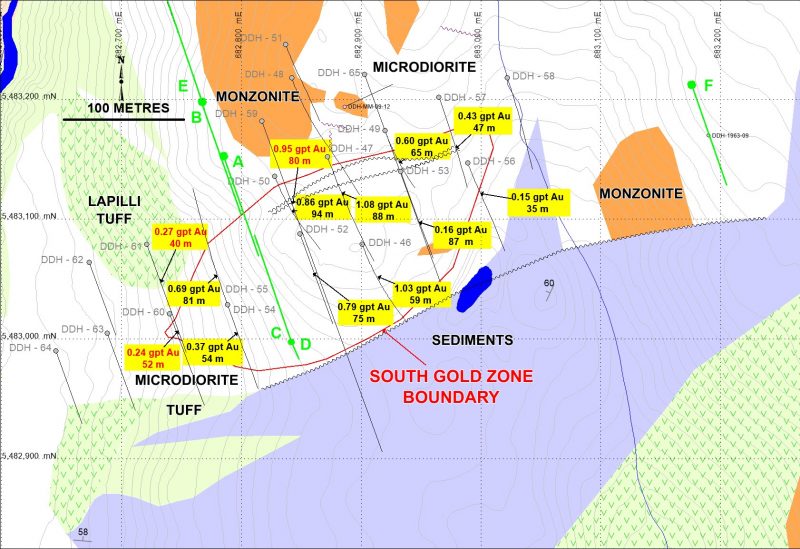

- Historic intersections include up to 1.08 g/t Au over 88.0 m, within an oval mineralized footprint ~285 m long by 145 m wide to ~70 m vertical depth.

- The South Gold Zone is currently a “Target Reviewed” 90,000–150,000 ounces of near‑surface gold, per an SRK Consulting (Canada) Exploration Target Review (Sept. 24, 2024). Note: exploration target; not a NI 43‑101 resource.

- ~4 holes (~470 m) are designed to close an ~80 m gap between sections, collect specific gravity data, and support advancing the zone toward a NI 43‑101 resource “possible” category.

- Metallurgy: a non-cyanide leach will be tested to confirm a 2021 bench‑scale cyanide test that returned ~95 per cent gold recovery, with an eye to improved economics and ESG profile.

Cuba Zone (deeper porphyry copper‑gold)

- Step‑outs will probe ~500 m below a >1 per cent Cu porphyry intersection indicated on long section, approximately 1,700 m NE of the South Gold Zone.

- DDH‑37 previously cut 4.4 m of 1.2 per cent Cu and 0.24 g/t Au within 11 m of 0.6 per cent Cu and 0.12 g/t Au at 233 m depth (Feb. 28, 2019 news), motivating the deeper test.

- PGMs: A subsequent analysis of DDH‑37 reported 0.13 g/t Pd over 2 m, supporting the alkalic signature (Oct. 24, 2023).

What “investment proportion” looks like here

Investors often ask how capital is being allocated between targets and enabling work. Based on the current plan:

- ~47 per cent of metres (≈470 m) are dedicated to de‑risking the South Gold Zone—filling data gaps for a potential initial resource pathway and completing SG measurements and metallurgical confirmation (non‑cyanide test). This is the near‑term value‑definition component.

- ~53 per cent of metres (≈530 m) target deeper, higher‑impact copper‑gold potential in the Cuba Zone, stepping below prior >1 per cent Cu indications to test the porphyry core at depth. This is the discovery‑upside component.

That split could provide a balanced risk profile: advancing a shallow, potentially bulk‑mineable gold zone while pursuing a classic copper‑gold porphyry source that could drive scale.

Infrastructure, access, and permitting context

- Access and utilities: Road‑accessible pastureland with grid power on site supports year‑round exploration—significantly reducing mobilization and camp costs.

- Regional mining ecosystem: The immediate area hosts the long‑lived Copper Mountain operation (now 100 per cent Hudbay), with an established workforce, supply chain, and power infrastructure—factors that can expedite future development scenarios.

- Geologic belt fit: Technical papers link Miner Mountain’s geology to the Nicola Group within the Quesnel Terrane—the same alkalic porphyry belt as Copper Mountain—reinforcing regional prospectivity.

Funding in place: Private placement closed in early November 2025

Sego closed the final tranche of its 2025 financing in early November, providing fresh dollars for the current program and working capital:

- 7,200,000 Flow‑Through Units at $0.025 for $180,000; each FT Unit = 1 FT share plus 1 warrant at $0.05 for 2 years.

- 11,990,000 Non‑Flow‑Through Units at $0.02 for $239,800; each NFT Unit = 1 common share plus 1 warrant at $0.05 for 3 years.

- Including a first tranche (Aug. 7, 2025), total gross proceeds = $625,800. All securities from the final tranche carry a four‑month‑and‑one‑day hold ending March 5, 2026.

- Use of proceeds: exploration at Miner Mountain and general working capital. Exploration spending above the FT amount qualifies for a 30 per cent BC Mining Exploration Tax Credit and planned exploration expenditures are expected to exceed $200,000. No funds will be used for investor relations services.

Why this matters: The blend of flow‑through (tax‑advantaged exploration dollars in Canada) and non‑flow‑through units equips the company to execute the planned drilling, complete metallurgical work, and maintain flexibility without dilutive add‑ons like IR spend.

Key technical highlights at a glance

- South Gold Zone: up to 1.08 g/t Au over 88.0 m; target range 90,000–150,000 oz Au (Exploration Target; not a resource).

- Cuba Zone: historic 1.2 per cent Cu over 4.4 m within 0.6 per cent Cu over 11 m (DDH‑37); follow‑up drilling will test ~500 m below a >1 per cent Cu intersection.

- PGMs present: 0.13 g/t Pd over 2 m in DDH‑37 underscores alkalic porphyry affinity.

- Location: ~15 km north of Copper Mountain Mine; no camp required, road and grid‑power access enable efficient work.

Risk and diligence notes for investors

- The South Gold Zone tonnage/ounces remain an exploration target, not an NI 43‑101 resource—additional drilling, specific gravity measurements, and modeling are needed for resource classification.

- Deeper Cuba Zone drilling targets a conceptual porphyry centre; results are exploration‑stage with success dependent on structure, alteration intensity, and sulphide distribution—typical for alkalic porphyry systems.

- Junior explorers can be sensitive to commodity prices, financing cycles, and program execution; Sego’s recent financing provides runway for the current phase.

A Princeton‑proximate catalyst path—stock up ~50 per cent YTD

With drills mobilized, a balanced metre split between near‑surface gold de-risking and deeper copper‑gold discovery, and fresh flow‑through and hard‑dollar funding, Sego offers a clear set of near‑term catalysts in a mining-friendly district rich in infrastructure. Notably, Sego’s share price is up ~50 per cent year‑to‑date as of mid‑November 2025, reflecting growing attention to its Princeton‑area story and the broader copper‑gold backdrop.

If you’re considering exposure to exploration‑stage copper‑gold in BC, this is an opportune moment to deepen your due diligence: review the November 12, 2025, mobilization release, the SRK Exploration Target Review, and historic technicals on the Cuba and South Gold zones—then monitor drill results as they arrive.

For the latest updates, visit segoresources.com.

Join the discussion: Find out what everybody’s saying about this stock on the Sego Resources Stock Forum, and check out the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.