When it comes to investing in top penny stocks, it’s essential to identify value off the balance sheet to make sound allocation decisions.

This is because most penny stocks are unprofitable, requiring an assessment for attractive assets and operational advantages that could, at some point in the future, turn a company into a cash-generating machine.

Such an assessment will necessarily be more art than science, given how loss-making companies are by no means standard suggestions for the average retail portfolio, but it can provide robust returns with proper due diligence and a long-term time horizon.

Three penny stocks in particular have been garnering investor attention over the past two weeks thanks to value-added news to their already prospective businesses:

Xtract One breaks new barriers with global expansion

Xtract One Technologies (TSX:XTRA) has grown its business overseas with three contracts with multi-national companies, including a more than US$5.1 million deal with a global entertainment organization to deploy its SmartGateway patron screening solution.

The SmartGateway uses AI-powered sensors to scan patrons for weapons and other prohibited items, offering an up to 7x increase in throughput compared to legacy systems.

The company is focused on securing reseller agreements, channel partners and certifications to scale its global presence as it fields ongoing inquiries from other entertainment organizations, sports franchises and other international organizations.

Spurred on by an encouraging Fiscal 2023 – which saw the company increase total contract bookings by 344 per cent YoY from US$3.4 million to US$15 million, surpass 50 contracts for its technology, as well as complete a C$13.4 million investment from Madison Square Garden Sports – Xtract One shareholders are optimistic about the continuation of this growth trajectory, despite a comprehensive loss of C$16.3 million for the year.

Xtract One Technologies stock (TSX:XTRA) is up by 88.89 per cent YoY, trouncing the S&P/TSX Composite Index’s 3.46 per cent return over the period.

Click here to read Xtract One Technologies’ latest investor presentation.

American Eagle Gold drills significant copper interval on flagship project

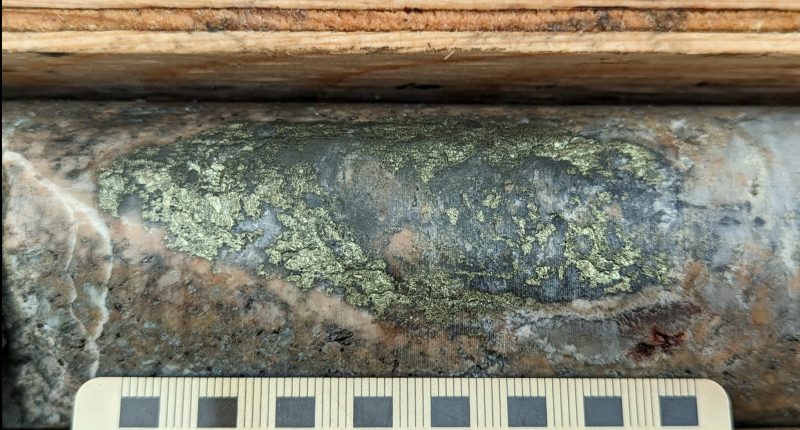

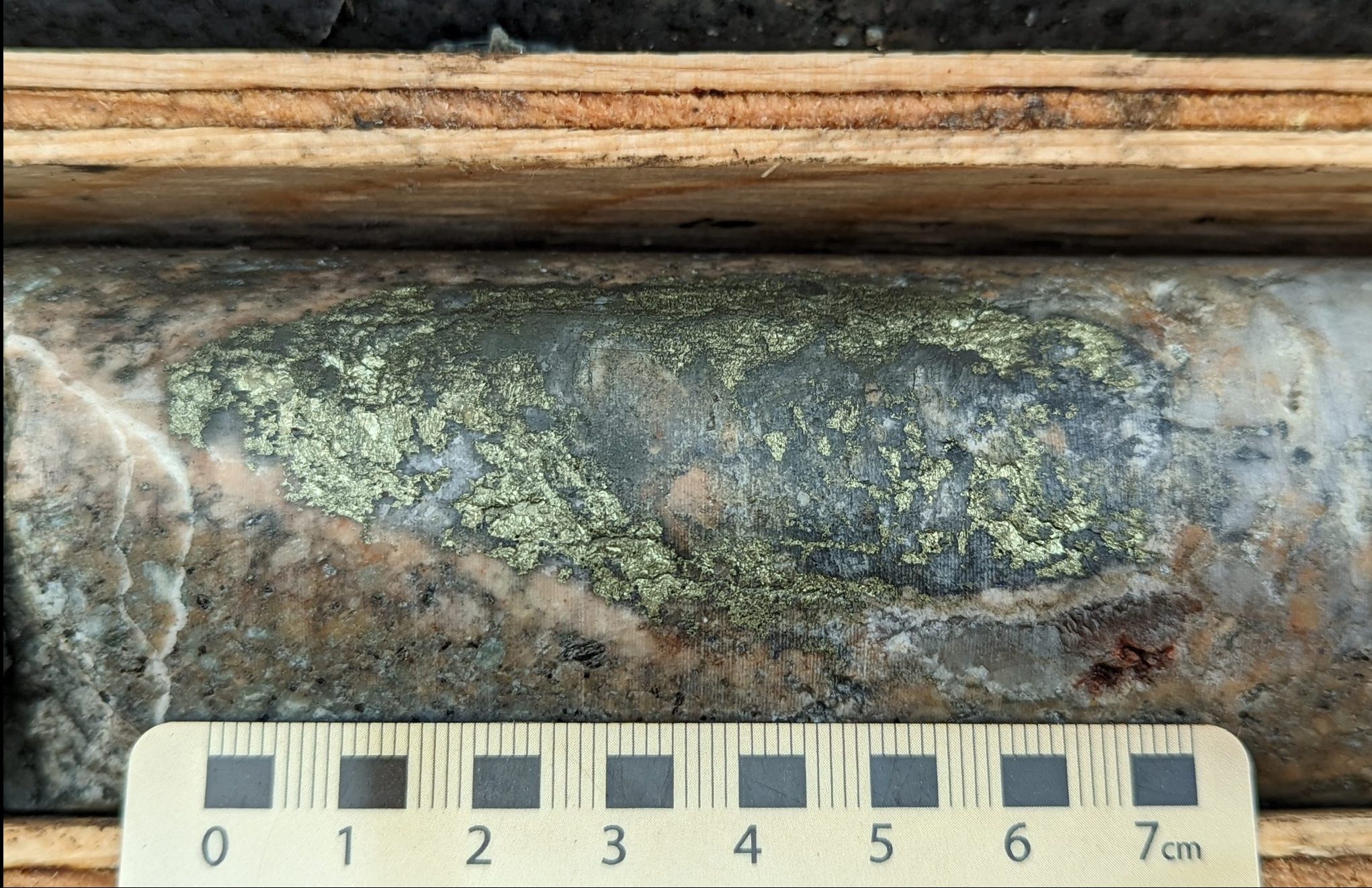

American Eagle Gold (TSXV:AE) recently drilled a wide copper interval in the North Zone of its NAK copper-gold porphyry project in British Columbia.

Drill hole NAK23-12’s 900-metre interval of 0.50 per cent copper equivalent (CuEq) ended in high-grade mineralization of 1 per cent CuEq, further substantiating the project’s scale and grades.

The NAK project, located in B.C.’s Babine copper-gold porphyry district, contains a large near-surface copper-gold system measuring more than 1.5 km x 1.5 km, with American Eagle’s 2022 drilling program discovering significant copper-gold mineralization along a northerly trend. Highlight results include:

- NAK22-01: 851 m of 0.37 per cent CuEq, including 126 m of 1.05 per cent CuEq from surface

- NAK22-02: 956 m of 0.37 per cent CuEq, including 301 m of 0.61 per cent CuEq from surface

Ongoing 2023 drilling seeks to expand NAK’s known mineralized footprint and identify higher-grade zones of copper and gold. Assays for drill holes NAK23-13 and 14 will be received in the coming weeks.

Shareholders, including Teck Resources (TSX:TECK.A), have grown their conviction thanks to the company’s steady release of strong results painting a clearer picture of a potentially major discovery.

American Eagle Gold (TSXV:AE) has added 437.50 per cent over the past year, outperforming the TSX Index by more than 126x.

Click here to read American Eagle Gold’s latest investor presentation.

Blackrock Silver updates mineral resource estimate for Tonopah West project

Blackrock Silver (TSXV:BRC) has added considerable intrinsic value after an updated mineral resource estimate (MRE) for its Tonopah West project in Western Nevada. The new estimate is highlighted by:

- 0.57 million ounces (Moz) of gold and 47.74 Moz of silver or 100.04 Moz of silver equivalent (AgEq), which is a 135 per cent increase over the maiden MRE from April 28, 2022

- An average inferred mineral resource grade of 508.5 g/t AgEq, up by 14 per cent over the maiden MRE

- A structural re-interpretation of the Victor and DPB areas and incorporation of new drilling from the Northwest Step Out target, the latter helping to double the mineralized footprint from the maiden MRE to more than 3 km of strike

Management views these highlights as catalysts for potential expansion. As CEO Andrew Pollard put it in the news release, “There are no signs of the system stopping both along strike and at depth.”

Pollard spoke with The Market Herald’s Ryan Dhillon about Tonopah West’s increased prospectivity.

Blackrock Silver also benefits from a second property, Nevada’s Silver Cloud project, which yielded a bonanza-grade gold and silver discovery of 70 g/t gold and 600 g/t silver over 1.5 m.

The follow-up drilling program for this discovery produced intercepts up to 2.24 g/t gold in banded epithermal quartz veins. The company enhanced its understanding of the strike and orientation of the surrounding structure, with a review of down-hole geochemical data underway to hone in on the high-grade system.

Despite Blackrock Silver’s considerable upside, backed by its management team’s long history of project development, shareholders have seen BRC shares fall by 35.42 per cent over the past year. The absence of corresponding events for the negative sentiment, as well as the company’s 416.67 per cent return over the past five years, suggest a potential value opportunity.

Click here to read Blackrock Silver’s latest investor presentation.

A note on risk: While our three top penny stock picks offer numerous reasons for future optimism, readers should be aware of the heightened risks of investing in small and micro-cap stocks before committing to an allocation.

Join the discussion: Find out what everybody’s saying about top penny stocks on the Xtract One Technologies, American Eagle Gold and Blackrock Silver Bullboards, and check out Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Xtract One Technologies, American Eagle Gold and Blackrock Silver, please see full disclaimer here.