- Abitibi Metals Corp. (CSE:AMQ) has commenced its fully funded Phase 3 drill program, totalling approximately 20,000 metres at the B26 Polymetallic Deposit located in Québec

- This program follows the company’s mineral resource estimate of 11.3 million tonnes at 2.13 per cent CuEq (Indicated) and 7.2 million tonnes at 2.21 per cent CuEq (Inferred)

- The Phase 3 drill program is planned to further define and expand high-grade zones within the B26 Deposit, with a primary focus on increasing tonnage and grade in areas of limited drilling

- Abitibi Metals stock (CSE:AMQ) last traded at $0.29 per share

Abitibi Metals Corp. (CSE:AMQ) has commenced its fully funded Phase 3 drill program, totalling approximately 20,000 metres at the B26 Polymetallic Deposit located in Québec.

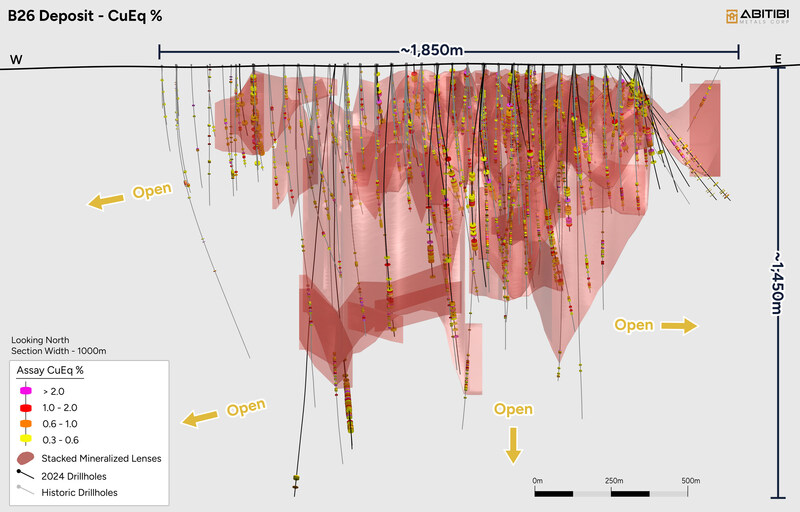

This program follows the company’s mineral resource estimate of 11.3 million tonnes at 2.13 per cent CuEq (Indicated) and 7.2 million tonnes at 2.21 per cent CuEq (Inferred). In November 2023, the company signed an option agreement on the B26 Deposit to earn up to 80 per cent ownership over seven years from SOQUEM Inc., a subsidiary of Investissement Québec.

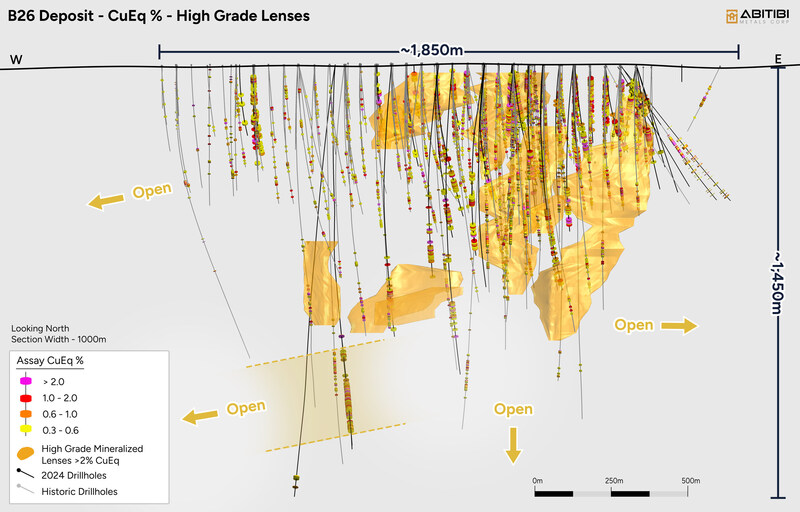

The Phase 3 drill program is planned to further define and expand high-grade zones within the B26 Deposit, with a primary focus on increasing tonnage and grade in areas of limited drilling. This work builds upon what was returned from previous campaigns, which saw some of the highest-grade intercepts in the project’s history — including 10.6 metres at 11.4 per cent CuEq, within 61.3 metres at 2.5 per cent CuEq, near surface.

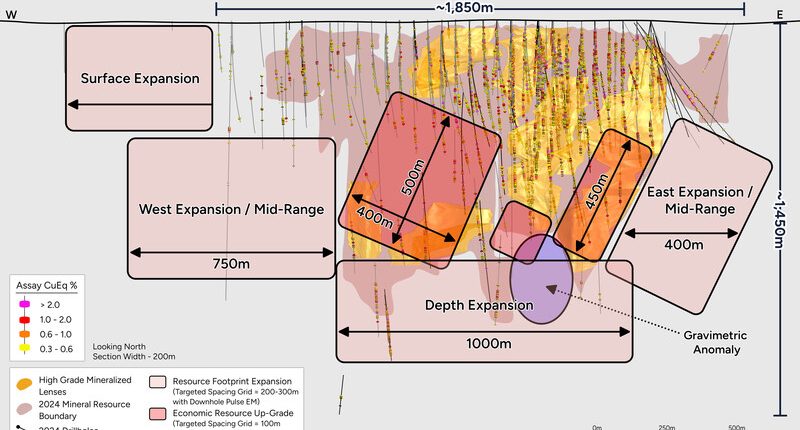

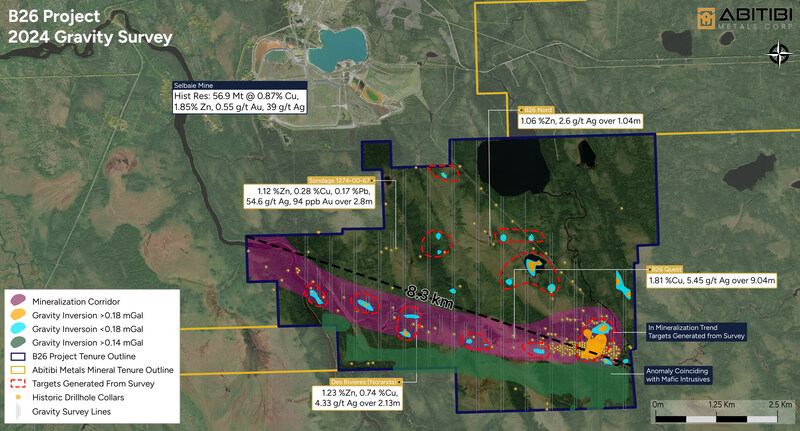

An initial 2,500 metres across four drill holes of the 20,000-metre program is underway, targeting 300 to 500 metres depth continuity within interpreted high-grade mineralized lenses. Airborne and downhole EM geophysics are also underway, with further details to be announced in a subsequent press release. The remaining 17,500 metres of drilling will be strategically prioritized based on the success of these initial drill results, the new geophysical data, and a complete geological re-evaluation and interpretation of the deposit. A key focus of the additional 17,500 metres in Phase 3 will be step-out drilling to test the large-scale expansion potential of the deposit.

Once the ongoing targeting work is complete, the team pans to release a detailed outline of the Phase 3 drill program, which will encompass the targeted areas illustrated above. Drilling has commenced with one rig, with the flexibility to deploy additional rigs as the program advances, depending on results and operational efficiencies. The company intends to complete the initial four holes prior to spring breakup, after which a brief pause is anticipated. Drilling will then resume with the broader Phase 3 program, which is expected to continue throughout the remainder of the year.

2025 phase 3 drill program objectives

The Phase 3 program at B26 is structured around three strategic objectives:

- Increase resource grade by expanding high-grade zone – Targeted in-fill drilling will further define the continuity of previously underestimated high-grade zones and enhance confidence in the geological model. The focus will be on expanding areas with grades exceeding 3 per cent CuEq, particularly within the central high-grade core of the deposit.

- Increase resource size by extending open-ended mineralized trends – Step-out drilling will test for extensions at depth and along strike to increase the overall tonnage and footprint of the deposit, while also targeting new high-grade zones. Target prioritization will be guided by ongoing expansion of the geological model, the integration of downhole EM vectorization, and interpretation of recently published gravimetric data. Notably, this data indicates an excess mass at a depth of approximately 800 metres on the eastern side of the B26 Deposit—an area outside the current resource footprint with strong potential for sulfide and copper-zinc mineralization.

- Unlock regional potential (property-wide) – The program will explore for new discoveries within the 8km east-west trend and the 7km northwest-southwest corridor between B26 and the past-producing Selbaie Mine, leveraging the project’s 3,328-hectare footprint. Target prioritization will be enhanced through the interpretation of the property’s lithostructural and geological models, as well as recent gravity and airborne EM geophysics surveys. The program is designed to identify additional polymetallic systems similar to the B26 and Selbaie deposits.

Management commentary

“This program represents a pivotal step in advancing our goal of developing an economic deposit with significant upside. Our key focus is expanding high-grade copper-gold mineralization within and beyond the current footprint of the deposit, while also testing new high-priority targets across the broader property,” Abitibi Metals’ CEO and president, Jonathon Deluce, said in a news release. “Previous results have highlighted B26’s exceptional grade profile, and with global demand for critical minerals accelerating, we believe this is a strategic time to advance one of Québec’s most promising emerging polymetallic deposits. With the recent closing of our $10 million no-warrant financing, we are fully funded through 2027 and well-positioned to deliver long-term value alongside a strong base of existing and new shareholders who believe in our long-term vision of establishing a significant metals company in the Abitibi greenstone belt.”

About Abitibi Metals Corp.

Abitibi Metals Corp. is focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi’s portfolio of strategic properties provides target-rich diversification, such as the Beschefer Gold Project, where the company recently provided an update on its fall drilling program.

Abitibi Metals stock (CSE:AMQ) last traded at $0.29 and is up more than 18 per cent since this time last month, but has lost 50 per cent since April 2024.

Join the discussion: Find out what everybody’s saying about this stock on the Abitibi Metals Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo: Phase 3 overview of high grade and expansional targets. Source: Abitibi Metals Corp.)