- From July 28 to August 5, approximately 10,000 flight attendants are voting to authorize strike action amid stalled contract talks

- A strike cannot legally occur until after a mandatory 21-day cooling-off period, followed by 72 hours’ notice

- The earliest potential job action is in late August

- The airline completed a C$500 million share buyback and fully repaid its convertible notes in July 2025

- Air Canada’s share price went down by more than 11% in a single trading session following the start of the strike action vote

Air Canada (TSX:AC) faces mounting pressure as thousands of its flight attendants vote to authorize a strike, just days after the airline missed profit expectations in its second-quarter results.

This article is a journalistic opinion piece which has been written based on independent research. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Flight attendants vote

On July 28, nearly 10,000 flight attendants represented by the Canadian Union of Public Employees (CUPE) began casting ballots in a strike authorization vote that runs through August 5. The union says negotiations have stalled, with members demanding improvements to wages, rest rules, pensions, and compensation for unpaid work.

“We’re calling attention to systemic issues, especially the 35 hours per month flight attendants spend working unpaid during boarding,” said a CUPE spokesperson. Additionally, “That time must be recognized and compensated.”

Although the union cannot legally strike until it completes a 21-day cooling-off period and provides 72 hours’ notice, the vote signals escalating frustration among front-line staff. Subsequently, the earliest possible job action could begin in late August.

Air Canada responded by stating that strike votes are a standard part of collective bargaining and don’t necessarily indicate a disruption. Still, with the peak summer travel season in full swing, the airline risks serious operational and financial consequences if negotiations fail.

Air Canada’s Q2 2025 Financials

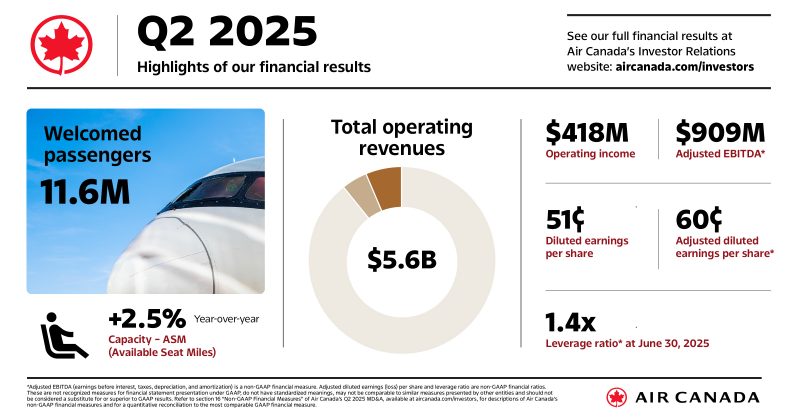

Consequently, these labour concerns come on the heels of the airline’s second-quarter earnings release, which delivered mixed results.

The airline generated $5.63 billion in revenue, a 2% year-over-year increase, but saw its net income drop to $0.60 per share, down from $0.98 in Q2 2024. All in all, shares fell more than 11% following the earnings announcement.

Despite strong contributions from Aeroplan, Cargo, and Air Canada Vacations, investors reacted negatively to the drop in profitability. Operating income totalled $418 million with a 7.4% margin, and adjusted EBITDA reached $909 million. In addition, the airline also reported $183 million in free cash flow.

CEO Michael Rousseau pointed to Air Canada’s strong operational performance in May and June, when the airline led North America in on-time arrivals. “We executed well despite macroeconomic pressures,” said Rousseau, adding that the company remains focused on long-term growth and capital discipline.

In addition, during the quarter, Air Canada completed a $500 million share buyback and fully repaid its convertible notes in July—moves aimed at strengthening shareholder value and reducing debt.

Air Canada’s forward looking projections

Albeit, the airline expects to increase third-quarter capacity by 3.25% to 3.75% over the previous year. At this point, management reaffirmed full-year adjusted EBITDA guidance of $3.2 to $3.6 billion and maintains long-term goals of $30 billion in annual revenue by 2028.

Air Canada’s 2028 Target & 2030 Aspiration Chart

| Metric | 2028 Target | 2030 Aspiration |

|---|---|---|

| Operating Revenues | ~$30 billion | Exceed $30 billion |

| Adjusted EBITDA Margin* | ≥ 17% | 18% – 20% |

| Net Cash Flow from Operations (% of Adj. EBITDA) | ~90% | ~90% |

| Capex (% of Operating Revenues) | ≤ 12% | < 12% |

| Free Cash Flow Margin | ~5% | ~5% |

| Return on Invested Capital (ROIC) | Not provided | ≥ 12% |

| Fully Diluted Share Count | < 300 million shares | < 300 million shares |

*Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), adjusted EBITDA margin, net cash flows from operating activities as a percentage of adjusted EBITDA, additions to property, equipment and intangible assets as a percentage of operating revenues, free cash flow margin and return on invested capital are referred to in this news release.

At this time, the flight attendants’ strike vote introduces a new layer of uncertainty. As a result, Air Canada must now juggle cost control, operations, and labour relations at a critical time for the company’s recovery and strategic positioning.

Despite the over 11 per cent trading session drop July 29th as a result of the strike action vote, Air Canada’s share price is up nearly 20 per cent on the year, last trading at C$19.34.

Join the discussion: Find out what the Bullboards are saying about Air Canada and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.