- Almonty Industries (TSX:AII) signed an exclusive offtake agreement with SeAH Group, the largest molybdenum processor in South Korea and the second-largest molybdenum oxide smelter in the world

- The property in question, Almonty’s Sangdong molybdenum project, is scheduled to reach production in 2026, beginning an estimated 60-year life of mine

- Almonty is focused on mining, processing and shipping tungsten concentrate

- Almonty stock has added 83.58 per cent year-over-year and 132.08 per cent since 2020

Almonty Industries (TSX:AII) signed an exclusive offtake agreement with SeAH Group, the largest molybdenum processor in South Korea and the second-largest molybdenum oxide smelter in the world.

SeAH is entitled to 100 per cent of production from Almonty’s Sangdong molybdenum project in South Korea through its estimated 60-year life of mine. Sangdong is expected to begin production by the end of 2026, generating up to 5,600 tons of molybdenum annually at full capacity.

The offtake agreement includes a hard floor price of US$19 per pound of molybdenum – with the critical material currently trading at approximately US$22 per round – and will benefit from infrastructure borrowed from Almonty’s Sangdong tungsten project only 150 metres away.

South Korea’s substantial metals and shipbuilding industries rely almost completely on imported molybdenum, primarily from China, making it a key priority to re-shore its supply chain.

SeAH is building a US$110 million metals and fabrication facility in Temple, Texas, set to provide metal products to SpaceX, and the U.S. defense and civilian aerospace sectors more broadly.

Molybdenum is a critical material to the defense, green energy technology and advanced manufacturing industries and is expected to experience growing demand through 2050.

Leadership insights

“We are thrilled to partner with SeAH M&S, a highly respected leader in the Korean market,” Lewis Black, Almonty Industries’ chief executive officer, said in a statement. “This agreement underscores the strategic importance of Almonty Korea Moly Corp. and reflects strong confidence in Almonty’s ability to deliver high-quality resources. The floor price provides a stable foundation and access to low-rate domestic construction lending as we advance our molybdenum project, while keeping the material in South Korea strengthens local supply chains and supports domestic industry. This collaboration builds on the success of our Sangdong tungsten project, positioning us to deliver another transformative project and further reinforce our leadership in the critical materials sector.”

About Almonty Industries

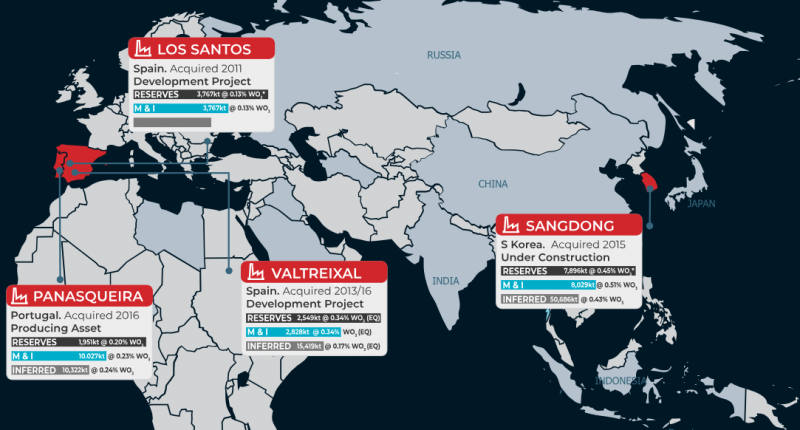

Almonty is focused on mining, processing and shipping tungsten concentrate from its Los Santos Mine in Spain and its Panasqueira mine in Portugal. The company is also developing its Sangdong tungsten mine in South Korea and the Valtreixal tin and tungsten project in Spain.

Almonty stock (TSX:AII) is up by 11.82 per cent trading at C$1.23 per share as of 11:00 am ET. The stock has added 83.58 per cent year-over-year and 132.08 per cent since 2020.

Join the discussion: Find out what everybody’s saying about this tungsten and molybdenum stock on the Almonty Industries Inc. Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image of Almonty Industries projects: Almonty Industries)