- Energy Transition Minerals (ASX:ETM) is developing the massive Kvanefjeld rare-earth project in southern Greenland—one of the world’s largest REE deposits—though progress is stalled due to Greenland’s uranium ban and ongoing arbitration

- The project’s geology and location offer strong advantages—outcropping ore, year‑round port access, and valuable magnet metals—but Greenland’s harsh topography and limited infrastructure remain major development obstacles

- U.S. President Donald Trump’s push to acquire or control Greenland underscores the strategic importance of its rare-earth resources, heightening geopolitical interest but also increasing local and international resistance

- Energy Transition Minerals stock (ASX:ETM) last traded at $0.16

Energy Transition Minerals (ASX:ETM), formerly Greenland Minerals Ltd, has focused since 2007 on developing the Kvanefjeld (Kuannersuit) project—a world-class rare-earth deposit nestled in southern Greenland’s Ilimaussaq intrusive complex. As of 2015, this flagship venture hosts over 1 billion tonnes of JORC-compliant mineral resources, including 108 million tonnes ore reserve, brimming with elements essential to electric vehicles, renewable energy, and defense technology.

The ore is rich in light and heavy rare earth elements (LREEs & HREEs)—notably neodymium, praseodymium, dysprosium, and terbium—all critical for high-performance permanent magnets. Notably, uranium and zinc co-occur as by-products, with roughly 362 ppm of uranium in the ore reserve.

Geography and topography

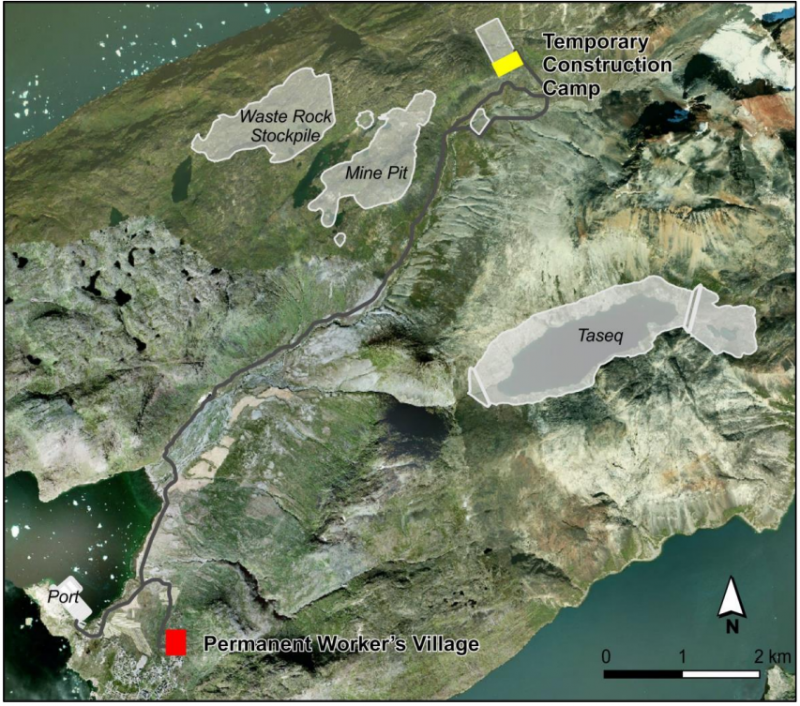

Kvanefjeld sits atop a broad plateau overlooking southern Greenland’s fjord coastline, in the Kujalleq municipality, approximately 8 km northeast of Narsaq and 70 km from the Narsarsuaq airstrip. It occupies part of the Mesoproterozoic Ilimaussaq intrusion, a geologic marvel of layered, peralkaline nepheline syenite (lujavrite), which hosts the valuable REE mineralization.

The site enjoys important operational advantages—mineralization often outcrops, enabling lower mining costs; and with port access year-round, it supports continuous shipping—a significant edge in an Arctic setting.

Economic and environmental profile

A 2016 feasibility study projected full-scale production of ~32,000 t/year of rare-earth oxides, including 4,260 t NyO, 1,420 t PrO, and 270 t DyO, alongside uranium oxide, zinc concentrate, and fluorspar as by-product streams. The mine life is expected to exceed 37 years, with initial capex reduced from US$832 million to approximately US $505 million, yielding an NPV of US$1.59 billion and internal rate of return (IRR) around 43 per cent. [miningweekly.com]

The project includes a mine, concentrator, and refinery producing a 20–25 per cent REO concentrate, pivotal for sourcing Western supply chains. A comprehensive Environmental & Social Impact Assessment (EIA/SIA) guides development, though uranium co-deposits have increasingly drawn opposition.

Regulatory and market challenges

In 2021, Greenland’s parliament passed a law banning uranium-rich mining (threshold above 100 ppm)—a major blow, given Kvanefjeld’s combined uranium (~360 ppm) and REE layers. ETM has filed for arbitration in Copenhagen, contesting the licensing and seeking compensation, with legal disputes still unresolved.

Meanwhile, investors—particularly in Europe and Asia—are increasingly valuing security of supply over costs, driving ETM’s stock up by nearly 80 per cent in 2026 amid growing global demand and geopolitical tensions.

The Trump factor and Greenland’s geopolitical context

U.S. President Donald Trump reignited headlines—declaring that annexing or acquiring Greenland was on the table—for national security and critical minerals reasons. Analysts see his rhetoric as part of a broader strategy to counter Chinese and Russian influence in the Arctic, while securing rare-earth-rich territories.

Yet extraction in Greenland remains challenging. Lack of infrastructure—often just roads, no railways, minimal power, and harsh conditions—raise capital costs and logistical complexity. Environmental sensitivities and uranium concerns compound regulatory hurdles, deterring rapid deployment.

Even so, some view U.S. interest—notably talks on offtake, infrastructure support, and financing—as an opportunity for ETM to progress Kvanefjeld should diplomatic cooperation strengthen.

Investment takeaways for investors

- World-class resource: Kvanefjeld ranks among the top global REE deposits, with substantial reserves of key magnet metals.

- Geographic advantage: Year-round port access and low-cost mining via outcropping mineralization.

- Geopolitical tailwinds: Growing Western demand for sovereign rare-earth supply chains, amplified by U.S.–China rivalry.

- Key risks: Uranium ban triggers legal battle; infrastructure costs; community resistance; processing complexity.

- Upside potential: If ETM wins arbitration or secures alternative licensing, Kvanefjeld could transform into a cornerstone of Western critical-mineral infrastructure.

Note the recent spike in ETM share price. Energy Transition Minerals sits at the intersection of geology, global geopolitics, and clean-energy ambitions. With a potentially transformative project in hand and rising investor interest amid Arctic geopolitics, ETM could pivot from exploration to strategic supplier—if regulatory, technical, and diplomatic hurdles are resolved.

Energy Transition Minerals Ltd. explores for rare earth elements and lithium deposits at its flagship Kvanefjeld project located in southern Greenland.

Energy Transition Minerals stock (ASX:ETM) last traded at $0.16 and has risen around 70 per cent since this time last year.

Join the discussion: Find out what the Bullboards are saying about Energy Transition Minerals and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.