- Altamira Gold (ALTA) provided an exploration update on its Cajueiro, Santa Helena, and Apiacas projects in Brazil

- Cajueiro hosts total contained gold of 700,000 oz

- Apiacas returned significant intervals of low-grade disseminated gold mineralization including 30.5 metres at 0.52g/t gold

- Porphyry-style alteration has been identified at the Santa Helena project

- Altamira Gold Corp is a junior natural resource company

- Altamira Gold is unchanged, trading at C$0.15 at 11:40 am ET

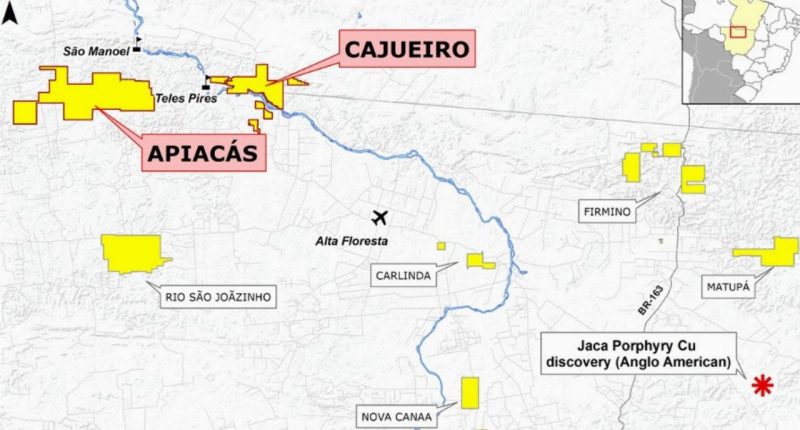

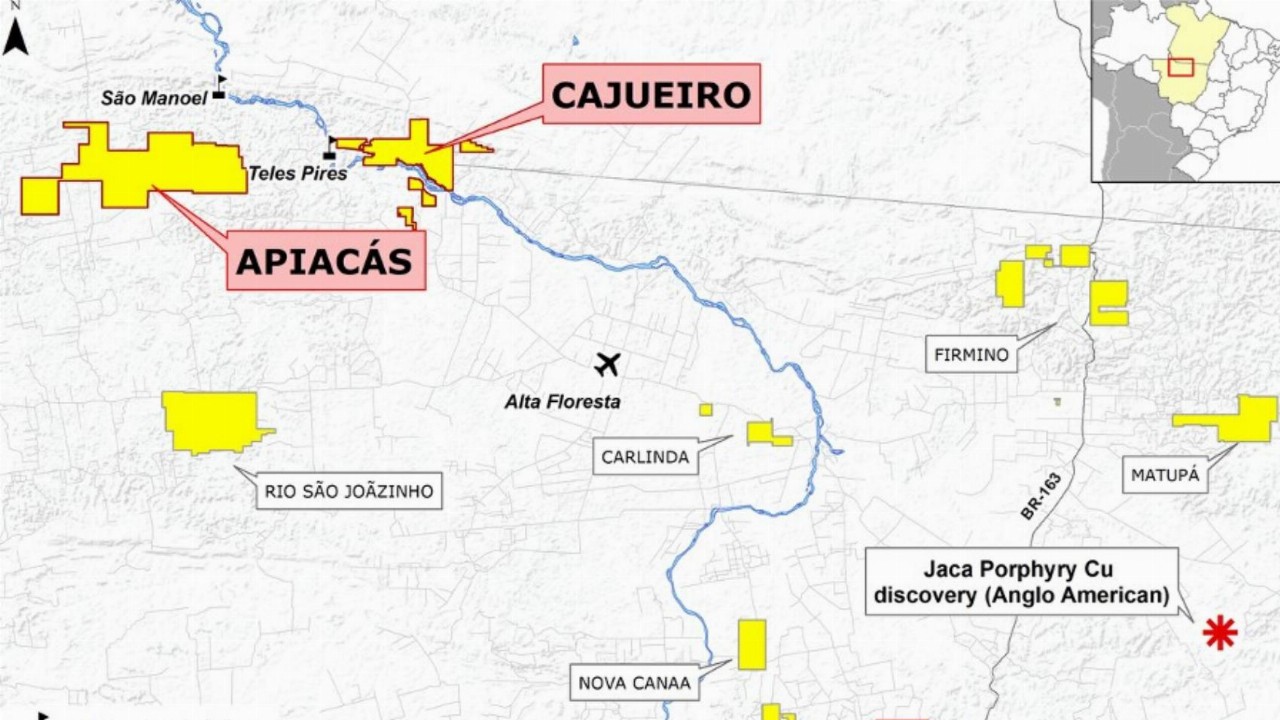

Altamira Gold (ALTA) has provided an exploration update on its Cajueiro, Santa Helena, and Apiacas projects in Northern Mato Grosso, Brazil.

Drilling continues at Cajueiro, which hosts an Indicated resource of 5.66Mt at 1.02 g/t gold (185,000oz) and an Inferred resource of 12.66Mt at 1.26 g/t gold (515,000oz) for a total contained gold of 700,000 oz.

The Baldo target is being tested initially where previous trenching returned values, including 28 metres at 3.0 g/t gold and 7 metres at 5.5 g/t gold.

Twenty-three diamond drill holes have been completed at the Santa Helena project, where porphyry-style alteration has been identified, and results are pending.

Nine of the 13 holes on the Apiacas project returned significant low-grade disseminated gold mineralization intervals, including 30.5 metres at 0.52g/t gold.

President and CEO of Altamira Gold, Michael Bennett, commented that the initial drill results at Apiacas have provided significant encouragement regarding the potential for a sizeable disseminated gold system extending over at least 2 km strike length.

“While we wait for drill results from 23 holes at the Santa Helena Project, the rig is currently testing several highly prospective targets at Cajueiro, including the previously untested Maria Bonita gold-in-soil anomaly where gold values in soils exceed 1g/t gold. This is an exciting time for Altamira with more work planned at Mutum (Apiacas), drill results pending on Santa Helena, and drilling in progress at Cajueiro.”

Altamira Gold Corp is a junior natural resource company engaged in the acquisition, exploration, development, and mining of mineral properties in Canada and Brazil.

Altamira Gold is unchanged, trading at C$0.15 at 11:40 am ET.