- Tudor Gold (TSXV:TUD) and Seabridge Gold (TSX:SEA) became embroiled in a dispute over a Government of British Columbia license of occupation in the province’s mineral-rich Golden Triangle.

- Early Wednesday, Seabridge announced that the B.C. government renewed the License of Occupation for the Mitchell Treaty Tunnels at Seabridge’s KSM Project until Sept. 27, 2044.

- Tudor Gold stated that it has not been provided with any copy of the LoO from the B.C. government nor has it been informed of the reasons for granting the LoO

- Shares of Tudor Gold Corp. are down 4.39 per cent, trading at C$1.09, and shares of Seabridge Gold Inc. are down 0.34 per cent, trading at C$23.52.

Tudor Gold (TSXV:TUD; FSE:H56) and Seabridge Gold (TSX:SEA; NYSE:SA) on Wednesday became embroiled in a dispute over a Government of British Columbia license of occupation in the province’s mineral-rich Golden Triangle.

Early Wednesday morning, Seabridge announced that the B.C. government renewed the License of Occupation (LoO) for the Mitchell Treaty Tunnels (MTT) at Seabridge’s KSM Project until Sept. 27, 2044.

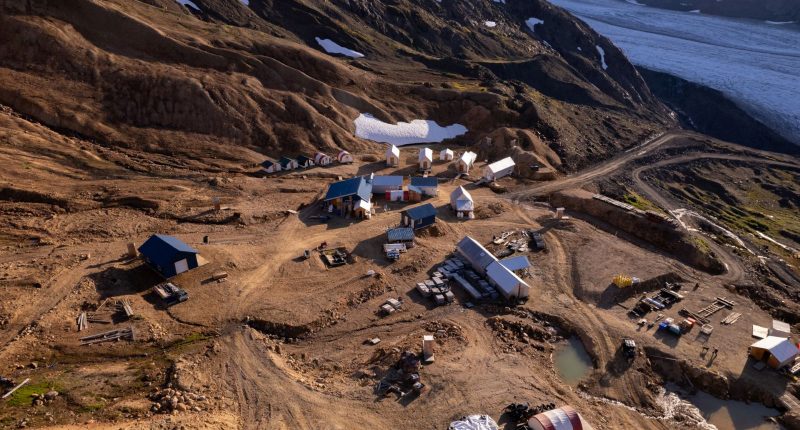

The KSM (Kerr-Sulphurets-Mitchell) Project is 65 kilometres northwest of Stewart in northwest B.C., and the original LoO is scheduled to expire Friday.

Seabridge’s news release stated that the LoO provides Seabridge’s wholly owned subsidiary, KSM Mining ULC (KSMCo), with the right to occupy the area in which it intends to construct the MTT. The MTT are the two 23-km-long parallel tunnels planned to connect the east and west sides of the KSM Project Mine Site.

“Approximately 12.5 km of the MTT route passes through 11 mineral claims owned by a joint venture consisting of Tudor Gold Corp., Teuton Resources Corp. and American Creek Resources Ltd. of which Tudor is the operator,” Seabridge’s news release stated.

Seabridge claims the new LoO replaces the original LoO for the MTT granted in 2014, and the original LoO provided KSMCo’s rights to be “subject to the prior rights” of the holder of the 11 mineral claims owned by the Treaty Project Claim Holders that have been removed from the newly issued LoO because it served no purpose.

“The LoO grants KSMCo no interest in the minerals within the LoO. The ‘prior rights’ of the Treaty Project Claim Holders to the area of the LoO that traverses the 11 mineral claims of the Treaty Project Claim Holders are subject to a conditional mineral reserve (the ‘Mineral Reserve’) established in 2012,” Seabridge stated. “The Mineral Reserve expressly limits the rights of the Treaty Project Claim Holders such that they may not ‘obstruct, endanger or interfere with, or allow any other person to obstruct, endanger or interfere with, the construction, operation or maintenance of’ the MTT. The new LoO makes it clearer that KSMCo’s use of the area of the LoO for the MTT takes priority over any use Tudor proposes to make of that area.”

In response later Wednesday morning, Tudor Gold issued a news release stating that it has not been provided with any copy of the license of occupation from the B.C. government nor has it been informed of the reasons for granting the LoO that Seabridge Gold announced.

“Tudor Gold takes the position now and maintains its position that section 50(1)(a)(ii) of the Land Act restricts any disposition of Crown lands, including this license of occupation, from interfering with mineral tenure rights,” Tudor Gold’s release stated.

In addition, Tudor asserted that no grant of any mineral reserve pursuant to the Mineral Tenure Act can grant mineral title rights to any party and cannot interfere in any way with pre-existing rights. This applies to conditional mineral reserve grants and non-staking mineral reserve grants, the company stated.

“Tudor Gold shall take all steps necessary to protect its mineral tenure rights, its rights to property, and its shareholders,” Tudor’s news release stated, additionally vowing to protect its rights “if it is required an action for damages for a statutory taking.”

“Upon receipt of the Government of British Columbia’s official copy of the license of occupation, and the governmental decision makers’ reasons, if any, for the granting of the license of occupation, and allowing for consideration and advice on those matters, Tudor Gold shall take such steps as are necessary to protect its mineral tenures, rights to property and its shareholders,” Tudor’s news release stated.

Seabridge Gold and Tudor Gold have previously clashed over the MTT Tunnel route at Seabridge’s KSM Project. In November 2023, Tudor Gold disagreed with the interpretation of correspondence received from the B.C. Ministry of Energy, Mines and Low Carbon Innovation (EMLCI) and the Ministry of Water, Land and Resource Stewardship.

“The Ministry of EMLCI has stated that the Permitted Mine Area of Seabridge Gold Inc. does not include in its M-245 permit the MTT Tunnel route,” Tudor’s news release stated. “The ministry has stated that it is the ministry’s position that any future applications by Seabridge Gold Inc. to construct the MTT Tunnel route shall be considered by the ministry only as applications which are subject to the prior mineral tenure rights of Tudor Gold Corp.”

Seabridge Gold alleged that the EMLCI rejected Tudor Gold’s request to cancel a license of occupation and a permit held by Seabridge subsidiary KSM Mining.

About Seabridge Gold

Seabridge Gold holds a 100 per cent interest in several North American gold projects, including the KSM project and Iskut project in Northwest British Columbia, the Courageous Lake project in Northwest Territories, the Snowstorm project in the Getchell Gold Belt of Northern Nevada and the 3 Aces project set in the Yukon Territory.

About Tudor Gold

Tudor Gold Corp. is a precious and base metals exploration and development company with claims in B.C.’s Golden Triangle. The 17,913-hectare Treaty Creek project (in which Tudor has a 60% interest) borders Seabridge Gold Inc.’s KSM property to the southwest and borders Newmont Corporation’s Brucejack property to the southeast.

Shares of Tudor Gold Corp. (TSXV:TUD) are down 4.39 per cent, trading at C$1.09 as of 2:54 pm ET.

Shares of Seabridge Gold Inc. (TSX:SEA) are down 0.34 per cent, trading at C$23.52 as of 2:52 pm ET.

Join the discussion: Find out what everybody’s saying about these mining stocks on the Tudor Gold Corp. Bullboard and Seabridge Gold Inc. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo of the Mitchell Treaty Tunnels: Tudor Gold)