Vista Gold is Positioning Mt Todd as a leading development opportunity

- Demonstrated feasibility

- Tier 1 jurisdiction

- Shovel-ready

Vista Gold Corp. (NYSE American/TSX: VGZ) holds the Mt Todd Gold Project, a shovel-ready development-stage gold deposit located in the Tier-1 jurisdiction of Northern Territory, Australia. Mt Todd offers large-medium scale development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated financial strength.

Vista Gold continues to advance Mt Todd in ways that efficiently position the project for development while exercising the discipline necessary to best realize value at the right time.

2024 updates:

- January – commenced 6,000-7,000 meter drill program

- March – published the 2024 updated feasibility study and the company’s inaugural ESG report

- June – received final $10 million payment under the Wheaton Precious Metals royalty and ended Q2 2024 with $20 million of cash

- August – announced Phase 1 drill results

- September – commenced trade-off studies to evaluate the size for an alternative development scenario and announced interim Phase 2 drill results

- Q4 2024 – commencing a feasibility study for a project targeting 150,000-200,000 oz of gold per year and capex less than $400 million

“Fred Earnest, President and CEO of Vista Gold, stated, “We are advancing evaluations of a development scenario for Mt Todd, initially targeting 150,000 – 200,000 ounces of annual gold production, with a raised cut-off grade of 0.45 to 0.50 g Au/t. We are targeting a mineral reserve grade of approximately 1 g Au/t and an initial capex of less than $400 million, while preserving the option for expansion at some future time.” See news release.

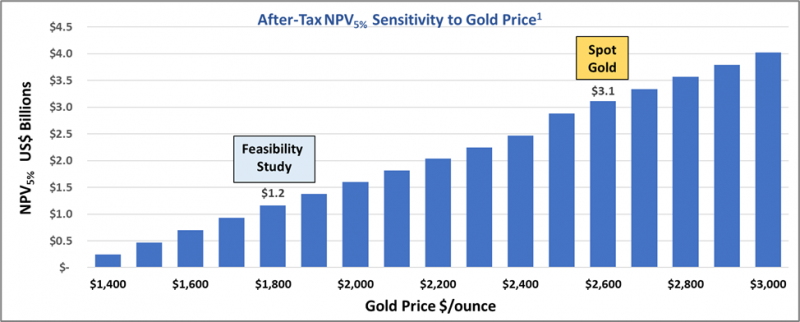

Mt Todd demonstrates robust project economics. For every US$100 increase in the gold price, the NPV5% increases by approximately US$220 million.

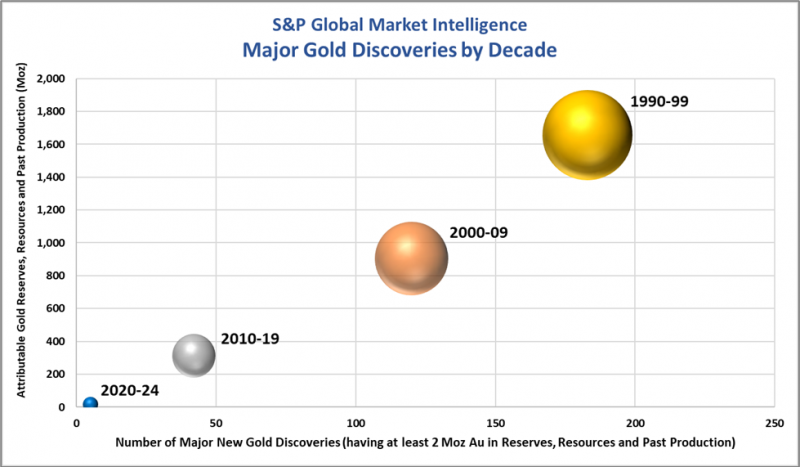

Shovel-ready projects like Mt Todd are positioned as valuable assets in an environment of decreasing major gold discoveries. Scarcity of new discoveries will drive greater focus on optimizing existing operations and acquiring advanced stage projects like Mt Todd.

Investment corner

Vista Gold has demonstrated strong financial performance for the quarter ended June 30, 2024, and promising drilling results. The company plans to initiate a feasibility study for a project targeting annual production of 150,000 – 200,000 oz gold and capex of less than $400 million. Investors are encouraged to conduct thorough due diligence to understand the full potential of Vista Gold Corp. and its Mt Todd gold project.

Vista Gold and its shareholders will be major beneficiaries of a strong gold market and rising gold prices. With gold prices at all-time highs, an opportunity boasting such a solid financial foundation and ongoing exploration success presents a compelling opportunity for those looking to invest in the gold mining sector.

To keep up with the latest developments from the company, visit vistagold.com. To join the Vista Gold email list, sign up here.

Join the discussion: Find out what everybody’s saying about this stock on the Vista Gold Corp. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Vista Gold Corp., please see full disclaimer here.