- Consolidated Uranium (CUR) has announced a bought-deal private placement for gross proceeds of C$15,000,325

- Red Cloud Securities Inc. will purchase for resale 5,660,500 units at a price of C$2.65 per unit

- Consolidated Uranium has granted the underwriters an over-allotment option to purchase up to 755,000 additional units to raise additional gross proceeds of up to $2,000,750

- The offering is scheduled to close on or about November 22, 2021

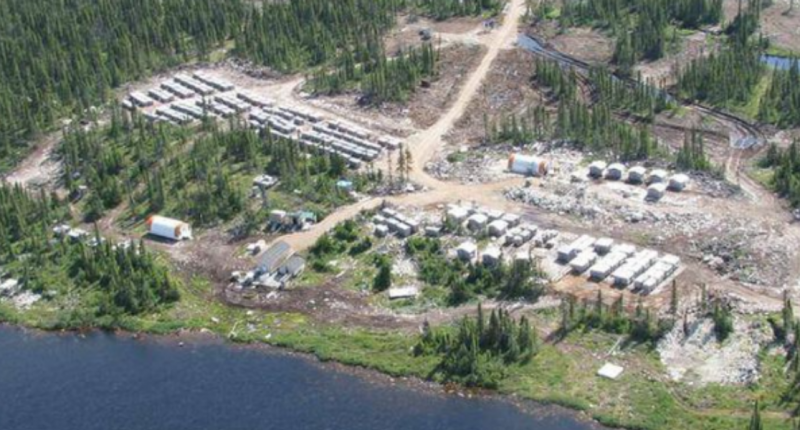

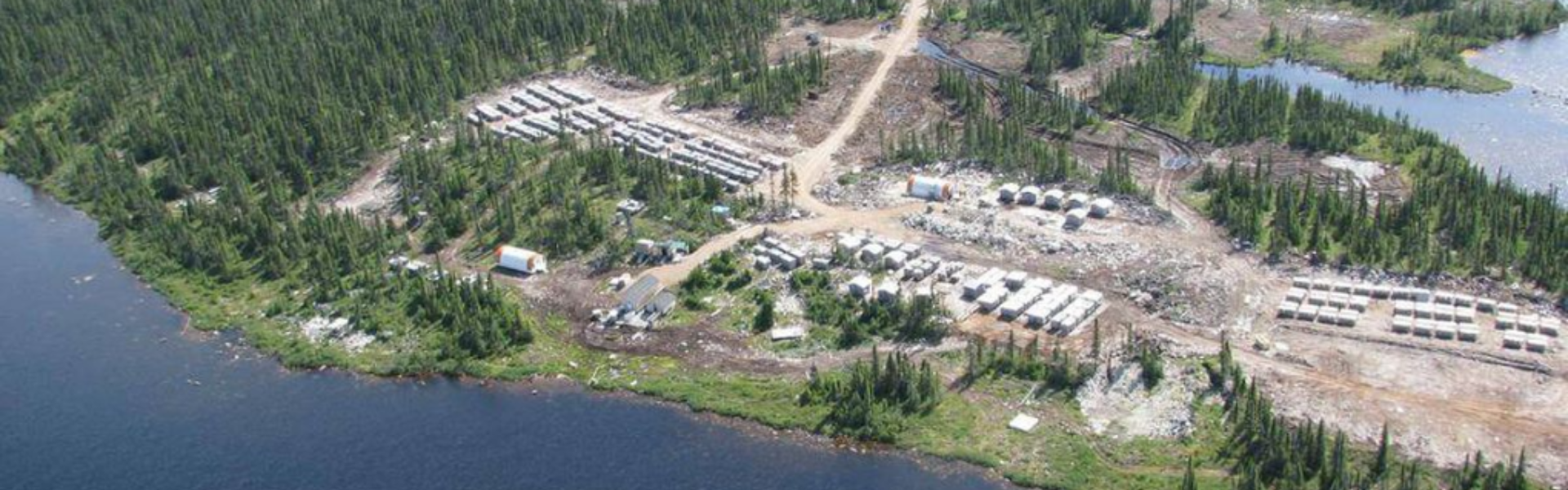

- Consolidated Uranium Inc is an exploration company with uranium projects in Australia, Canada, Argentina and the US

- Consolidated Uranium Inc. (CUR) is up 0.71 per cent, trading at C$2.85 per share at 4 pm ET

Consolidated Uranium (CUR) has announced a bought-deal private placement for gross proceeds of C$15,000,325.

Red Cloud Securities Inc. as lead underwriter and sole bookrunner, on behalf of a syndicate of underwriters, will purchase for resale 5,660,500 units at a price of C$2.65 per unit on a “bought deal” private placement basis.

Each unit will include one common share and one half of one common share purchase warrant. Each whole warrant can be exercised for one common share at a price of $4.00 at any time within 24 months after the closing of the offering.

Consolidated Uranium has granted the underwriters an over-allotment option to purchase up to 755,000 additional units to raise additional gross proceeds of up to $2,000,750.

The offering is scheduled to close on or about November 22, 2021, and is subject to certain conditions, including the receipt of all necessary regulatory and other approvals and approval of the listing of the unit shares and warrant shares on the TSXV. Consolidated Uranium Inc is an exploration company that has acquired or has the right to acquire uranium projects in Australia, Canada, Argentina and the United States.

Consolidated Uranium Inc. (CUR) is up 0.71 per cent, trading at C$2.85 per share at 4 pm ET.