- Copper Fox (CUU) has announced Q3 financials highlighted by the continued development of its flagship projects

- The company incurred a net loss of C$747,620 (July 31, 2020 – C$845,158) for the nine months ended July 31, 2021

- As of July 31, 2021, Copper’s cash position was C$3,781,225 (October 31, 2020 – C$491,933)

- Post-quarter, the PEA for Schaft Creek yielded an after-tax net present value of US$842.1 million

- Copper Fox Metals is focused on copper exploration and development in Canada and the United States

- Copper Fox (CUU) is up by 1.82 per cent and is currently trading at $0.28 per share

Copper Fox (CUU) has announced Q3 financials highlighted by the continued development of its flagship projects.

2021 Q3 highlights

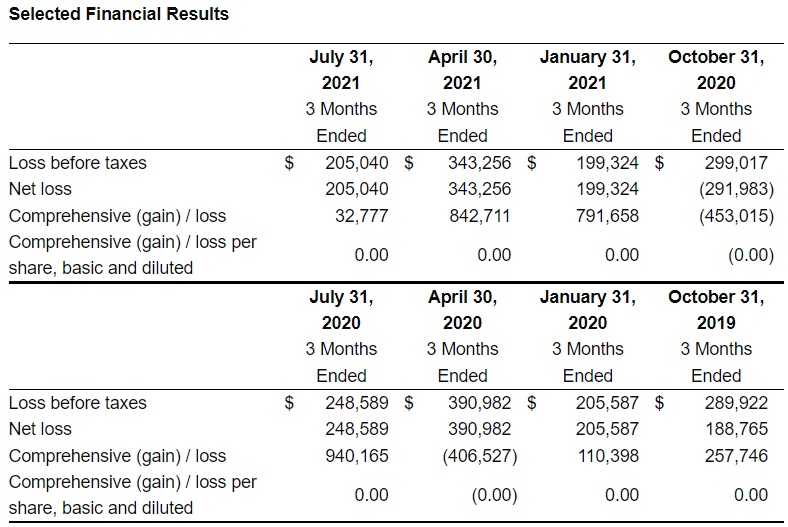

- Incurred a net loss of C$747,620 (July 31, 2020 – C$845,158) for the nine months ended July 31, 2021

- It also incurred C$1,156,194 in expenditures related to development work on Van Dyke, Schaft Creek and the 2021 Eaglehead exploration program

- Filed a National Instrument 43-101 technical report containing a mineral resource estimate update for Schaft Creek

- Advanced the preliminary economic assessment (PEA) for Schaft Creek

- Completed an induced polarization survey on Mineral Mountain

- Compilation, geological modelling and commencement of the 2021 field program on Eaglehead

- As of July 31, 2021, the company’s cash position was C$3,781,225 (October 31, 2020 – C$491,933)

Post-quarter highlights

- Retained Montgomery & Associates to prepare a data gap analysis and conceptual hydrogeological model for the Van Dyke Project

- Qualified to trade on the OTCQX Best Market under the symbol CPFXF

- Announced the results of the PEA for Schaft Creek, which yielded an after-tax net present value of US$842.1 million, internal rate of return of 12.9 per cent, life of mine EBITDA of US$10.81 billion and free cash flow before recovery of initial expenditures of US$9.96 billion

Elmer B. Stewart, President and CEO of Copper Fox, stated,

“During the quarter, our primary focus was the Schaft Creek preliminary economic assessment and advancing the Van Dyke copper project.

Compilation of the historical data has significantly increased our understanding of the geometry, controls and potential to locate additional polymetallic copper mineralization within the Eaglehead Project.

The large positive chargeability/resistivity anomalies outlined at Mineral Mountain demonstrate a strong correlation to copper-molybdenum mineralization exposed in outcrop and has provided the confidence to move the project to the drilling stage planned for early 2022.”

Copper Fox Metals is focused on copper exploration and development in Canada and the United States.

Copper Fox (CUU) is up by 1.82 per cent and is currently trading at $0.28 per share as of 10:24 am ET.