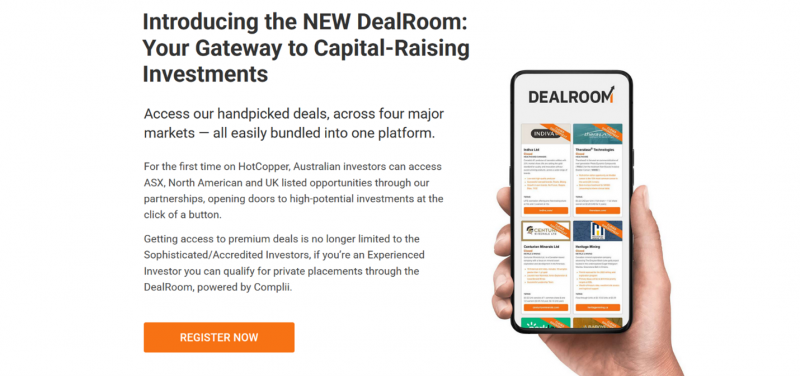

A global investment platform—now with UK deal access

DealRoom, the global capital-raising platform operated by ADVFN, has officially expanded into the United Kingdom—opening the door to UK-based private placements and pre-IPO opportunities for Canadian investors.

For Stockhouse readers, this expansion represents a meaningful step forward in accessing early-stage and private market deals beyond Canada’s borders, all through a single, centralized platform. DealRoom is built to connect investors directly with high-demand capital-raising opportunities, offering early visibility into transactions that are often difficult to source through traditional channels.

With the UK now live, DealRoom strengthens its position as a truly global investment gateway—bringing together opportunities from Canada, the United States, Australia, and the UK under one roof.

What is DealRoom—and why does it matter?

DealRoom is a dedicated capital-raising service designed to give investors direct access to pre-IPO and private placement opportunities, without geographic constraints. Investors can review upcoming raises, evaluate deal details, and decide which opportunities align with their investment strategy—without obligation to participate.

What makes DealRoom unique is its reach. Through ADVFN’s global investor network—including Stockhouse, HotCopper, ADVFN.com, and InvestorsHub—DealRoom now connects companies with more than 30 million investors worldwide each year.

For Canadian investors, this means expanded deal flow, increased diversification opportunities, and earlier insight into capital raises happening well beyond the TSX and TSXV.

UK expansion strengthens cross-border deal flow

The launch of DealRoom in the UK reflects a broader trend across capital markets: companies and investors are thinking globally. Businesses are increasingly raising capital across multiple jurisdictions, while investors are seeking exposure to growth stories wherever they originate.

“We can match the right investors with the right transactions,” said Tim Sylvester, Director of Capital Markets at HotCopper. “Opening DealRoom to UK investors also benefits Canadian investors by expanding the quality and diversity of opportunities flowing through the platform.”

As more companies pursue dual listings, international acquisitions, and offshore growth strategies, platforms like DealRoom play a critical role in connecting capital with opportunity—efficiently and transparently.

Why now is an attractive time for investors

Private placements are gaining renewed momentum across global markets. Improving capital conditions, increased investor appetite, and growing cross-border activity are all contributing to a more active deal environment.

Over the coming year, DealRoom expects increased participation from both issuers and investors as companies look to fund growth, advance projects, and position themselves ahead of broader market exposure.

For investors, DealRoom offers a front-row seat—providing early awareness of upcoming transactions and the ability to assess opportunities at their own pace.

How Canadian investors can get involved

DealRoom is open to investors across Canada, the United States, Australia, and the UK.

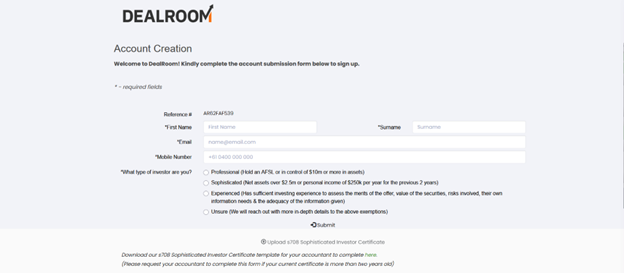

Registration is simple, and access allows investors to view available opportunities, receive updates on new deals, and stay informed as the platform continues to expand globally.

Stockhouse users can access DealRoom directly through the navigation bar by clicking the DealRoom tab or right here and clicking “Register Now”.