- Dynacor Group (DNG) has announced gold sales of C$132.2 million for the first half of 2022

- This represents a 24.3 per cent increase in sales over last year

- For 2022, the corporation forecasted sales in range of US$200 to $220 million

- Dynacor is an international gold ore industrial corporation servicing artisanal and small-scale miners (ASMs)

- Dynacor Group Inc’s (DNG) share price remains unchanged, trading at $3.05 per share at 11:05 am EDT

Dynacor Group (DNG) has announced gold sales of C$132.2 million for the first half of 2022.

This represents an increase of 24.3 percent over last year.

In June, the corporation had sales of $21.5 million compared to $17.7 million in June 2021.

The average selling price of gold in June 2022 was US$1,829 per oz, compared to US$1,815 per ounce last year.

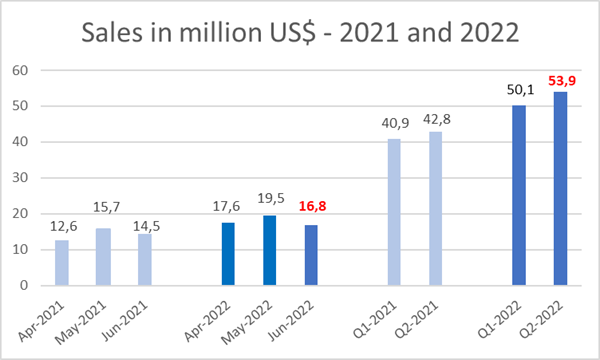

The 2022 second-quarter sales amounted to US$53.9 million compared to US$50.1 million for Q1 2022.

The comparative sales were as follows:

Cumulative sales for the first six months of 2022 amounted to US$104.0 million, compared to US$83.7 million for the first half of 2021, a 24.3 per cent increase. The average selling price of gold for the first half of 2022 was US$1,870 per oz compared to US$1,805 per ounce in 2021.

For 2022, Dynacor forecasted sales in the range of US$200 to $220 million based on a year opening US$1,800 per ounce average gold price.

At the end of June, the corporation is in line with its forecasted sales.

Dynacor is a dividend-paying industrial gold ore processor headquartered in Montreal QC.

At present, Dynacor operates in Peru, where its management and processing teams have decades of experience working with ASM miners. It also owns a gold exploration property (Tumipampa) in the Apurimac department.

Dynacor Group Inc’s (DNG) share price remains unchanged, trading at $3.05 per share at 11:05 am EDT.