- Electronic Arts (NASDAQ:EA) stock lost more than 2 per cent at Friday’s open, following a 17 per cent plunge in the previous trading session, its worst drop since September 2023

- This was the fallout from news out of the company that it plans to endure a significant cut in its financial outlook due to weaker-than-expected demand for its EA SPORTS FC 25 video game, its top franchise

- On Friday, several law firms announced that they are investigating EA over this financial update and are reaching out to investors who may have lost money in the company.

- Electronic Arts stock (NASDAQ:EA) opened trading at US$118.58

It has been a rough week for Electronic Arts (NASDAQ:EA), from an underwhelming quarterly report, bad news for its soccer franchise (yes, I said “soccer”), and the gaming outfit is under a legal investigation.

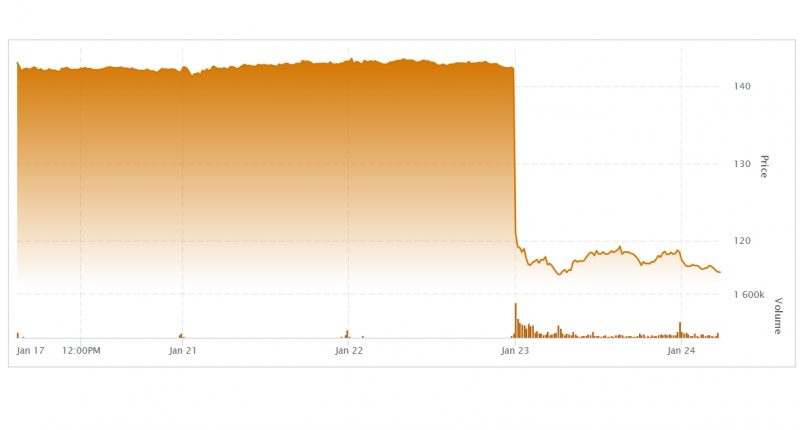

EA stock lost more than 2 per cent at Friday’s open, following a 17 per cent plunge in the previous trading session, its worst drop since September 2023 and also notable as the biggest loser on the S&P 500.

This was the fallout from news out of the company that it plans to endure a significant cut in its financial outlook due to weaker-than-expected demand for its EA SPORTS FC 25 video game, its top franchise.

In preliminary results released late Wednesday, EA reported that it now expects net bookings of $2.22 billion for its fiscal third quarter, which ended on December 31st. This is a notable drop from the previously forecasted range of $2.4 billion to $2.55 billion, and below analysts’ expectations of $2.44 billion. Consequently, EA also revised its fiscal 2025 net bookings forecast to between $7 billion and $7.15 billion, down from the earlier projection of $7.5 billion to $7.8 billion.

The company’s global football segment, which includes the EA SPORTS FC franchise, experienced a slowdown as initial momentum in the fiscal third quarter did not sustain through to the end. This segment had previously enjoyed consecutive fiscal years of double-digit net bookings growth but has struggled in its second year without the FIFA license, facing mixed reviews and declining user adoption of their FC Ultimate Team live service.

EA’s Dragon Age franchise engaged approximately 1.5 million players during the quarter, falling nearly 50 per cent short of the company’s expectations.

The final fiscal third-quarter results are set to be announced on February 4th.

On Friday, several law firms announced that they are investigating EA over this financial update and are reaching out to investors who may have lost money in the company.

Levi & Korsinsky, Bronstein, Gewirtz & Grossman, and Block & Leviton are three of the firms looking at possible violations of federal securities laws.

With headquarters in Redwood City, California, and studios all over the world, Electronic Arts is a digital interactive entertainment company that develops, markets, publishes and delivers games, content and services that can be played by consumers on a range of platforms such as game consoles, personal computers, mobile phones, and tablets.

Electronic Arts stock (NASDAQ:EA) opened trading at US$118.58 and has lost 18.48 per cent since Monday and is down 16.87 per cent since this time last year.

Join the discussion: Find out what everybody’s saying about this gaming stock on the Electronic Arts Inc. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image: EA stock chart – Jan 17 – Jan 24, 2025)