Mining investors may already recognize the name Tocvan Ventures Corp. (CSE:TOC/OTC:TCVNF/FSE:TV3).

The company’s Pilar Gold-Silver Project in Sonora state, Mexico, has been turning heads with its increasingly robust drill results.

2022 Phase III drilling highlights on that property suggest that Tocvan Ventures is onto something big:

- 116.9 meters @ 1.2 Au, including 10.2 meters @ 12 g/t Au and 23 g/t Ag

- 108.9 meters @ 0.8 g/t Au, including 9.4 meters @7.6 g/t Au and 5 g/t Ag

- 63.4 meters @ 0.6 g/t Au and 11 g/t Ag, including 29.9 meters at 0.9 g/t Au and 18 g/t Ag

The high-grade gold intercepts here will catch the eye of investors. But it is bulk tonnage gold deposits (even at lower grades) that generate most of the world’s commercial mine prospects – especially those with friendly geology.

Previous metallurgical work on the Pilar Gold/Silver Project has registered gold recoveries as high as 96.9%. Recoveries from the silver mineralization exceed 90% at the high end.

Tocvan has completed over 22,000 meters of drilling on the Pilar Project. Now drilling is underway on the Company’s second gold/silver property in Sonora state, its El Picacho Gold-Silver Project.

On November 17, 2022, Tocvan Ventures announced its maiden drill program for El Picacho.

Initial drilling focused on two primary areas that are associated with high-grade gold/silver mineralization. Three historic drill holes completed by Timmins Gold (in 2012) “intersected low-grade mineralization and alteration associated with multiple shear zones, de-risking the potential for continued mineralization at depth.”

Drilling has now been completed. Tocvan has informed The Market Herald that samples have been shipped to the lab, and assay results will be released in due time.

El Picacho is a huge property (~24km2), with several other target areas already permitted for drilling. Tocvan is seeking “to tie together” both high-grade samples and the previous low-grade mineralization from drill results.

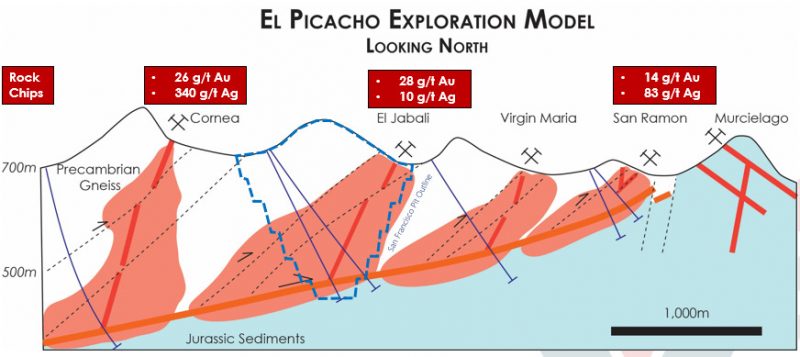

The previous sampling from different zones of El Picacho has produced some big gold and silver numbers.

A cross-section view of these zones provides investors with a better grasp of the geological modeling here.

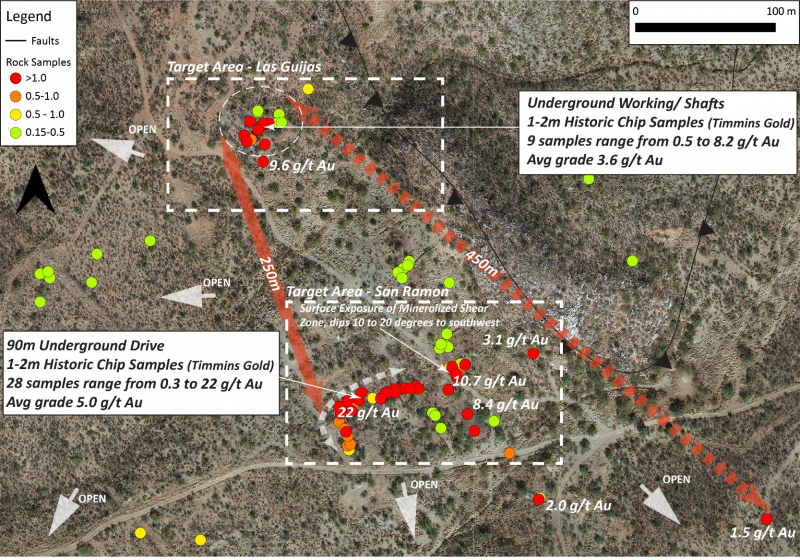

Brodie Sutherland, CEO of Tocvan Ventures, pointed investors specifically to the San Ramon Target at El Picacho.

“San Ramon has long been our priority target due to the established historical workings identifying high-grade structures with the potential of low-grade mineralization in between. There are a lot of parallels to the San Francisco Mine which was discovered from very similar surface characteristics and substantial artisanal workings.”

Initial drilling focused on a 500-meter X 500-meter exploration zone within San Ramon. Drilling is looking to build on previous high-grade chip samples of two key targets:

- Las Guijas: chip samples of up to 8.2 g/t (Au), and averaging 3.6 g/t

- San Ramon: chip samples of up to 22 g/t Au, averaging 5.0 g/t

Tocvan is currently permitted for 14 drill pads at San Ramon, providing a wealth of additional targets for future drilling.

Mexico is a preferred destination for gold and silver exploration.

Historically, Mexico has been the world’s premier silver-producing nation. It’s also a major gold-producing nation (currently #10 in the world).

With friendly mining regulations, a large and experienced mining workforce, and a favourable exchange rate, Mexico is one of the most-efficient jurisdictions to explore for gold and silver.

Precious metals investors are getting increasingly excited about the investment potential for gold and silver today.

The World Gold Council recently reported record gold-buying by central banks in Q3 of 2022: nearly 400 tonnes of gold. Since then, rumours have swirled that China soaked up 300 tonnes of this gold by itself.

Meanwhile, silver has been on a recent tear, up more than 30% since hitting its 2022 low at the end of August – and currently trading at $23.10 per ounce.

Tocvan Ventures offers investors two exciting gold projects based in Mexico, both with robust silver credits.

The Pilar Gold-Silver Project already looks like a significant gold-silver deposit in the making. Now the Company is offering investors more blue-sky potential as it looks to unlock the gold-silver mineralization at Tocvan’s El Picacho Gold-Silver Project.

A strong mining jurisdiction. A track record of robust drill results. A maiden drill program awaiting assay results on the Company’s second project.

For investors looking for a highly prospective gold investment, Tocvan Ventures is a strong candidate.

DSCLOSURE: This is a paid article by The Market Herald.