- G Mining (GMIN) is announcing results from its drilling program at the Tocantinzinho Gold Project

- The campaign on the Brazilian property has successfully confirmed the continuity of higher-grade gold in the main pit area

- It also confirmed that mineralization extends below the existing pit shell and increased the definition of areas to be mined during pre-production

- Highlights include 193.6 m of 1.48 g/t Au (TOC285) and 144.7 m of 1.70 g/t Au (TOC286)

- President and CEO Louis-Pierre Gignac spoke with Daniella Atkinson about the drill results and future exploration plans

- G Mining Ventures is a mineral exploration company with properties in Quebec and Brazil

- G Mining Ventures (GMIN) is unchanged trading at $0.66 per share

G Mining (GMIN) is announcing results from its drilling program at the Tocantinzinho Gold Project.

Tocantinzinho measures 996 km2 and is the largest known gold deposit in the Tapajós Gold Province. Tapajós is a vastly underexplored gold province with an estimated 15-30 Moz of gold produced in alluvium/saprolites in the region.

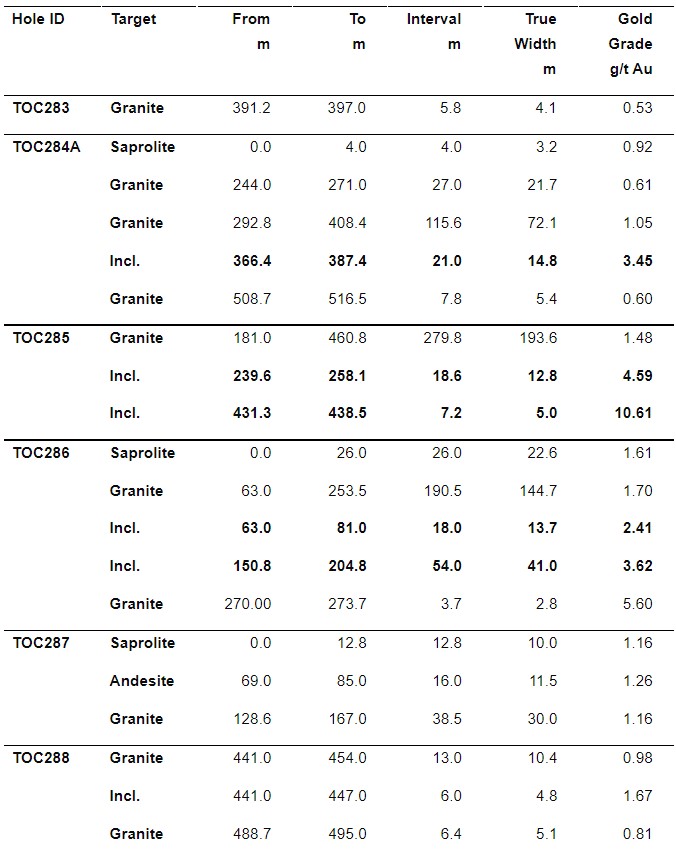

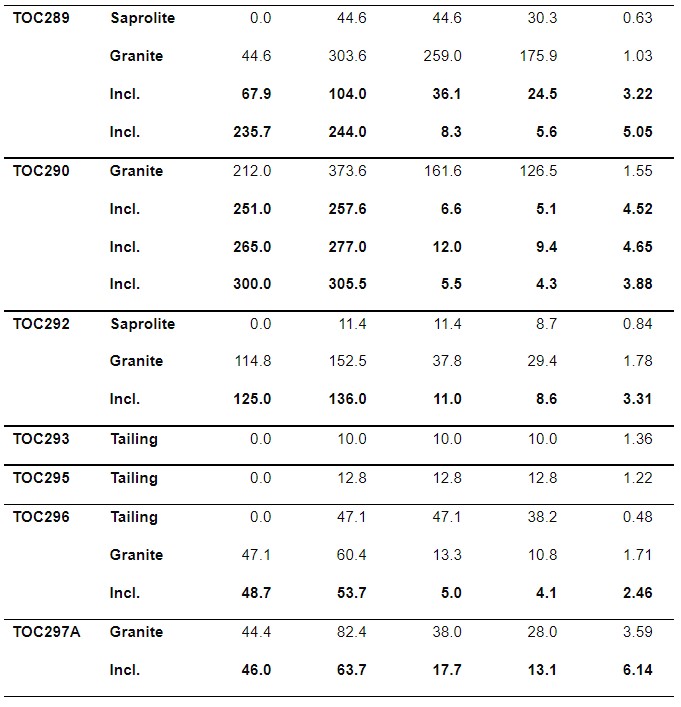

The company has drilled 6,234 m this year at the Tocantinzinho Deposit to delineate the first years of production while testing the near-surface limit of the tailings, saprolite and unit contacts.

The campaign on the Brazilian property has successfully confirmed the continuity of higher-grade gold in the main pit area and that the mineralization extends below the existing pit shell. It also increased the definition of areas to be mined during pre-production.

A higher-grade body (TOC 285, 286, 289) presents continuous mineralization above 1.5 g/t Au and follows the SW lineament plunge of the Tocantinzinho sinistral shear zone.

Mineralization was confirmed outside of the feasibility study pit shell with 72.1 m of 1.05 g/t Au (TOC284A) and 10.4 m of 0.98 g/t Au (TOC288).

Nine assay results are forthcoming.

Major composite of the 2022 drilling campaign

New targets and upcoming exploration program

Castor Target

Located directly southeast of the Tocantinzinho Deposit, Castor is a high-priority target identified along the TZ trend through sampling and successful reconnaissance drilling.

Grab samples have assayed up to 25.40 g/t Au.

Initial drill holes toward the southeast returned 8 m of 1.66 g/t Au (TOC214) and 8.4 m of 2.20 g/t Au (TOC212).

Ongoing sampling continues to identify further anomalous results, including gold. Infill soil sampling lines are in progress to tighten from 800 m to a 400 m spacing.

Current activity and next steps

Follow-up drilling on the initial hits is currently underway, as is a thorough mapping and sampling campaign to refine and prioritize drill targets. Further drill testing is planned for Q4 2022 and into 2023.

Déjà Vu Target

The company will engage in a regional soil sampling program to complete gaps in existing information on GMIN claims. The program will start along the Déjà Vu Target, on the western portion of the property, which is defined based on the soil sampling anomaly observed along a structural trend parallel to TZ.

Grab samples returned assays up to 100 g/t Au. Mapping and grab sampling will also contribute to defining future drilling targets.

President and CEO Louis-Pierre Gignac spoke with Daniella Atkinson about the drill results and future exploration plans.

G Mining Ventures is a mineral exploration company with properties in Quebec and Brazil.

G Mining Ventures (GMIN) is unchanged trading at $0.66 per share as of 12:16 pm EST.