Gold is breaking record after record. Goldman Sachs has now raised its forecast for the price per troy ounce. Barrick and Newmont woke up last week and showed that large investors are also investing in gold mining stocks again. The takeover candidate Desert Gold (TSXV:DAU) offers an opportunity for multiplication. The rally has largely passed the stock by, which has been in a sideways trend for over a year. Analysts see an attractive risk-reward ratio and recommend buying the stock. Deutz is also receiving buy recommendations. Analysts view the announced acquisition as a strategic move with the potential for electrifying military vehicles in the future. And what is the gold heavyweight Barrick doing?

Barrick Gold: Goldman Sachs raises forecast

The gold price has quickly recovered from its weak phase and jumped above the USD 3,200 mark. If Goldman Sachs has its way, there is still plenty of room for it to rise. As reported by Reuters, the US investment bank has raised its forecast for the gold price to USD 3,700 per troy ounce by the end of the year. On the one hand, the price of the precious metal is being driven by higher than expected demand from numerous central banks. Gold reserves have been significantly increased worldwide. In addition, inflows into gold-backed ETFs are higher than assumed. In light of the growing fear of recession, this trend is not expected to change – gold should become even more attractive. As a safe haven, the precious metal remains a good choice for investors.

Like the gold price, Barrick’s stock also quickly ended its phase of weakness. Last week, it rose from EUR 16.13 to over EUR 18, bringing it to a key resistance level. However, it is still quite a way to its all-time high of around EUR 40. And it is also not likely that the stock will approach this level anytime soon. The Company remains too preoccupied with its problem mines for that. Last year, Barrick ruled out any acquisitions. However, the strategy could change if the price continues to lack momentum. Given its solid balance sheet, Barrick would undoubtedly be in a position to afford one or two takeovers. One candidate could be Desert Gold.

Desert Gold: Takeover candidate with multiplication potential

While the gold price is at an all-time high, Desert Gold (TSXV:DAU) offers investors great catch-up potential. The Canadian gold explorer’s stock has been trading between CAD 0.06 and CAD 0.07 for almost a year. Much too low, say the analysts at GBC Research. They recommend the stock as a “Buy” with a target price of CAD 0.425. In their view, this means that a multiplication is possible.

With a growing resource base, a strategic location, and an improving regulatory environment, Desert Gold could emerge as one of the winners of the gold boom. In light of political and regulatory reforms that are transforming the natural resources sector in Mali, analysts see attractive opportunities for strategically well-positioned companies – including Desert Gold.

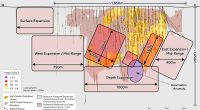

Desert Gold holds a 440 km² land package in the Kenieba Window, surrounded by major players such as Barrick Gold, B2Gold, Allied Gold, and Endeavour Mining. The region is home to highly productive mines. Desert Gold has already confirmed 310,300 ounces and indicated 769,200 ounces. This adds up to a solid 1.079 million ounces of gold – and counting. Recently, the Company acquired historical drilling data from an Australian firm. The evaluation is ongoing, and a further 480,000 ounces are suspected. This increasingly positions Desert Gold as an attractive takeover candidate.

Deutz: Target price reduced

Analysts see less upside potential in Deutz than in Desert Gold. However, calling the Deutz stock stagnant would be inaccurate. Things are currently going almost too well for the engine manufacturer: It is benefiting from the defense boom and the billions that the German government plans to spend on infrastructure. In addition, the Cologne-based company will likely support the Black-Red coalition’s plans to scrap the heating law and lift the ban on combustion engines. On top of that, Deutz has announced a strategically interesting acquisition in the field of electromobility.

On Friday, analysts at Warburg Research confirmed their “Buy” recommendation for Deutz shares. However, the price target was slightly reduced from EUR 11.80 to EUR 10.90. The stock is currently trading at EUR 6.23. The acquisition of the Dutch company UMS would strengthen the product portfolio with new technologies. Order intake likely saw a slight increase at the beginning of the year.

Incidentally, this makes Warburg one of the Deutz bulls. According to marketscreener.com, the average price target is EUR 8.64. The five analysts covering the Company all recommend buying.

The Desert Gold stock is ripe for an upward breakout. The takeover speculation is acting as a support for the downside. Barrick Gold is likely to benefit from the rising price of the precious metal, but as a rule, explorers typically offer greater leverage. The Deutz share has already performed well. Accordingly, the short-term potential is likely to be limited.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a “Transaction”). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

This is sponsored content issued on behalf of Apaton Finance GmbH, please see full disclaimer here.

(Top image of Rheinmetall ammunition: Rheinmetall SE)