- Golden Independence (IGLD) has completed a preliminary economic assessment for the near-surface resource at the Independence Project

- The study envisions a mine-life of just over six years, which the company estimates will exploit only 60 per cent of the near surface resource

- The PEA also estimated an average annual production of 32,050 ounces gold at US$1,078/ounce

- The company currently has initial capital of US$63 million

- Golden Independence Mining is an exploration company engaged in the acquisition and exploration of mineral property assets

- Shares in Golden Independence (IGLD) are steady, trading at $0.13 per share

Golden Independence (IGLD) has completed a preliminary economic assessment for the near-surface resource at the Independence Project in Nevada.

The PEA is based on an updated mineral resource estimate (MRE), effective November 15th, 2021. This current pit-constrained resource supersedes previous resource estimates for the project, including the estimate included in Monday’s news release.

The study envisions a mine-life of just over six years, producing 195,443 ounces of gold and 1.28 million ounces of silver.

Other highlights from the Independence PEA include:

- An average annual production of 32,050 ounces gold at an all-in sustaining cost of US$1,078/ounce;

- A life-of-mine after-tax cash flow of US$59 million at base case prices and US$72 million at spot prices;

- Initial capital of US$63 million including working capital and contingencies; and

- That the mine life of 6.1 years will exploit only 60 per cent of the near surface resource.

Christos Doulis, CEO of Golden Independence, commented on the PEA results.

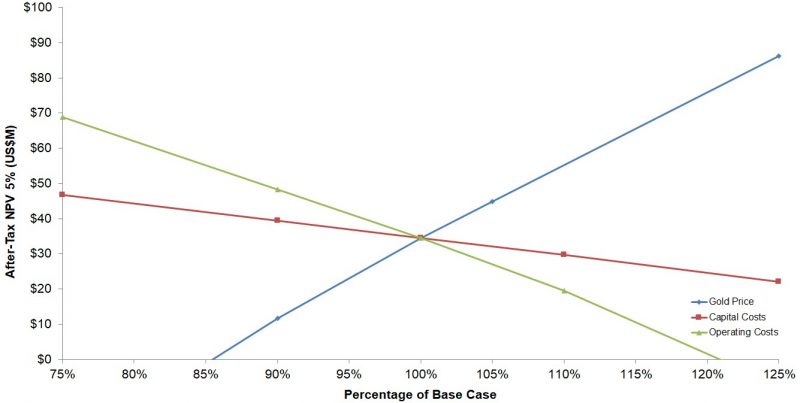

“The PEA shows,” he said, “that at base case gold prices of US$1,700 per ounce, the heap leach component of the Independence project has a significant positive net present value and very strong leverage to the gold price.”

“Our focus in 2022 will be to continue to examine opportunities to significantly grow the project through additional exploration work and strategic acquisition,” said Mr. Doulis, adding that the company would also focus on “unlocking the value of the high-grade skarn and advancing and expanding the heap leach component of the project.”

Golden Independence Mining is an exploration company engaged in the acquisition and exploration of mineral property assets.

Shares in Golden Independence (IGLD) are steady, trading at $0.13 per share as of 9:30 am EST.