- GreenSpace Brands Inc. (JTR) has announced a $2.502 million bought deal private placement

- The company has engaged a syndicate of underwriters led by PI Financial and Canaccord Genuity

- PenderFund Capital Management, an insider and control person of the company, also intends to participate in the offering

- Net proceeds will be used for working capital, investments in innovation, geographic and channel expansion, and for general corporate purposes

- GreenSpace is a North American organic and plant-based food business

- GreenSpace Brands Inc. (JTR) is currently down 7.14 per cent, trading at $0.065 per share

GreenSpace Brands Inc. (JTR) has announced a $2.502 million bought deal private placement to support its efforts in innovation, expansion, and capital.

The company has engaged a syndicate of underwriters led by PI Financial and Canaccord Genuity. The underwriters will receive a seven per cent cash commission on the private placement.

PenderFund Capital Management, an insider and control person of the company, also intends to participate in the offering.

As insiders, PenderFund and management of GreenSpace who are participating in the private placement will be required to obtain minority shareholder approval for a related party transaction.

PenderFund and its affiliates beneficially own or control, directly or indirectly, 152,270,428 common shares of GreenSpace, representing 33.5 per cent of the issued and outstanding common shares.

GreenSpace Management beneficially owns or controls 2,000,000 common shares representing 0.4 per cent of the issued and outstanding common shares.

The offering will be conducted on a bought deal private placement basis and will consist of 41,700,000 units at $0.06 per unit, with each unit consisting of one common share and half of a common share purchase warrant.

The company will grant the underwriters an option to increase the size of the offering by up to 15 per cent at any time prior to the closing of the offering, which is expected to be on or about September 28, 2021.

Net proceeds will be used for working capital, investments in innovation, geographic and channel expansion, and for general corporate purposes.

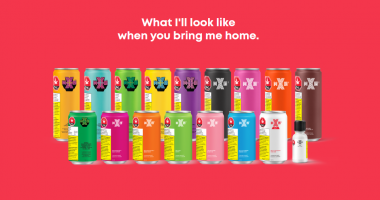

GreenSpace is a North American organic and plant-based food business that develops, markets and sells premium food products to consumers within the fast-growing natural and organic food categories.

GreenSpace Brands Inc. (JTR) is currently down 7.14 per cent, trading at $0.065 per share as of 9:56 am ET.