- Hanstone Gold (HANS) will conduct a non-brokered private placement for aggregate gross proceeds of $1,000,000

- The offering will consist of common share units and flow-through units

- Proceeds will be used to fund the company’s ongoing exploration drilling program, working capital requirements and other general corporate purposes

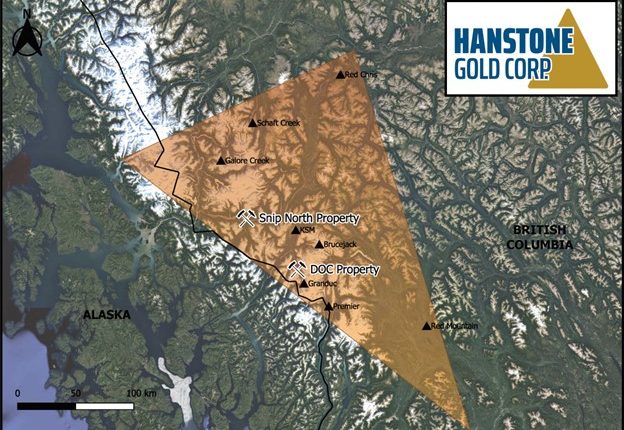

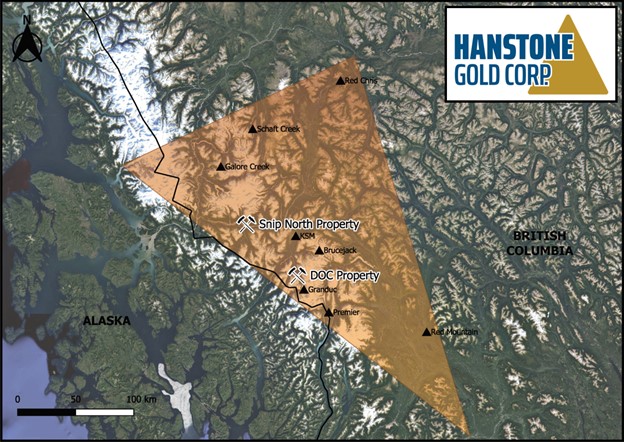

- Hanstone Gold is a precious and base metals explorer focused on the Doc and Snip North Projects located in the Golden Triangle of BC

- Hanstone Gold Corp. (HANS) opened trading at C$0.26 per share

Hanstone Gold (HANS) will conduct a non-brokered private placement for aggregate gross proceeds of $1,000,000.

The offering will consist of units priced at $0.28 and flow-through units priced at $0.30. The maximum number of securities to be issued is 3,571,428 units.

Units will consist of one common share and one common share purchase warrant. Each warrant may be exercised to acquire one common share at a price of $0.32 for a period of 24 months.

Flow-through units will consist of one common share and one common share purchase warrant. Each FT warrant may be exercised to acquire one common share at a price of $0.35 for a period of 24 months.

Proceeds will be used to fund the company’s ongoing exploration drilling program, working capital requirements and other general corporate purposes.

The closing of the offering is subject to the receipt of the approval of the TSX Venture Exchange. Securities issued under the offering will have a hold period of four months and one day from the date of issuance.

Hanstone is a precious and base metals explorer with its current focus on the Doc and Snip North Projects located in British Columbia.

Hanstone Gold Corp. (HANS) opened trading at C$0.26 per share.