The S&P 500 is an index that tracks the performance of 500 large-cap companies listed on major U.S. stock exchanges.

Considered a benchmark for the overall U.S. stock market, the S&P 500 (short for Standard & Poor’s 500) provides investors with a diversified exposure to various sectors and industries. This article will help guide you through the process of investing in the S&P 500, including background information, steps to invest, associated risks, and its performance in the current year.

Understanding the S&P 500 index

Started in 1957, the S&P 500 includes companies from a diverse range of sectors, such as technology, healthcare, finance, consumer goods and many others. Companies listed on the index are selected based on size, market capitalization, liquidity and other factors deemed important. It is because of this reputation that the index is often considered a reliable representation of the U.S. stock market’s health and performance.

Steps to invest in the S&P 500

1. Research and education: Before investing, it is crucial to have a fundamental understanding of the stock market, index funds and the S&P 500 specifically.

Familiarize yourself with investment concepts, strategies and the historical performance of the index.

2. Choose an investment strategy: To invest in the S&P 500, investors commonly opt for index mutual funds or exchange-traded funds (ETFs). These funds replicate the performance of the index by holding the same stocks as the S&P 500 in the same proportion.

3. Select a brokerage account: Open a brokerage account with a reputable broker that offers access to mutual funds or ETFs. To choose the most suitable option, compare fees, available tools, customer support and the ease of use.

For more on this, check out How to invest in stocks: A beginner’s guide.

4. Fund your account: Deposit the desired amount of money into your brokerage account. Make sure you have enough funds for the minimum investment required by the chosen mutual fund or ETF. Be cautious of any transaction fees that may apply.

5. Choose the right fund: Research and select a specific index mutual fund or ETF that tracks the S&P 500. Consider factors such as expense ratios, historical performance, asset size and the fund manager’s track record.

6. Invest your money and time: Using your brokerage account, purchase the chosen index mutual fund or ETF that tracks the S&P 500. Determine the amount of your investment based on your risk tolerance, financial goals and available funds.

Risks with Investing in the S&P 500

1. Market volatility: The stock market, and consequently the S&P 500, experience fluctuations in value. Prices can rise and fall rapidly because of various factors, including economic conditions, interest rates and geopolitical events.

2. Diversification limitations: While the S&P 500 offers diversification, it does not guarantee complete protection against individual company risks. If a particular sector or company within the index underperforms, it might impact the overall index’s returns.

3. Long-term focus: Investing in the S&P 500 requires a long-term perspective to ride out short-term market fluctuations. It is not recommended for short-term or speculative investors.

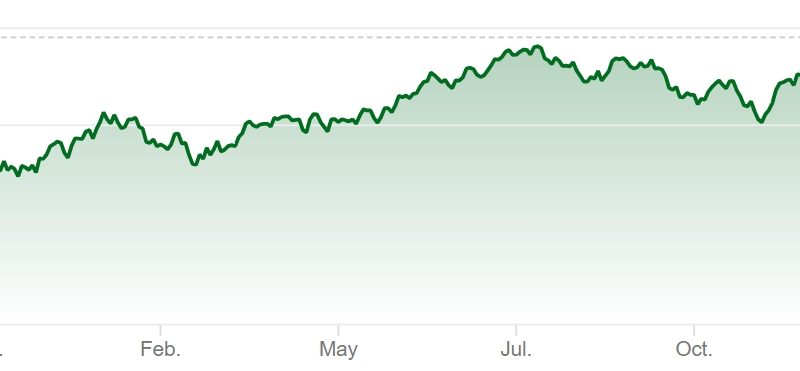

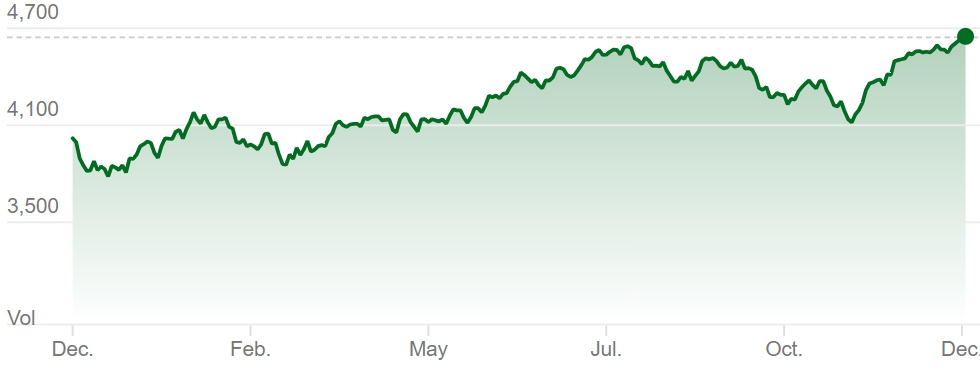

The S&P’s performance in 2023

The S&P 500’s performance fluctuates year by year but has seen consistent consecutive weekly gains from early November to mid-December 2023. To find the most accurate and up-to-date information regarding its performance in the current year, it is advised to consult reputable financial news outlets, specialized financial websites, or consult with a financial advisor.

In summary

Investing in the S&P 500 provides an opportunity for individuals to gain exposure to a broad representation of the U.S. stock market.

By following these steps, investors can participate in the potential growth of some of America’s largest companies. However, it is essential to consider the risks associated with investing and the need for a long-term investment horizon to achieve optimal results. As always, seeking advice from a qualified financial professional can help navigate the intricacies of investing in the S&P 500.

Join the discussion: Find out what everybody’s saying about public companies and hot topics about stocks at Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.