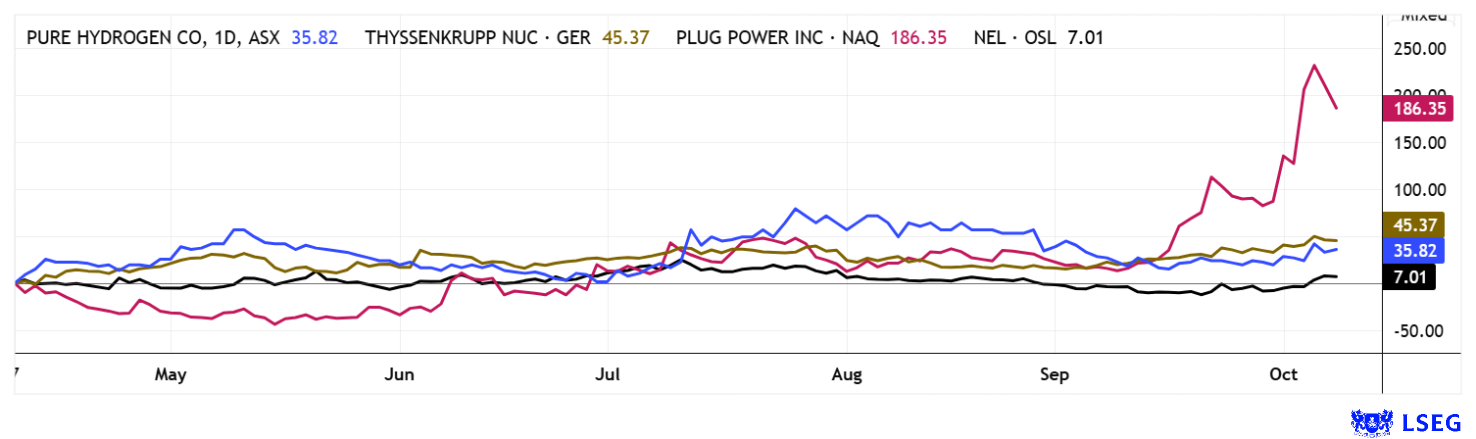

For a long time, hydrogen stocks were very quiet. But now they have been kissed awake. Led by Plug Power, which posted a 300% turnaround in just two months, the upward momentum is now spreading across the entire sector. Nel ASA, the Norwegian pioneer, has had some weak quarters, making November a particularly exciting month. The Australian H2 powerhouse Pure Hydrogen has performed strongly since the beginning of the year. And the thyssenkrupp spin-off nucera is also making an impressive comeback. Are the protagonists already betting on the next wave of EU investment? Where are the opportunities for investors?

This article is being disseminated on behalf of Apaton Finance GmbH, a third-party issuer and is intended for informational purposes only.

Plug Power and Nel ASA – A technical rebound is on the horizon

Established hydrogen companies Plug Power and Nel ASA are once again performing very dynamically after the price declines of recent years. Plug Power staged an impressive turnaround at around USD 0.70, achieving a 500% increase in September and reaching levels above USD 4.50. Nel ASA has also turned the corner. It is also worth taking another look at the operational side.

Plug Power increased its revenue by 21% to USD 174 million in the second quarter of 2025, exceeding analysts’ expectations. The electrolyser business grew particularly strongly, tripling compared to the previous year and implementing over 230 MW of GenEco projects worldwide. Analysts such as H.C. Wainwright surprised investors with a “Buy” rating and a price target of USD 7, representing a potential upside of at least another 100% as of yesterday. Analysts on the LSEG platform are still somewhat more cautious, with the 12-month consensus at USD 2.72 – a technically possible consolidation target?

Nel ASA recorded a 48% decline in revenue to NOK 174 million in the same quarter, but is suffering primarily from delayed decisions on significant projects in the alkaline segment. The PEM segment, on the other hand, shone with record revenues and order intake of NOK 290 million, underscoring the Company’s technological strength. The order backlog remains solid at NOK 1.46 billion, and planned cost-cutting measures are increasing operational efficiency. Analysts have given mixed assessments, with average price targets between NOK 2.08 and NOK 2.23, while highs of NOK 4.20 indicate further potential.

Both companies are benefiting from growing interest in hydrogen technologies and the trend toward zero-emission solutions. Plug Power’s strong revenue growth, international electrolyser projects, and the prospect of its first quarterly profit speak in its favor. Nel ASA impresses with stable order pipelines, a booming PEM segment, and a robust balance sheet. Due to high volatility, only risk-aware investors should consider investing.

Pure Hydrogen – Hydrogen strategy takes effect, and operational momentum picks up speed

Pure Hydrogen (PINL:PHCLF) is currently one of the most exciting players in the global hydrogen market. The Australian company is pursuing a technologically broad-based strategy: in addition to green hydrogen from renewable sources, it is focusing on turquoise hydrogen from methane pyrolysis and a new category, “emerald hydrogen,” which is currently being tested in pilot projects. Studies show that hydrogen solutions are often faster and more cost-effective to scale than a purely electric infrastructure, an advantage that Pure Hydrogen is exploiting. The Company not only thinks visionary, but also consistently implements its plans. It is developing hydrogen-powered commercial vehicles, generators, and mobile refueling solutions, and is working with partners such as Botswana H2 and Botala Energy in Africa. In Australia, gas exploration in the Cooper Basin forms a strategic foundation with over 25 years of production security, providing a stable bridge to the hydrogen economy.

According to the report dated June 30, 2025, Pure Hydrogen is on course for growth. In the final quarter of the 2024/2025 financial year, the Company generated AUD 409,000 in positive operating cash flow, and as of June 30, 2025, it had AUD 2.732 million in cash and cash equivalents and had repaid all short-term debt. Annual revenue climbed to AUD 4.554 million (previous year: AUD 1.78 million). Although the net loss was still around AUD 16 million due to a write-down, the momentum in revenue and cash flow shows that the business model is increasingly paying off. Important projects such as the delivery of a hydrogen-powered prime mover to Barwon Water and a distribution agreement with GreenH2 LATAM underscore this progress. At the same time, Pure Hydrogen is now also tapping into the US market with Riverview International.

To finance its growth, AUD 1 million was recently raised at AUD 0.085 per share, including attractive option rights. The share price has doubled since March and is currently consolidating, offering another favorable entry point for the emerging hydrogen player below AUD 0.10.

thyssenkrupp nucera – Green technology “Made in Germany”

thyssenkrupp nucera currently presents itself as one of the most strategically positioned players in the electrolysis market for green hydrogen, on a foundation that is significantly more stable than that of competitors such as Nel or Plug Power. With over 10 GW of installed capacity in the chlor-alkali sector, the Company has a long-standing profitable core business that financially secures its ambitious growth strategy in the hydrogen segment. Unlike pure electrolysis players, nucera has a history of positive results and remains profitable even in the current investment-intensive phase.

In the first nine months of the 2024/25 fiscal year, revenue rose by 9% to EUR 663 million, while EBIT turned from EUR -13 million in the previous year to EUR +4 million, a clear signal of operational strength. For the full year, the Management Board expects revenue of EUR 850 to 920 million and EBIT in the range of EUR –7 to +7 million, with the chlor-alkali segment alone contributing up to EUR 75 million in EBIT. Analysts at Berenberg see this as a solid buffer against possible fluctuations in the hydrogen segment. At the same time, Warburg Research highlights the combination of improved project margins and cost discipline as key drivers of stability. The positive free cash flow shows that growth can be achieved on the Company’s own merits without relying on expensive capital injections.

Most recently, the nucera Chlorine Symposium 2025 provided technological momentum, with the share price rising to over EUR 11. In addition to solid organic development, nucera is also focusing on targeted acquisitions, such as the recent purchase of key technology assets from the insolvent Green Hydrogen Systems in Denmark. Analysts at Hauck & Aufhäuser see this as a distinguishing feature compared to competitors. While competitors such as Plug Power repeatedly suffer from “capital injection fears,” nucera offers a resilient, scalable growth platform thanks to IPO funds and high liquidity. The stock market is rewarding this course with a stable valuation level that is significantly less volatile than the industry average. Given market developments in the green hydrogen sector and the emerging regulatory support in Europe, most firms see nucera as a structural winner over several years. **On the LSEG platform, 8 out of 13 analysts give it the thumbs up, with an average 12-month price target of EUR 11.95. Although this is only 7% above the current price, investors should keep an eye out for upcoming upgrades!

The hydrogen sector is showing the first signs of life. While Plug Power is forging ahead, Nel ASA is also gaining momentum. The strong operating performance of thyssenkrupp nucera is also surprising. Shares in Australia’s Pure Hydrogen had already doubled by the summer and are currently taking a short break. This creates new buying opportunities.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a “Transaction”). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.