Clean Air Metals Inc. (TSXV:AIR/OTC:CLRMF) is turning heads with its polymetallic flagship Project, located near Thunder Bay, Ontario. Why?

To begin with, “critical minerals.” The Thunder Bay North Critical Minerals Project boasts mineral-rich ore that is like a mining ETF all rolled into a single project: platinum, palladium, nickel, copper, gold, silver, rhodium, cobalt and sulphur.

Collectively, the Project has robust grades and a large-and-growing resource.

The Current and Escape Deposits comprise a lucrative commercial mine plan. Present insitu mineral resources are:

- Escape Deposit: Indicated Resource of 4.16 million tonnes at 7.61 g/t PtEq (1,018,330 ounces PtEq)

- Current Deposit: Indicated Resource of 10.38 million tonnes at 8.32 g/t PtEq (2,780,251 ounces PtEq)

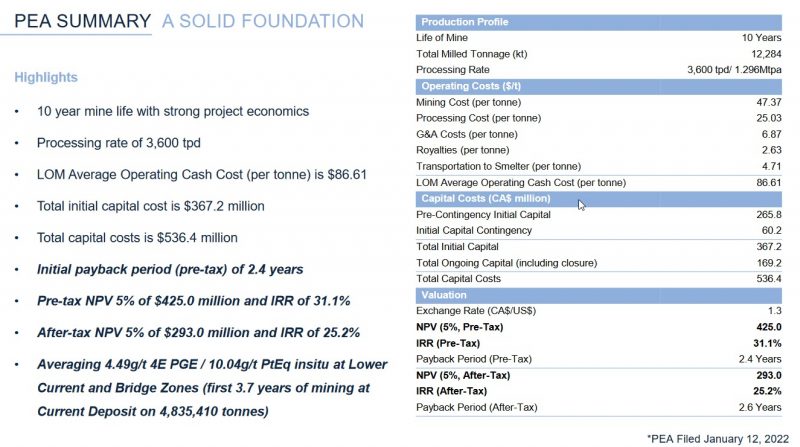

Not surprisingly, the rich deposit at Thunder Bay North is yielding strong economics. The January 2022 preliminary economic assessment (PEA) offers investors some exciting numbers, including:

- An IRR of 31.1%, (pre-tax) payback in 2.4 years

- A pre-tax NPV of CAD$425 million (discounted at 5%)

- Above-average insitu grades for first 3.7 years of operations (10.04 g/t PtEq)

The Company is expecting a big year in 2023 for this rapidly evolving Project. The news flow has already started with Clean Air Metals’ first release of the year.

On January 10, 2023, Clean Air reported that it has appointed its prime engineering consultant for the Prefeasibility Study of Thunder Bay North, Montreal-based BBA E&C Inc.

BBA’s Project assessment will include:

…[T]he overall underground mine design, optimized life-of-mine planning, dilution estimation, mining selectivity and cut-off policy optimization, mining value chain optimization (“mine-to-mill”), estimation of proven and probable (2P) mineral reserves and reporting according to NI 43-101 requirements. [emphasis mine]

With the awarding of this contract, Clean Air Metals is expecting three important milestones to flow from this over the course of 2023.

- Updated metallurgical optimization (estimated for Q1 2023).

- Mill flowsheet and plant design (estimated for Q2 2023).

- Completion of PFS, including updated resource estimates and the Project’s first mineral reserves (estimated for Q3 2023).

The set up here should generate strong interest among experienced mining investors. Thanks to the January 2022 PEA, investors already know that there will be several pieces of good news on the near-term horizon.

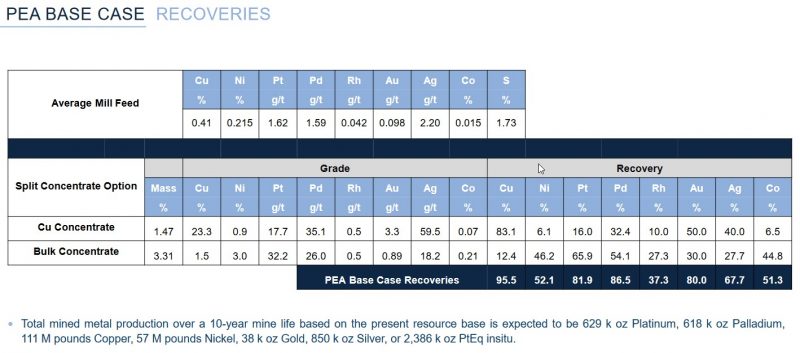

The “base case recoveries” from the PEA already offer strong recovery levels for most of these metals, with estimated recoveries for copper, palladium, platinum and gold all at 80% or higher, with especially strong copper recovery (95.5%).

These high recovery numbers are a key to Project success, with management estimating that 90+% of mine revenues will come from palladium, platinum and copper.

With another year of experience in analyzing the ore from Thunder Bay North, it’s highly unlikely that recovery numbers will go down when the Company reports updated metallurgical optimization later in Q1. Thus any “surprises” will likely be to the upside.

In Q2, Clean Air Metals expects to have numbers out on its plant design. This should give investors a clear picture of the capital requirements that will be contained in the upcoming PFS.

Then, in Q3, the completed PFS itself is expected to be released. More good news for investors, including an “updated” (i.e. enlarged) resource estimate that will include first estimates of mineral reserves for the Project.

The PFS itself will be crucial for investors for two reasons.

First, obviously, the updated resource estimate should be a catalyst for a significant bump in valuation. Secondly, the greater Project certainty from this assessment could put the Company in a much stronger position to either line up Project financing through an earn-in joint venture with a larger competitor or (perhaps) lead to a successful sale of Clean Air Metals itself.

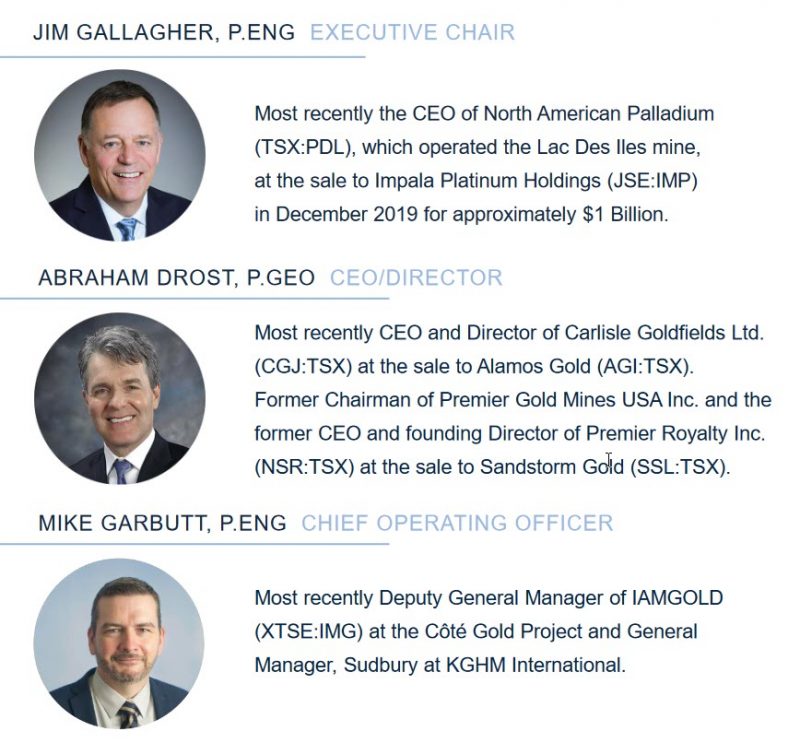

With the senior management team of Clean Air Metals demonstrating a significant track record of “successful exits”, either one of these outcomes should prove to be strongly beneficial for shareholders.

Juicing the upside potential for Clean Air Metals in 2023 is a terrible year for markets in 2022. The Company’s share price was dragged down to a small fraction of its previous (rational) valuation.

That’s bad news for existing shareholders. But it spells “opportunity” for new investors in 2023. Thanks to the market carnage in 2022, investors can scoop up shares in Clear Air with the market cap at a bargain-basement CAD$27 million.

The war in Ukraine has resulted in Western markets (and industries) being cut off from numerous important raw materials that were previously imported from Russia. Russia has been a particularly important source of both platinum (#2 in the world) and palladium (#2 in the world).

This makes it even more important for new Western-based production of these critical metals. In turn, this strong demand picture should improve prospects for Project financing.

Clean Air Metals is expecting a big year in 2023 for its Thunder Bay North Critical Minerals Project. Investors have the opportunity to buy in ahead of this news flow – and with the Company at an extremely attractive valuation.

Opportunity knocks.

DISCLOSURE: This is a paid article by The Market Herald.