- Mason Graphite (LLG) will purchase assets related to graphene processing technology from Thomas Swan & Co. for C$5.2 million

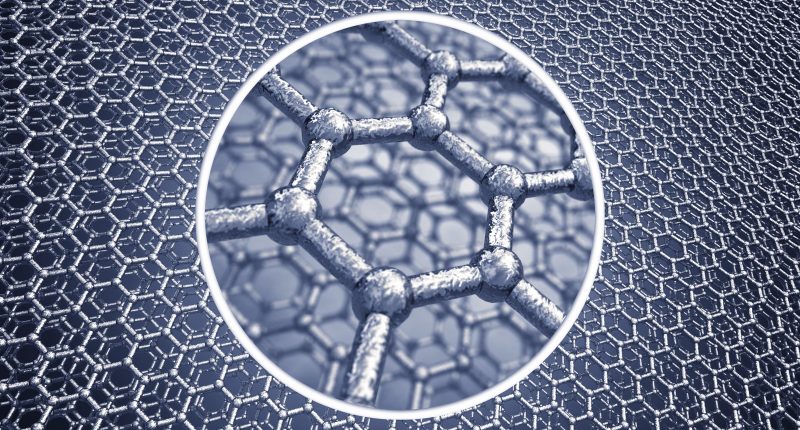

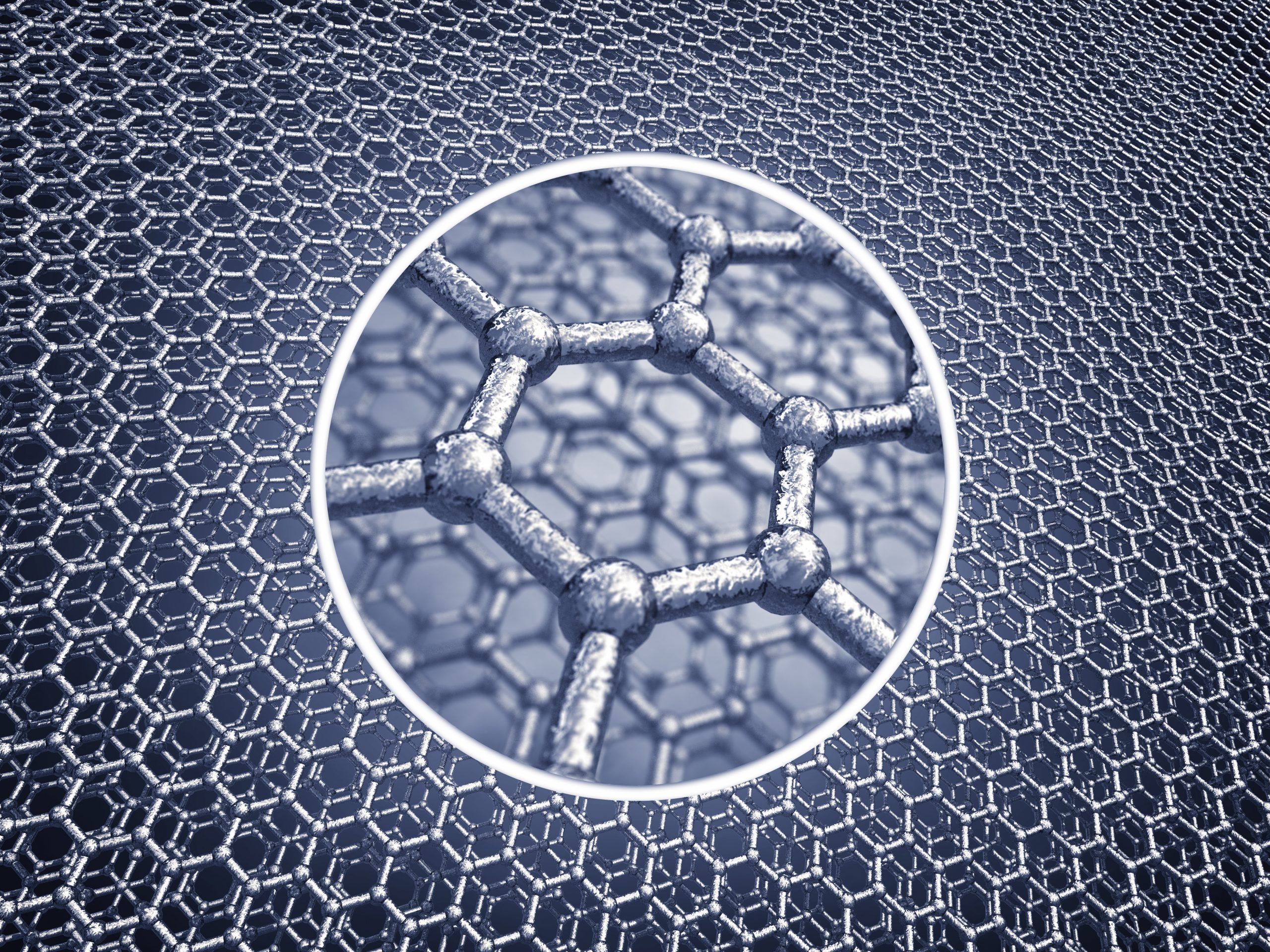

- Thomas Swan’s technology allows for the production of large volumes of high-performance graphene at low cost

- Mason made the purchase through Black Swan Graphene, a new joint venture between the companies which will go public in the coming months

- The transaction is expected to take place on or around August 19, 2021

- Mason Graphite is a Canadian corporation dedicated to the production and transformation of natural graphite

- Mason Graphite (LLG) is up by 11.11 per cent and is currently trading at $0.60 per share

Mason Graphite (LLG) will purchase assets related to graphene processing technology from Thomas Swan & Co.

Mason made the purchase through Black Swan Graphene, a new joint venture, of which Mason and Thomas Swan will own 66.67 per cent and 33.33 per cent, respectively.

Black Swan aims to establish a large-scale commercial production facility in Québec to leverage the province’s competitive hydroelectricity, as well as the proximity of Mason’s planned production sites.

The companies expect to take Black Swan public in the coming months.

Thomas Swan & Co.

Thomas Swan & Co. is a leading United Kingdom-based specialty chemical company founded in 1926 that exports to over 80 countries.

The company’s technology allows for the production of high-performance graphene at low cost, enabling commercial penetration in industrial applications requiring large volumes of graphene.

The companies expect Thomas Swan’s graphene to be widely used in off-the-shelf products in the near future.

Transaction

Thomas Swan will receive approximately $5.2 million for its technology.

Mason will invest $2.5 million in Black Swan for working capital purposes.

The transaction is expected to take place on or around August 19, 2021.

On closing of the transaction, Black Swan will enter into a license agreement with Trinity College Dublin for the production of exfoliated, defect-free, non-oxidized 2-D materials in large quantities.

Black Swan will also license graphene processing technology to Thomas Swan for production of up to 1,000 tonnes per year.

Harry Swan, CEO and owner of Thomas Swan, commented,

“This partnership creates a more efficient supply chain, which will solidify and accelerate the deployment of our graphene processing technology within a burgeoning industry.”

Fahad Al-Tamimi, Chairman of Mason Graphite, added,

“Not only is this new venture expected to create meaningful graphite demand and is therefore a natural extension of the Lac Guéret graphite project, but it truly transforms the company’s potential as it elevates Mason to a preeminent position within the fastest-growing segment of the carbon industry.”

Mason Graphite is a Canadian corporation dedicated to the production and transformation of natural graphite.

Mason Graphite (LLG) is up by 11.11 per cent and is currently trading at $0.60 per share as of 10:16 am ET.