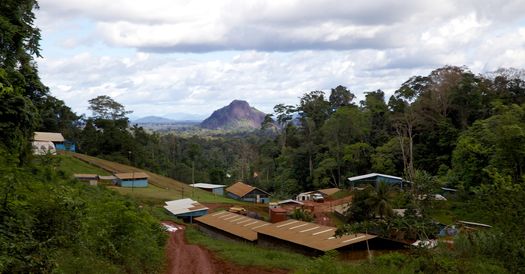

As many junior explorers continue to search well-explored belts in south American jurisdictions, Guyana is emerging as a new destination for exploration investment due to its stable political and regulatory environment, and relatively immature stage of exploration. Some forward-thinking junior exploration companies operating in this emerging destination for gold exploration are looking to highly-prospective, new belts and areas within Guyana.

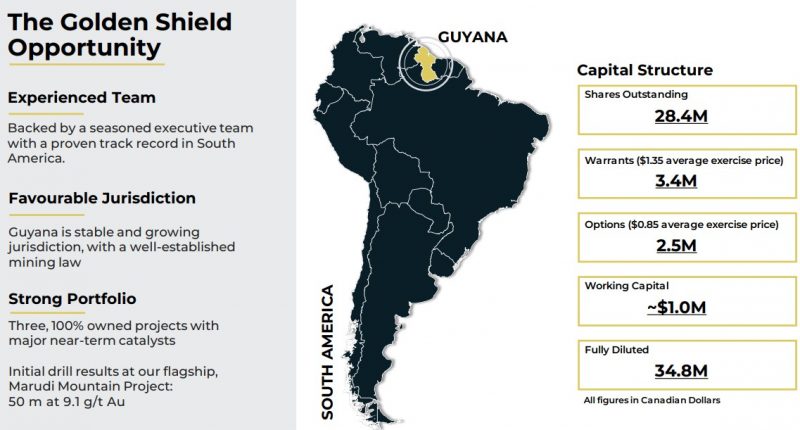

Enter Golden Shield Resources Inc. (CSE:GSRI) – a fully financed, Vancouver BC-based junior explorer that is currently operating three high-grade gold projects in mining-friendly Guyana in South America. Currently focused on three projects in Guyana – Marudi Mountain, Arakaki & Fish Creek. This gold-rich country contains one of the world’s most underexplored greenstone belts – The Guiana Shield – a 1.7-billion-year-old piece of the Earth’s crust in northeast South America that forms a portion of the northern coast.

To date, the Guiana Shield has received only a fraction of the exploration dollars of its sister formation – the West African Shield. The Guiana Shield currently hosts 110 million ounces of gold.

Golden Shield Resources’ flagship Marudi Mountain Project – located in the Rupununi District of southwestern Guyana – covers 5,457 hectares. Exploration activities at the Marudi Project can be conducted year-round. Gold mineralization at the Marudi Project is hosted in Proterozoic greenstones and occurs within a distinctive quartzite unit. The project is conveniently located just 35 kilometres from the community of Aishalton.

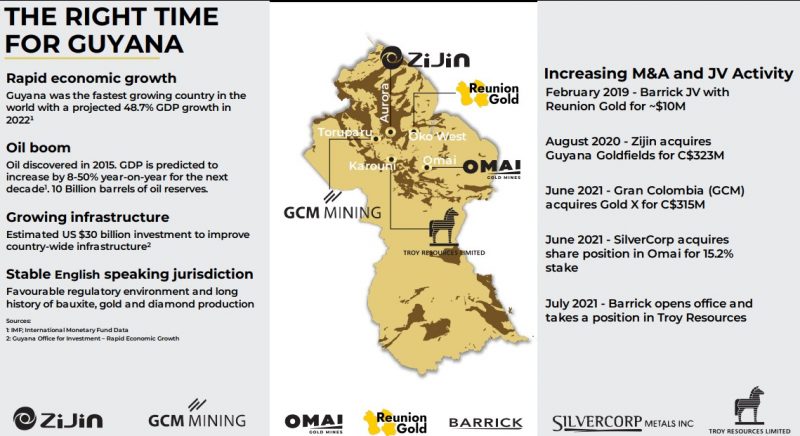

Marudi Mountain hosts an estimated 350,000 oz Au historical resource and is currently undergoing resource expansion and exploration drilling. Initial drill results at Marudi Mountain Project were highlighted by March 2022 drill results including 50 m at 9.1 g/t Au. A very high-grade result.

In the News

Earlier this spring, the company delivered drill results from the final four holes of a previous seven-hole program at Mazoa Hill, where 50 metres grading 9.10 g/t gold confirmed high-grade, continuous mineralization. High grade…indeed. But there’s more.

As a recent ditorial reported on May 17th, the company had discovered “Significant & Continuous High-Grade Mineralization” at Mazoa Hill – one of eight prospects at Marudi Mountain.

In February, GSRI announced that it has completed an initial drill program consisting of over 2,000 metres of diamond drilling in 13 drill holes (the “Initial Drill Program”) at the Company’s Marudi Mountain gold project.

Hilbert Shields, Chief Executive Officer of the Company commented:

“The Marudi Project is a large property and earlier exploration efforts focused mostly on the Mazoa Hill area. Golden Shield geologists have quickly gained a strong understanding of mineralization controls and are discovering new areas that will be explored and drill tested. We feel confident that the Marudi Project has significant exploration potential.”

Meet the Team

Golden Shield Resources was founded by experienced professionals who are convinced that there are many more gold mines yet to be found in Guyana. The company is well-financed and has three wholly controlled gold projects – its flagship Marudi Mountain project, along with the Arakaka and Fish Creek projects. Golden Shield continues to evaluate and advance other significant gold opportunities in Guyana.

CEO, Director & Co-Founder, Hilbert Shields, is a geologist and entrepreneur who has over 35 years of experience in the mineral exploration and mining industry. He was the co-founder of and served as, Chief Executive Officer of First Bauxite Corporation and was VP Exploration of Golden Star Resources where he managed the exploration of the Omai gold deposit in Guyana, from acquisition through to the completion of the feasibility study. Mr. Shields has previously been a Director of the Guyana Geology & Mines Commission and the Guyana Gold Board and is currently the Vice-President of the Guyana Gold & Diamond Miners Association, sits on the Council of the Private Sector Commission of Guyana, and is a Co-Chair of the Guyana Extractive Industries Transparency Initiative.

He holds a bachelor’s degree in Geology & Environment from Oxford Brooks University UK and a Master’s degree in Geology from Mackay School of Mines University of Nevada. Mr. Shields is a dual Canadian and Guyanese citizen.

Executive Chair & Co-Founder, Leo Hathaway, is a geologist and senior executive in the mining and exploration industry with 25 years of experience. He currently serves as Senior VP of Lumina Gold Corp., Senior VP Exploration of Luminex Resources Corp., and is a Director of Bluestone Resources Inc. His previous roles include Chief Geological Officer for Lumina Copper Corp., VP Exploration for Northern Peru Copper Corp, Regalito Copper Corp, and Lumina Resources Corp. All of these companies were acquired by large mining companies and were derived from the original Lumina Copper Corp, for which Leo was VP Exploration. Prior to 2004, he worked for Inmet Mining in Europe, Central, and South America, and also Australia. Mr. Hathaway holds a B.Sc. (Hons) degree in Applied Geology from the University of Plymouth, an M.Sc. in Mineral Exploration from the University of London, and has a P.Geo designation from the Association of Professional Engineers and Geoscientists of the Province of BC.

Vice President of Corporate Development is Rory Harding – an experienced business development professional and financier. Until 2018 Rory ran a West African representative office for London- based Merchant Bank and resource finance boutique, Strand Hanson. Rory now lives in Guyana where he continues to represent Strand Hanson for the Caribbean, as well as a number of multinational companies in a variety of industries. Rory has implemented business development for International Energy Trading Houses and has acted as the representative for two major Chinese state-owned enterprises, with infrastructure projects currently under development. Mr. Harding holds a BSc in BioSciences from the University of Exeter and is a dual British and Guyanese citizen.

Vice President of Exploration is Colin Porter – a geologist with over 25 years of experience in exploration management and applied structural geology. Colin’s expertise spans a wide range of gold mineralization systems including Archaean, Proterozoic, and Pan-African orogenic deposits and districts. Previous roles include Head of Exploration for Mwana Africa PLC and as a Structural Geologist for Anglogold Ashanti, Africa Region with extensive experience in the Birimian craton of West Africa, which included planning and implementation of deposit scale and brownfields exploration at major mines (Obuasi, Sadiola, Morila, Siguiri). Colin holds a BSc (Hons) in geology from Queen’s University Belfast, a Ph.D. in geology from the University of Southampton, and is a member of the Australian Institute of Mining and Metallurgy.

Grant Tanaka, Chief Financial Officer, brings over 15 years of financial leadership experience in the mining industry. Before joining Golden Shield Resources, he was the Director, Finance Operations with Ma’aden Gold & Base Metals. Prior to this, Mr. Tanaka held senior financial positions at Teck Resources Limited, New Gold, Copper Mountain Mining Corporation, and Bisha Mining Share Company an operating subsidiary of Nevsun Resources. He has experience at both the corporate and operational levels having worked throughout North America, Mexico, Africa, and the Middle East in gold, base metals, and coal operations. Mr. Tanaka has a Bachelor’s of Business Administration, specializing in Entrepreneurial Leadership and is a Canadian Chartered Professional Accountant (CPA).

A View From the C-Suite

The Market Herald recently met up with Leo Hathaway to give our investor audience a background look into the company and to take a deep dive into what Golden Shield has panned for future exploration and development into this underexplored ‘elephant country’ of Guyana.

TMH: To start off with, Leo, for those that may be discovering your company for the first time, can you please give us a little background history about yourself and a brief overview of the company.

LH: I’m a geologist and have been working in the mining industry for the last 25 years.

I am the Executive Chair and Co-Founder of Golden Shield Resources, Senior VP of Lumina Gold Corp., Senior VP Exploration of Luminex Resources Corp., and VP Exploration for Strategic Resources Corp.

Previously, I have worked as Chief Geological Officer for Lumina Copper Corp., VP Exploration for Northern Peru Copper Corp., Regalito Copper Corp., and Lumina Resources Corp.

Golden Shield is a brand-new story, listing on the CSE in February 2022. We are focused on advancing three 100% owned projects in Guyana, South America.

Golden Shield has an experienced global team of technical professionals, operators, and financiers. Our CEO, Hilbert Shields, is a dual Canadian and Guyanese citizen with extensive experience in Guyana.

Our flagship project, Marudi Mountain, hosts a 350,000 oz Au historical resource and is currently undergoing resource expansion and exploration drilling. Recent drilling returned extremely encouraging assays including 50m over 9.1 g/t gold.

We recently closed a 6 million CAD financing to advance our exploration activities in Guyana.

Golden Shield is also the newest member of Inventa Capital, a Vancouver-based investment group co-founded by Mike Konnert & Craig Parry.

TMH: For mining investors who might be new to the mining jurisdiction of Guyana in South America, can you give us an elevator pitch…pros and cons?

LH: I have always been interested in Guyana primarily because of its geology. The country hosts the same rock formation that exists in West Africa. There have been 275M ounces of gold found in West Africa and only 110M ounces discovered in the Guiana Shield, I believe there is more to be found here. Guyana is a stable English-speaking, mining-friendly country, and it’s underexplored That’s why we chose it.

In 2015, a significant oil discovery led to a rapid economic revolution within Guyana. Projections state that the country’s GDP will increase by 48.7% in 2022 alone. We hope to see an increase in infrastructure country-wide which will also benefit exploration.

We believe now is the perfect time to be an explorer in Guyana. There has been a recent increase in the level of M&A and JV activity, especially from Barrick who opened an office in Georgetown in 2021.

TMH: The company has three wholly controlled high-grade gold projects – your flagship Marudi Mountain project, as well as Arakaka, and Fish Creek. Can you briefly walk us through each of the projects?

LH: Marudi Mountain is our flagship project, it is a large, underexplored land package covering ~54 sq km in southern Guyana. It is a high-grade project with a historical resource of about 350,000 ounces Au. But that’s not the real story, we think there is a much larger gold deposit waiting to be discovered at Marudi.

Originally, when we went back and modeled the geology, we found it was open at depth and open to the east. Follow-up drilling returned intersections of 50m at 9.1 g/t gold – which is an exceptional intercept!

We have 6 additional drill-ready targets with high-grade gold at surface, that we are advancing to drill stage, and we continue to find more of these. At Mazoa Hill we are aiming for an updated resource estimate in Q4 2022 and will resume drilling there in Q3 2022, as well as start systematically testing the other drill targets on the property.

Arakaka is located in a prolific historical artisanal mining district and has district-scale exploration potential. It’s an extremely large property covering 177 sq km.

Fish Creek is located 10km to the west of Arakaka, within a well-known regional structural zone. A projected 100 ounces has been extracted through past artisanal production on the property. We expect to start preliminary drilling on both Arakaka and Fish Creek in Q4 2022.

TMH: Can you update our investor audience and your Golden Shield shareholders and potential investors on any new company developments, especially an update the recent results from Mazoa Hill at your Marudi Mountain Gold Project…some pretty impressive numbers here! 350-thousand-ounce potential?

LH: We were extremely encouraged by the initial drill results on the Mazoa Hill target. We were originally attracted to the target because of its high grade, and the March 14 results of 50m at 9.1 g/t gold confirmed this, it also extended beyond the existing resource. We are hoping to continue to expand this resource.

We have a lot more lookalike targets that have not been drilled at Marudi so we need to systematically work our way through them. We are currently undertaking surface mapping, sampling, and trenching to confirm that the bedrock is running gold over a significant strike. Then we plan to drill it.

For me, Marudi represents a project that has size potential at very high grades that may have been overlooked until now. I am excited to be involved in exploring there.

We also received further results from our 6 initial diamond drill holes at Toucan Creek that returned 6m at 4.84 g/t gold and 7m at 2.58 g/t gold.

TMH: You recently closed a C$6.3M private placement. What can shareholders and investors glean from this raise?

LH: Well, firstly they can infer that even in a very tough market there are investors who are excited by what we are doing at Golden Shield and understand the potential. As for the money raised, this will be used to advance the exploration on our properties in Guyana, as well as for working capital and general corporate purposes.

Specifically, the funds raised will be used to continue extending mineralization at the Mazoa Hill prospect, as well as drill test additional exciting prospects at the Marudi Mountain project.

TMH: What differentiates Golden Shield from the competition in the gold exploration space and what makes your business model unique?

LH: It comes down to 3 major factors – an experienced team, a favorable mining jurisdiction, and a strong portfolio of assets.

Golden Shield is backed by a seasoned technical team with a proven track record for discoveries in South America. We are operating in a favorable jurisdiction. Guyana – is stable and growing and has a favorable regulatory environment with well-established mining laws. Additionally, Guyana is booming on the back of major oil discoveries and massive infrastructure spending.

We have a strong portfolio of 3 projects, all 100% owned with major near-term catalysts for discovery.

It is also important to note that our CEO, Hilbert Shields, is Guyanese and lives in Georgetown, allowing us to be a Guyanese company operating in Guyana. He has been navigating the political and cultural landscape for the past 40 years, and we believe we can leverage his in-country knowledge to really make things happen on the ground.

TMH: Any other recent timely and topical company news we should know about?

LH: We released a steady flow of drill results from Mazoa Hill over the last few months which included intercepts of 33m at 3.45 g/t Au and 31m over 7.58 g/t Au. We are excited to resume drilling at Marudi Mountain and further explore the potential of this project.

TMH: Can you discuss the long-term exploration strategy for the company moving into 2022 and beyond?

LH: Our long-term exploration strategy is to expand, explore and grow. We hope to expand the resource at Mazoa Hill and Marudi North and consolidate resources across the property. We already have 6 drill-ready targets to move on.

In Q3 and Q4 we expect to begin preliminary exploration programs at the Arakaka and Fish Creek projects.

Our main goal is to grow our market cap, and our land position in Guyana through project acquisitions, joint ventures, and strategic in-country alliances in hopes of consolidating a regional belt play.

The Bottom Line

Ground-floor precious metals investment opportunities offering inherent value in underexplored, mining-friendly jurisdictions don’t pop up every day. Golden Shield Resources’ tightly held share structure, highly experienced team, along with some very promising recent drill results all add up to an intriguing gold play…now and into the future.

For more information about the company, visit goldenshield.ca.

FULL DISCLOSURE: This is a paid article produced by The Market Herald Canada.