- Musk Metals (CSE:MUSK) has staked more claims on the recently optioned Lac du Km 35 germanium property near Chibougamau, Quebec, expanding it from 2,767 hectares to 4,150 hectares

- The property houses numerous polymetallic targets backed by sampling and electromagnetic survey data, including the highest germanium value ever reported from an outcrop in Quebec

- Musk Metals is a mineral exploration company developing projects highly prospective for uranium, lithium, zinc, gold and silver in some of Canada’s top mining jurisdictions

- Musk Metals stock is flat year-over-year and down by 55.56 per cent since changing its name from Gold Plus Mining in 2021

Musk Metals (CSE:MUSK) has staked more claims on the recently optioned Lac du Km 35 germanium property near Chibougamau, Quebec, expanding it from 2,767 hectares to 4,150 hectares.

Lac du Km 35 is located in the northeast portion of the prolific Abitibi greenstone belt with easy access to Highway 167 and a main lumber road that transects the entire property. Highlight targets include:

- The Faribault shear zone, a prospective conduit for hydrothermal fluids.

- The Lac Doré intrusive suite, a mafic-to-ultramafic stratiform and synvolcanic intrusion.

- The Laganière germanium showing, discovered by government geologists in 1998, returning 0.02 per cent (186 parts per million) germanium, the highest value ever reported from an outcrop in Quebec.

Musk collected 39 outcrop samples on the property in 2024, yielding up to 0.27 per cent nickel, 0.04 per cent cobalt, 0.24 per cent copper, 0.07 per cent zinc and 0.21 grams per ton of gold. The digestion method selected to analyze the samples rendered germanium values unreliable.

Laganière is adjacent to a cluster of electromagnetic anomalies measuring 400 m x 400 m that have never been tested, and is only 450 m northeast of Faribault, making its “vastly underexplored and overlooked” land package “the prime focus for Musk,” according to Friday’s news release.

What investors need to know about germanium

Germanium is a greyish and brittle metal with applications in electronics, solar, fiber optics and infrared optics for both the civil and military sectors, allowing it to command spot prices that have exceeding US$4,000 per kilogram. Most notable among these uses is the metal’s role in thermal imaging cameras and night vision technology in autonomous vehicles.

China held a 70-75 per cent share of global germanium output in 2024 and banned exports to the U.S. on December 3, creating significant uncertainty around future supply.

With germanium listed as a critical metal in the U.S., as well as Canada and the European Union, Musk Metals has an early-stage opportunity to foster shareholder value by delivering on Lac du Km 35’s exploration upside.

Leadership insights

“Germanium spot prices have traded as high as US$4,000 per kilogram last month, reflecting a 44 per cent increase over the past 12 months,” Mario Pezzente, Musk Metals’ chief executive officer, said in a statement. “As the global supply faces unprecedented challenges due to geopolitical dynamics, the strategic importance of this critical metal is clearer than ever. With demand outpacing supply and prices on an upward trajectory, now is the time to position ourselves in the germanium market.”

About Musk Metals

Musk Metals is a mineral exploration company developing projects highly prospective for uranium, lithium, zinc, gold and silver in some of Canada’s top mining jurisdictions.

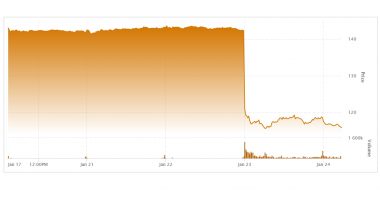

Musk Metals stock (CSE:MUSK) last traded at C$0.04 per share. The stock is flat year-over-year and down by 55.56 per cent since changing its name from Gold Plus Mining in 2021.

Join the discussion: Find out what everybody’s saying about this junior mining stock on the Musk Metals Corp. Bullboard and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image of Musk Metals’ logo: Musk Metals)