- A new Royal Bank of Canada (TSX:RY) survey has found that 38 per cent of Canadians have moderate to high-risk potential for becoming victims of cyberattacks.

- RBC’s new Cyber Safety Index reviewed how often Canadians engage in certain behaviours online.

- Within the past year, 77 per cent have knowingly or accidentally engaged in at least one risky online behaviour, with the most commonly reported being using public Wi-Fi (49%).

- Shares of Royal Bank of Canada were down 0.97 per cent, trading at C$167.17 at 10:48 am.

A new Royal Bank of Canada (TSX:RY; NYSE:RY) survey released Tuesday found that 38 per cent of Canadians have moderate to high-risk potential for becoming victims of cyberattacks.

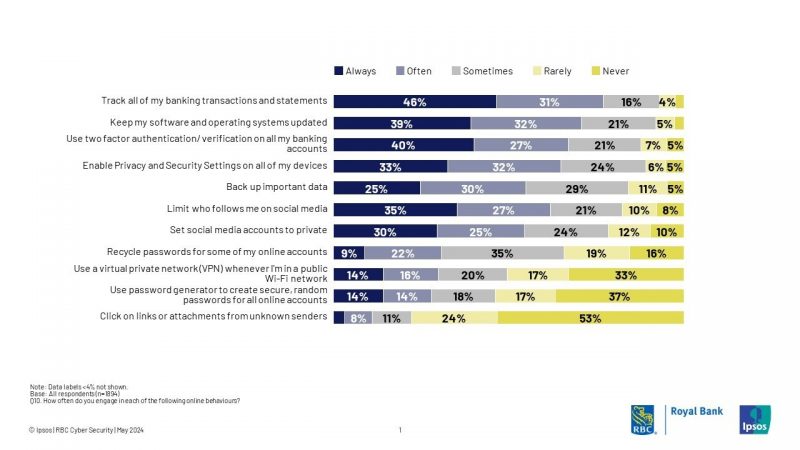

RBC’s new Cyber Safety Index reviewed how often Canadians engage in certain behaviours online. According to RBC’s news release, the majority practice at least some good cyber practices, but less than half say they always use all of the recommended online safety behaviours. These include:

- Keeping software and operating systems updated (71%)

- Using two-factor authentication/verification on online banking accounts (67%)

- Enabling privacy and security settings on all devices (65%)

- Limiting who follows them on social media (63%)

- Less than a third (30%) always or often use virtual private networks (VPN) when surfing public Wi-Fi.

- Twenty-eight per cent use password generators to create secure, random passwords for online accounts.

“The responses to our Cyber Safety Index show that while many Canadians are aware of things they can do to be safer online, there’s still opportunities for them to change behaviours and close that risk gap,” Adam Evans, chief information security officer at RBC, said in a statement. “At RBC, we’re focused on providing Canadians with the practical tips and education they need to take control of their online safety and mitigate risks in an ever-evolving digital world.”

Increased exposure to cyberattacks

RBC states that many Canadians are participating in risky online activities that could further increase the potential of exposure to cyberattacks.

Within the past year, 77 per cent have knowingly or accidentally engaged in at least one risky online behaviour, with the most commonly reported being using public Wi-Fi (49%). Others include consenting to share their personal information when asked (27%), clicking on pop-up ads (19%), visiting unsecure websites (18%) and ignoring privacy settings on social media platforms (13%).

More than a third (35%) have used the same password(s) across multiple platforms, and nearly as many are more concerned about missing out on exclusive events/activities than disclosing personal information online (32%), and/or have interacted with unsolicited texts or social media messages (31%).

A large majority of Canadians (85%) replied that they are comfortable learning new ways to protect their online information. To help with that RBC has articles on cyber awareness on its website and offered the following tips:

- Limit the information you share on social platforms. Don’t accept friend requests from people you don’t know, and even if the privacy settings on your accounts are enabled, try to limit what you share online to avoid scams such as spear-phishing.

- Keep your financial information safe. Never log in to online banking using a link sent through email, text message, or social media. Instead, type the address into your browser. Clear your browser’s memory cache regularly to improve security.

- Be vigilant when shopping online. Look for the little padlock icon to the left of the URL bar and ensure the website you’re visiting has an address that begins with “https.” Read reviews before you buy to ensure they’re legitimate and trustworthy businesses.

- Create long, strong passwords. Always use the maximum password length allowed and aim for at least 16 characters. Longer is better, such as “passphrases” made of randomly chosen words, that can be easy to remember and hard for someone else to guess.

The study’s findings came from an Ipsos poll conducted in English and French on behalf of RBC. A sample of 1,894 Canadians older than 18 was surveyed online via the Ipsos I-Say panel from May 3 to 7, 2024.

Royal Bank of Canada is one of the largest banks in the world, based on market capitalization, and has a diversified business model. Its segments include personal and commercial banking, wealth management, insurance and capital markets.

Shares of Royal Bank of Canada (TSX:RY) were down 0.97 per cent, trading at C$167.17 at 10:48 am.

Join the discussion: Find out what everybody’s saying about bank stocks on the Royal Bank of Canada Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo: Adobe Stock)