- Mayo Lake Minerals (MLKM) has announced a private placement of flow through units and common share units for gross proceeds of up to $200,000

- The offering is expected to close on or about August 18, 2022

- The company has awarded a total of 3,990,000 incentive options to corporate officers, directors, contractors and advisors

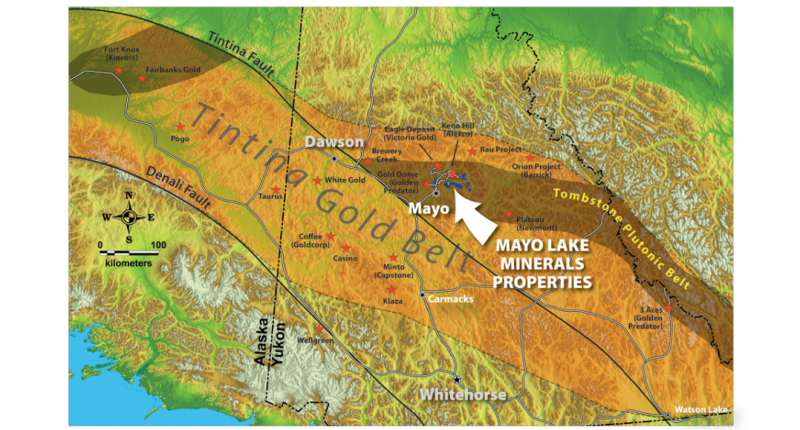

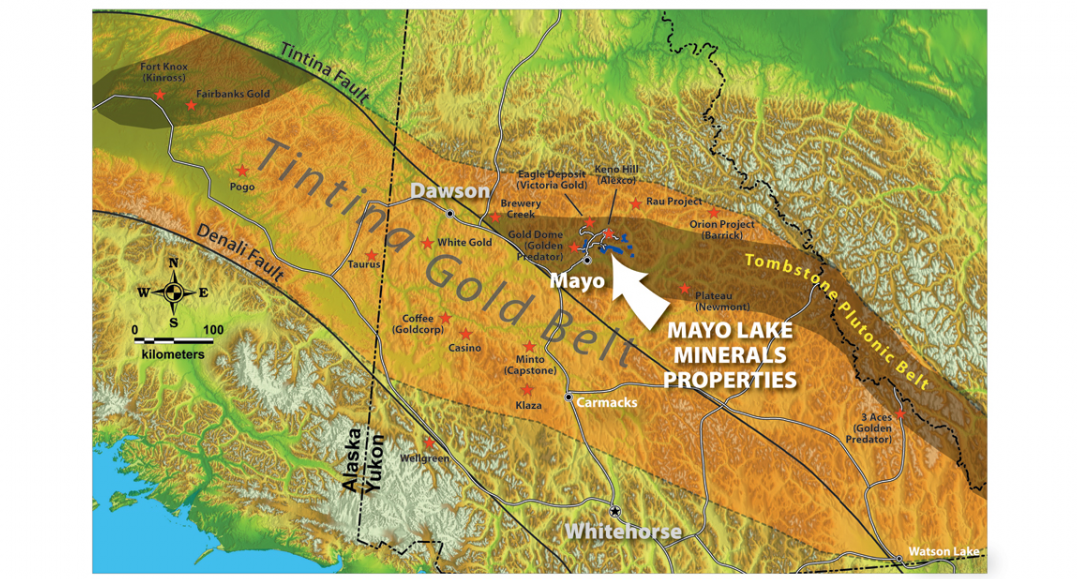

- Mayo Lake Minerals Inc is focused on the development of five precious metal projects in the Tombstone Plutonic Belt of the Tintina Gold Province in Yukon

- Mayo Lake Minerals Inc. (MLKM) opened trading at C$0.135

Mayo Lake Minerals (MLKM) has announced a private placement of flow through units and common share units for gross proceeds of up to $200,000.

The company will issue flow through units at $0.15 per unit and common share units at $0.12 per unit.

The offering is expected to close on or about August 18, 2022.

Dr, Vern Rampton, President & CEO of Mayo Lake Minerals, commented on the company’s plans.

“We continue to make excellent progress on our exploration at our Carlin-Roop Silver Project in the Keno Hill Silver District and see an opportunity to add to our portfolio through further exploration at our primary Anderson Davidson gold property and highly prospective Trail Minto property which lies in proximity to Banyan Gold’s Aur-Mac property in the Tombstone Plutonic Belt.”

The company has awarded a total of 3,990,000 incentive options to corporate officers, directors, contractors and advisors. The options are valid for 5 years and vest in three equal annual tranches beginning on Aug 1, 2022.

Mayo Lake Minerals Inc is focused on the development of five precious metal projects in the Tombstone Plutonic Belt of the Tintina Gold Province in Yukon. Its projects include Anderson-Davidson; Edmonton; Cascade; Carlin-Roop and Trail-Minto.

Mayo Lake Minerals Inc. (MLKM) opened trading at C$0.135.