- ADF Group (TSX:DRX), an industrial stock with profitable operations, posted net income of C$16.4 million in Q3 ended October 31, 2024, up from C$11.2 million year-over-year

- The quarter extends ADF’s profitable track record since 2020

- ADF Group is a North American company focused on the design and engineering of complex steel structures, heavy steel build-ups, as well as miscellaneous and architectural metals for the non-residential infrastructure sector

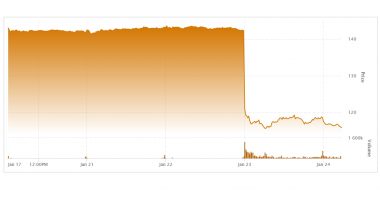

- ADF Group stock has added almost 750 per cent since 2019

ADF Group (TSX:DRX), an industrial stock with profitable operations, posted net income of C$16.4 million in Q3 ended October 31, 2024, up from C$11.2 million year-over-year (YoY), extending its profitable track record since 2020.

Revenue in Q3 came to C$80 million, down from C$82.1 million YoY, while revenue for the first nine months of the fiscal year reached C$262.2 million, up by C$19.6 million or 8.1 per cent YoY.

Gross margin as a percentage of revenue was 30.4 per cent, up from 24.4 per cent YoY, while growing from 21.1 per cent to 31.7 per cent during the first nine months of the fiscal year.

Adjusted EBITDA for the first nine months of the fiscal year was C$72 million, up by C$31.6 million or 78.1 per cent YoY.

Working capital stood at C$105.4 million at quarter end, with C$53.3 million in operating cash flow during the first nine months of the fiscal year.

Net income for the first nine months of the fiscal year hit C$47.7 million (C$1.53 per share), up from C$27.1 million (C$0.83 per share) YoY.

According to Thursday’s news release, ADF attributes this growth to “a better absorption of fixed costs, in line with the increase in the fabrication volume, the continued favorable impact of the investments in automation at ADF’s plant in Terrebonne, Quebec, and a favorable project mix.”

The company’s backlog of C$330.3 million as of October 31, 2024 – down from C$510.9 million as of January 31, 2024 – will extend until the end of the fiscal year ending January 31, 2026.

Management is nothing if not confident in future growth and ADF’s prospects for shareholder value, on Wednesday approving a share buyback plan despite the stock adding almost 750 per cent since 2019.

Leadership insights

“Once again, we closed the three-month and nine-month periods ended October 31, 2024, with excellent results,” Jean Paschini, ADF Group’s chairman and chief executive officer, said in a statement. “It is still early to fully understand the impacts of the U.S. election, including the potential impact of tariffs. However, we have the assets and personnel to face these challenges, including our fabrication plant in Great Falls, Montana, USA. We will continue to monitor the situation and take the necessary decisions to pursue ADF Group’s growth.”

About ADF Group

ADF Group is a North American company focused on the design and engineering of complex steel structures, heavy steel build-ups, as well as miscellaneous and architectural metals for the non-residential infrastructure sector.

ADF Group stock (TSX:DRX) is up by 6.35 per cent trading at C$10.21 per share as of 9:58 am ET.

Join the discussion: Find out what everybody’s saying about this profitable industrial stock on the ADF Group Inc. Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo from ADF Group’s facility in Montana: ADF Group)