- Pure Gold Mining (PGM) has closed the non-brokered private placement for aggregate gross proceeds of approximately C$3,473,000

- Pure Gold issued a total of 3,307,619 units to AngloGold Ashanti Limited at a price of C$1.05 per unit

- The offering increases AngloGold’s ownership percentage of Pure Gold to 14.96 per cent

- The net proceeds from the offering will be used to fund operations at its PureGold Mine Project

- Pure Gold Mining Inc is a Canadian based mining company

- Pure Gold Mining Inc. (PGM) opened trading at C$0.96 per share

Pure Gold Mining (PGM) has closed its previously announced non-brokered private placement for aggregate gross proceeds of approximately C$3,473,000.

Pure Gold issued a total of 3,307,619 units to AngloGold Ashanti Limited at a price of C$1.05 per unit.

Each unit consists of one common share and one-half of one common share purchase warrant. Each whole warrant entitles the holder to acquire one common share of Pure Gold at a price of C$1.36.

The offering increases AngloGold’s ownership percentage of Pure Gold to 14.96 per cent.

Due to its share ownership, AngloGold is considered a “related party” of Pure Gold and, accordingly, the Offering constitutes a “related party transaction”.

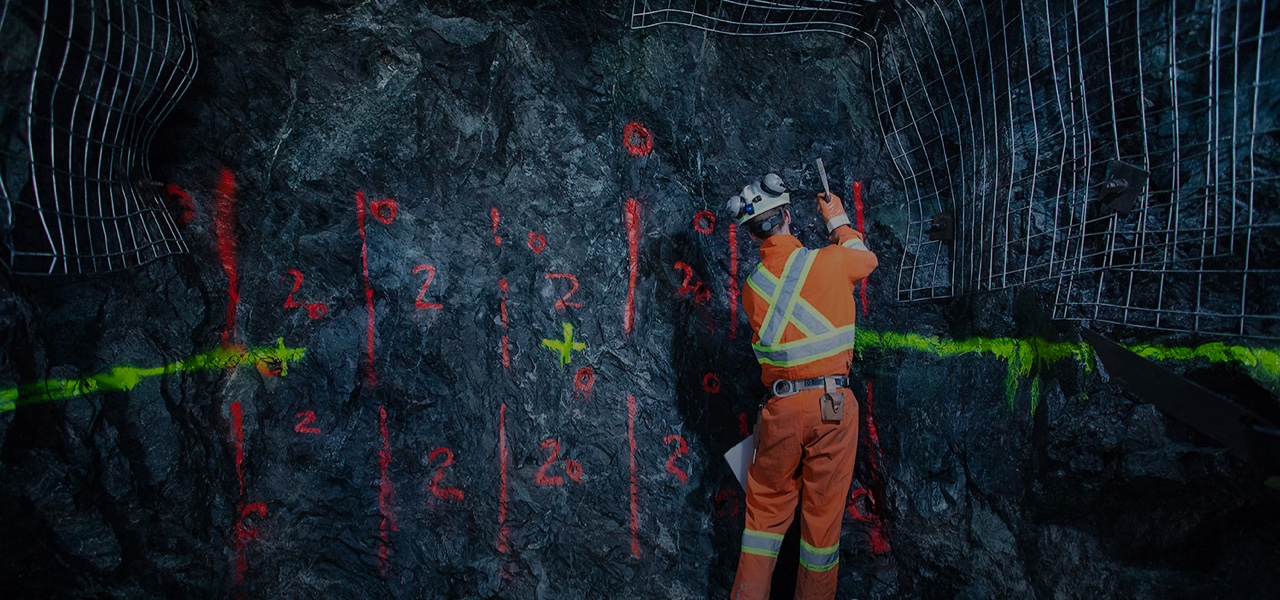

The net proceeds from the offering will be used to fund operations at its 100 per cent owned PureGold Mine Project located in Red Lake, Ontario, underground drilling and development of the high-grade 8 zone, and for general corporate purposes.

The securities issued have a hold period of four months and one day from closing, expiring on February 16, 2022.

Pure Gold Mining Inc is a Canadian-based mining company.

Pure Gold Mining Inc. (PGM) opened trading at C$0.96 per share.