- Remedy Entertainment (OTC Pink: RMDEF) released its financial statements for the year ending December 2024, showing significant achievements and advancements

- Revenue increased by 13.1 per cent to €11.7 million, compared to €10.3 million in the same period last year

- EBITDA improved to -€0.6 million, up from -€3.9 million, representing -4.9 per cent of revenue

- Remedy Entertainment stock (OTC Pink:RMDEF) last traded at C$20.49

Remedy Entertainment (OTC Pink:RMDEF) released its financial statements for the year ending December 2024, showing significant achievements and advancements. The company reported a notable increase in revenue and a successful launch of Alan Wake 2, which has exceeded two million units in sales and started to accrue royalties.

Highlights for October–December 2024

- Revenue: Increased by 13.1 per cent to €11.7 million, compared to €10.3 million in the same period last year.

- EBITDA: Improved to -€0.6 million, up from -€3.9 million, representing -4.9 per cent of revenue.

- Operating profit (EBIT): Recorded at -€1.4 million, a significant improvement from -€12.8 million, with an operating profit margin of -11.9 per cent.

- Cash flow from operations: Decreased to -€1.2 million from €0.1 million.

Q4 2024 developments

- New option plan: The Board of Directors approved a new option plan for 2024.

- Leadership change: Santtu Kallionpää was appointed as chief financial officer.

- Alan Wake 2 expansion: The Lake House expansion and the physical edition of Alan Wake 2 were launched.

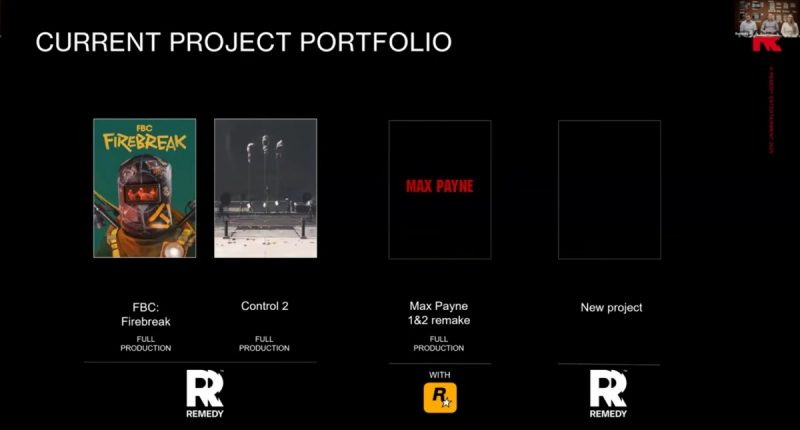

- New game announcement: Remedy announced FBC: Firebreak, a three-player cooperative multiplayer first-person shooter set in the world of Control, slated for self-publication in 2025.

Full-year 2024 financial highlights

- Revenue: Increased by 49.3 per cent to €50.7 million, up from € 3.9 million.

- EBITDA: Improved to €2.5 million from -€17.0 million, representing 5.0 per cent of revenue.

- Operating profit (EBIT): Recorded at -€4.3 million, a significant improvement from -€28.6 million, with an operating profit margin of -8.4 per cent.

- Cash flow from operations: Increased to €12.3 million from -€16.0 million.

Milestones achieved in 2024

- Control franchise acquisition: Remedy acquired full rights to the Control franchise from 505 Games.

- Partnership with annapurna: Announced a partnership with Annapurna, which will finance 50 per cent of the development budget for Control 2 and expand the Control and Alan Wake franchises into film and television.

- Convertible loan agreement: Entered into a €15 million unsecured convertible loan agreement with Tencent (OTC Pink:TCEHY).

- Game development progress: Significant advancements in the development of FBC: Firebreak, Control 2, and the Max Payne 1&2 remake.

2025 Outlook

Remedy expects its revenue and operating profit (EBIT) to increase from the previous year, with a positive operating profit anticipated. The company aims to double its 2024 revenue by 2027, with an EBITDA margin of 30 per cent.

Long-term business prospects

Remedy plans to grow and expand its established franchises, Control and Alan Wake, through self-publishing and strategic partnerships. The company aims to be a highly regarded creative studio with sustainable commercial success by 2030.

In the company’s update to shareholders, Remedy Entertainment’s CEO expressed confidence in the company’s strategic direction and growth potential, highlighting the dedication of the team and the successful execution of key initiatives throughout 2024.

Remedy Entertainment is a Finland-based game developer that creates cinematic story-driven action console and computer games, which are published by partners.

Remedy Entertainment stock (OTC Pink: RMDEF) last traded at €13.80 / C$20.49.

Join the discussion: Find out what everybody’s saying about this stock on the Remedy Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.