- Ridgeline Minerals (RDG) announced a non-brokered private placement to raise gross proceeds of up to $2,000,000

- Ridgeline will use the proceeds to fund exploration activities at its Nevada and Idaho projects and for general working capital

- Ridgeline is a gold and silver exploration company

- Ridgeline Minerals Corp. (RDG) is down 4.55 per cent, trading at C$0.21 per share at 10:47 am ET

Ridgeline Minerals (RDG) announced a non-brokered private placement to raise gross proceeds of up to $2,000,000.

The company plans to issue up to 10,000,000 units at $0.20 per unit. Each unit consists of one common share and one-half of one share purchase warrant. Each whole warrant entitles the holder to purchase one additional common share at $0.30 for 24 months from issue date.

Ridgeline will use the proceeds to fund exploration activities at its Nevada and Idaho projects and for general working capital.

Certain directors and officers of the company may also acquire securities under the private placement. The company may pay a finder’s fee in connection with the private placement.

All securities issued will be subject to a four month statutory hold period.

The company anticipates closing of the private placement as soon as practicable subject to receipt of all necessary regulatory approvals.

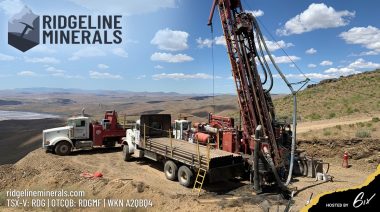

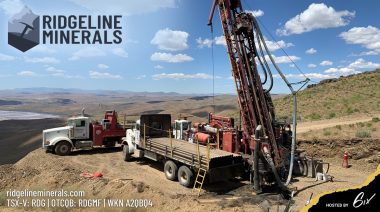

About Ridgeline Minerals

Ridgeline is a gold and silver exploration company. It focuses on acquiring large, highly prospective land packages in stable jurisdictions with a preference for under-explored districts.

In order to increase the odds of discovery, their technical team takes a systematic approach to exploration. It utilizes low-cost, high impact field work to advance its portfolio of projects. The company controls a 192 km² exploration portfolio across six projects in Nevada and Idaho, USA.

Ridgeline Minerals Corp. (RDG) is down 4.55 per cent, trading at C$0.21 per share at 10:47 am ET.