Introduction

In the evolving landscape of gold development, one leading project in Australia’s Northern Territory is redefining what it means to unlock value.

Backed by years of technical expertise and strategic discipline, Mt Todd has emerged as one of the most compelling undeveloped gold assets globally. A recently completed feasibility study signals a pivotal shift in strategy—moving from a large-scale vision to a more streamlined, capital-efficient design that prioritizes grade, mitigates risk, and preserves long-term growth potential. This recalibration offers investors a fresh perspective on how disciplined development can deliver robust returns in today’s dynamic gold market.

Enter: Vista Gold Corp.

Vista Gold Corp. (NYSE AMERICAN & TSX:VGZ) is a well-established gold development company focused on advancing its flagship Mt Todd gold project in Australia’s Northern Territory. With a proven track record of technical excellence and strategic foresight, Vista has positioned Mt Todd as one of the most compelling undeveloped gold projects globally. The company’s latest feasibility study marks a pivotal moment in its journey, demonstrating a development pathway to near-term production that balances robust economics with reduced capital intensity.

This article is disseminated in partnership with Vista Gold Corp. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Mt Todd: A world-class gold asset with a new approach

Mt Todd is one of the largest undeveloped gold projects in Australia, underpinned by a well-defined Batman deposit. Historically, Vista pursued a large-scale development strategy, as reflected in its 2024 feasibility study for a 50,000 tonnes-per-day (tpd) operation. However, in response to evolving market conditions and investor priorities, Vista has redefined its approach. The recently completed 2025 feasibility study introduces a smaller-scale, 15,000 tpd development scenario that prioritizes grade over tonnage, significantly reduces upfront capital requirements, and reduces development and operational risks. This strategic transformation reflects Vista’s commitment to delivering shareholder value while maintaining flexibility for future expansion.

Feasibility study highlights: A compelling investment case

Strong and stable gold production

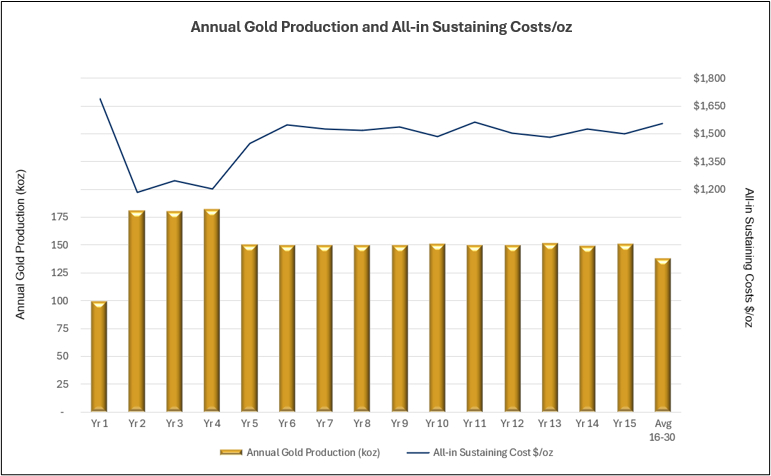

- Average annual gold production: 153,000 ounces (Years 1–15); 146,000 ounces (Life of Mine)

- Ore grade: 1.04 g Au/t (Years 1–15); 0.97 g Au/t (Life of Mine)

- Recovery: 88.5 per cent via proven 3-stage crush, sorting, grinding, and CIL circuit

- Operational strategy: Contract mining and third-party power generation to reduce capital and execution risk

Robust economics

- At US$2,500/oz gold:

- After-tax NPV (5 per cent): US$1.1 billion

- IRR: 27.8 per cent

- Payback: 2.7 years

- At US$3,300/oz gold:

- After-tax NPV (5 per cent): US$2.2 billion

- IRR: 44.7 per cent

- Payback: 1.7 years

- Initial capital: US$425 million (a 59 per cent reduction from 2024 feasibility study)

- Capital efficiency: US$93 per ounce

- All-in sustaining cost (AISC): US$1,449/oz (Years 1–15)

This smaller-scale project delivers exceptional capital efficiency and a benefit-to-cost ratio of 2.5, positioning Mt Todd as a highly competitive development alternative in today’s gold market.

Varied options: What’s next for Vista?

Vista is actively evaluating the optimal path forward for Mt Todd. The company’s options include:

- Joint venture partnership: Bringing in an experienced operator to share development risk and accelerate execution.

- Corporate or asset-level transaction: Monetizing Mt Todd to unlock immediate value for shareholders.

- Self-development: Leveraging the streamlined 15,000 tpd design to finance and build the mine independently.

Each scenario offers unique advantages, and Vista’s management is committed to selecting the strategy that maximizes shareholder returns.

Looking ahead, Vista is strengthening its corporate capabilities in Australia and plans to hire key personnel as it advances Mt Todd. Management is also targeting the start of detailed engineering and design at the end of 2026.

In an exclusive interview with The Market Online’s Capital Compass, Vista’s president and CEO, Fred Earnest, explained that the leadership team is weighing these options and the big question right now is which path to choose.

“Certainly, the rising gold price has increased the value of the project and made developing Mt Todd on a standalone basis more attractive than it was when we first announced the study,” he said. Click the video below to watch the interview in full.

Why this matters for investors

The 2025 feasibility study shows that Mt Todd can be developed at a scale that is both economically robust and operationally prudent. By raising the cut-off grade and focusing on the higher-grade core of the Batman deposit, Vista has optimized early-year cash flows while preserving optionality for future expansions.

Moreover, the company’s proactive approach—contract mining, third-party power generation, and experienced staffing—further reduces execution risk. With gold prices near historic highs and financing conditions favourable, Mt Todd’s revised economics make Vista an attractive proposition for investors seeking exposure to a high-quality development asset.

A golden opportunity

Vista Gold Corp. has delivered a feasibility study that redefines the Mt Todd investment thesis: lower capital, strong returns, and scalable growth potential. As the company advances toward a development decision, investors should take note of the compelling economics and strategic flexibility that underpin this project.

With shares up more than 244 per cent year-to-date, Vista’s momentum reflects growing market confidence in its vision. For investors seeking exposure to a world-class gold project with near-term development potential, now is the time to deepen your due diligence into this opportunity.

Join the discussion: Find out what everybody’s saying about this stock on the Vista Gold Corp. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.