- Sparta Capital (TSXV:SAY) is reporting multi-sector growth from its carbon credit program, which is operated through its environmental division, ERS, and its electronics recycling program

- Large financial institutions and IT companies are among the many new categories diversifying the division’s customer base

- Sparta Capital integrates emerging technologies through a decentralized business model with a focus on the environmental, health and transportation sectors

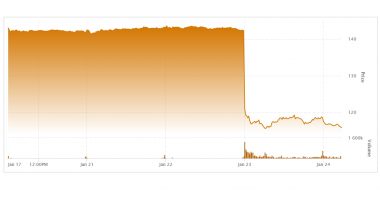

- Sparta Capital stock is down by 25 per cent year-over-year and by 62.50 per cent since 2019

Sparta Capital (TSXV:SAY) is reporting multi-sector growth from its carbon credit program, which is operated through its environmental division, ERS, and its electronics recycling program.

ERS’s leadership position among Bitcoin miners is now complemented by large financial institutions, large IT companies, logistics companies, companies servicing health-related organizations and companies servicing airlines.

According to Tuesday’s news release, ERS’s electronics recycling operation has one of the most stringent data erasure and disposal systems in Canada.

Leadership insights

“The more electronics we recycle, the better it is for our planet and for our bottom line. Companies choose to work with us because of the transparency and environmental impact our carbon credit program provides. It offers them a unique opportunity to align their operations with sustainability goals,” Joseph Cimorelli, director of global business development at ERS, said in a statement.

“When a new customer comes on board at ERS and wants to be part of this unique program, it means we are generating business and helping the environment,” added Tony Peticca, Sparta Capital’s president. “We are so pleased with the way this program is growing. If a company wants to do what’s right for the environment and is struggling to reduce emissions, ERS is qualified to help.”

About Sparta Capital

Sparta Capital integrates emerging technologies through a decentralized business model. The company’s divisions include Environment, Health and Transportation.

Sparta Capital stock (TSXV:SAY) is unchanged trading at C$0.015 per share as of 10:16 am ET. The stock is down by 25 per cent year-over-year and by 62.50 per cent since 2019.

Join the discussion: Find out what everybody’s saying about this technology stock’s carbon credit program on the Sparta Capital Ltd. Bullboard and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image, generated by AI: Adobe Stock)