Siemens Energy – The next IPO in the pipeline

The most successful DAX stock of 2025 is not only promoting its own ideas, but also successfully investing in industry competitors. As was recently announced, the Munich-based company will be participating in Asta Energy’s next IPO at the end of the week. Asta Energy Solutions is an Austrian copper specialist with 210 years of tradition that produces high-quality components for transformers, generators, and electric vehicles as a key supplier for the energy transition. Its order backlog has increased sevenfold since 2022, driven by EUR 580 billion in grid expansion investments in Europe by 2030. In 2024, revenue rose to EUR 642.6 million, and EUR 680 million is already expected for 2025 with an EBITDA margin of around 25%.

This article is disseminated in partnership with Apaton Finance GmbH. It is intended to inform investors and should not be taken as a recommendation or financial advice.

The planned IPO on the Prime Standard of the Frankfurt Stock Exchange could take place as early as January 30. For Asta Energy, it is expected to bring in up to EUR 125 million in fresh capital, supplemented by the sale of existing shares worth EUR 190 million. Several anchor investors and funds have already committed EUR 55 million, including Siemens Energy with a EUR 25 million ticket. The funds will be used for international expansion, capacity expansion, and debt reduction. Management considers it realistic to achieve sales of EUR 1 billion by 2030. Asta Energy and its investor Siemens Energy are thus riding the current infrastructure wave in the energy sector. Despite risks due to copper dependency, the megatrend of the energy transition offers strong growth potential. With a market value of over EUR 120 billion, Siemens Energy itself is no longer a small company and, with a 2026 P/E ratio of 38, is also ambitiously valued. Perhaps the better opportunities lie in the new Asta Energy share, which certainly enriches the stock market. Exciting!

Australia’s Pure One Corp. (formerly Pure Hydrogen) is also positioning itself in an increasingly contradictory energy market, where political narratives and physical reality are drifting further and further apart. On Australia’s east coast in particular, it is becoming apparent that the long-promoted shift away from fossil fuels is colliding with a severe shortage of natural gas supplies. In its latest outlook, Australian market operator AEMO points out that structural supply gaps are emerging from 2028 onwards, which could put pressure on both industry and power grids. Declining production volumes from established fields and the accelerated phase-out of coal are significantly increasing the demand for flexible gas capacities. Gas is thus evolving from a transitional fuel to a strategic safeguard for grid stability and industrial value creation. Contrary to the assumptions of climate change advocates, there are serious discrepancies in supply security.

Against this backdrop, companies with proven resources and infrastructure access are increasingly being valued at a premium on the stock market. Pure One stands out in this respect, as the market has so far failed to adequately reflect the value of the Company’s internal gas activities. A comparison with listed peers suggests that investors are currently receiving this asset without adequate consideration. It is not yet entirely clear what will happen to the gas activities, but strategic opportunities are likely under review. The valuation of these assets is likely to add value to Pure One in every respect. This situation offers many opportunities for investors. It creates an asymmetric investment profile in which strategic progress in the gas sector, disciplined capital allocation, and further operational progress in the core business converge, leading to expectations of positive development. New investors can get in at a valuation of just under AUD 30 million. In the current environment, that is a solid deal!

E.ON in transition – Why networks are becoming more important than power plants

In the eyes of the capital market, German energy specialist E.ON has finally transformed itself from a traditional energy supplier into a stable infrastructure company and is now consistently focusing on networks, metering systems, and energy-related services. Operationally, E.ON benefits from its role as Europe’s largest network operator with a pipeline network of around 1.6 million kilometers, which is becoming the backbone of the energy transition. The group is fully committed to a renewable energy system and has deliberately decided not to engage in nuclear power or traditional generation models.

However, CEO Leonhard Birnbaum regularly emphasizes that the restructuring of the energy system will only remain viable if it is more closely aligned with real demand and infrastructure requirements and less dependent on blanket subsidies. This strategic clarity is largely viewed positively by analysts, even if the upside potential remains limited in the short term. Institutions such as Deutsche Bank and UBS see the fair value of the share in the range of EUR 17 to 18, with the consensus on the LSEG platform at EUR 17.23. Thirteen out of 23 analysts are giving the thumbs up, and the strong price momentum of the last three months certainly points to revaluations being on the cards. For investors, the share remains primarily a defensive component. Predictable, regulated revenues, a high but easily calculable investment program, and a reliable dividend policy. With an expected P/E ratio of around 13 for 2027 and a dividend yield of just under 4%, many market observers see E.ON less as a growth story and more as a long-term anchor of stability in the European energy sector.

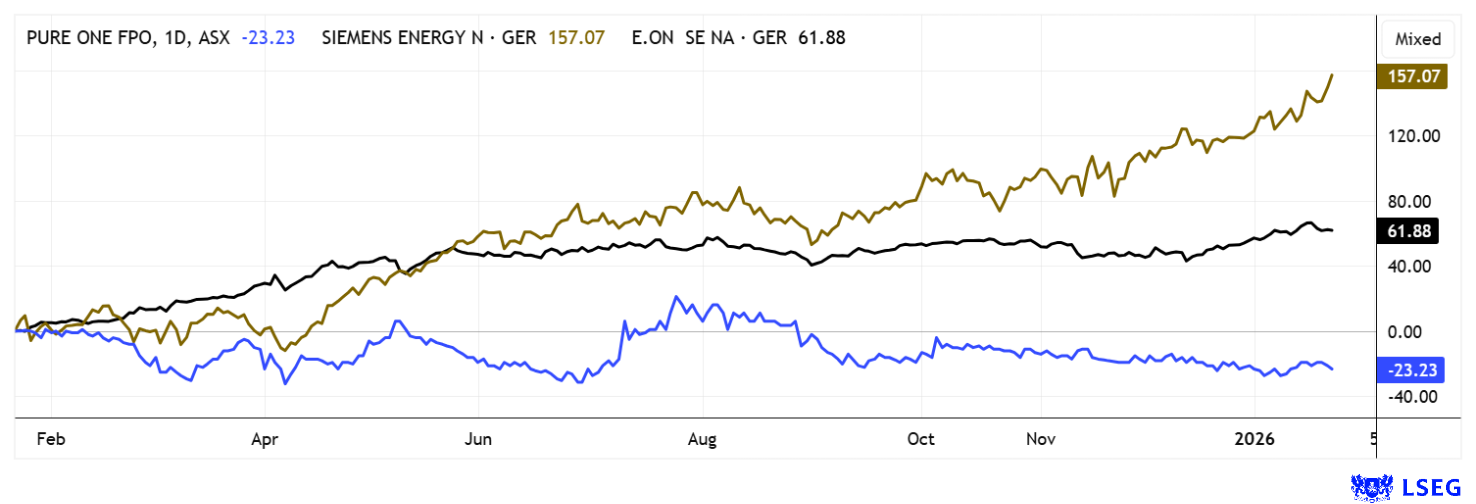

The energy sector has come into sharp focus in recent months. As a result, it is no longer the producers but rather the infrastructure and service providers who are dividing the billion-dollar pie among themselves. While Siemens Energy and E.ON are benefiting from their strong positioning and market coverage, Pure Hydrogen is now ready to take off with new ideas and balance sheet changes. A revaluation on the stock market is to be expected.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a “Transaction”). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.